The British pound has been on a roll lately, thanks to a slew of positive economic data and a generally optimistic outlook for the UK economy. However, as we’ve seen in the past, nothing goes up forever, and the recent rally against the US dollar has hit a snag.

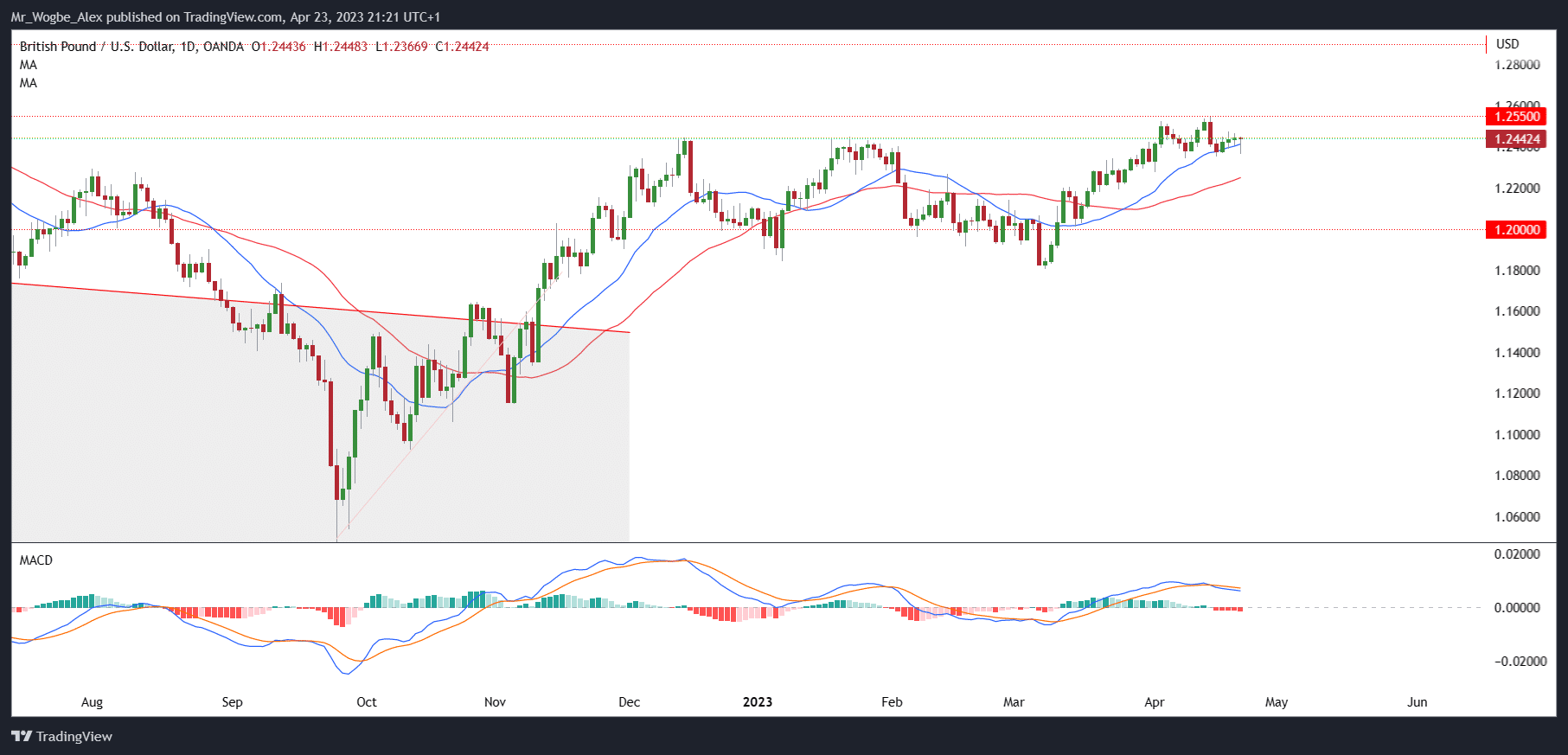

The latest data on UK inflation and wage growth suggests that price pressures are still high, and this has given investors pause. While there is still optimism about the UK’s economic recovery, the fact that the pound is overbought from a multi-month perspective means that a consolidation phase is likely in the cards.

Despite this, there is still a lot to be excited about when it comes to the pound’s long-term outlook. The UK economy is showing signs of strength, with wage growth in February surprising to the upside and core inflation holding steady at 6.2% YoY. This suggests that the Bank of England will continue to hike interest rates to keep inflation under control, which bodes well for the pound’s future value.

In contrast, the US Federal Reserve is also expected to hike interest rates in the near future, with the market pricing in a 90% chance of another quarter-point interest rate hike at its May 2-3 meeting before pausing. However, Fed officials remain hawkish, with the central bank president suggesting that there are more interest rate hikes ahead.

Optimistic Outlook for the Pound

Technical charts also indicate signs of exhaustion in the current GBP/USD rally, making a minor pause probable. As such, the British pound may continue to consolidate against the US dollar for a while before resuming its upward trajectory. This is good news for investors who are looking to enter the market at a lower entry point.

In conclusion, while the recent pause in the British pound’s rally against the US dollar may be disappointing for some investors, it is important to keep in mind the long-term outlook. With a robust UK economy and the Bank of England’s commitment to keeping inflation under control, the pound’s future value is likely to remain strong.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.