NZDUSD Analysis – October 9

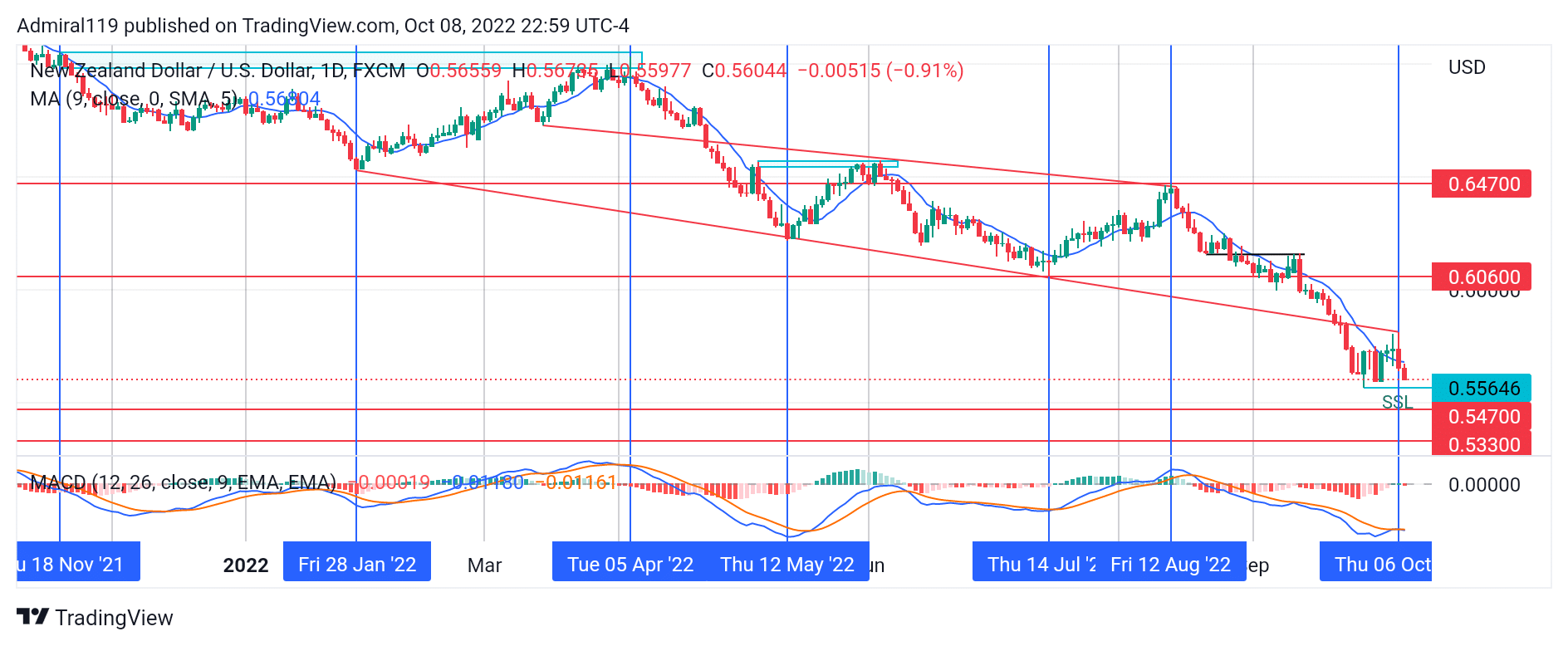

NZDUSD sellers continue the market trend to the downside. On the 5th of April, 2022, the market began to sink downward at the daily bearish order block. This daily bearish order block was formed on November 18, 2022. Ever since the rejection at the daily bearish order block, the market has continued to descend from the crest.

NZDUSD Major Zones

Demand Zones: 0.5470, 0.5330

Supply Zones: 0.6060, 0.6470

NZDUSD Long Term Trend: Bearish

Prices fell at the previous diagonal support on January 28th. As the price returned to the daily bearish order block, the market reached a year high. The market waned down to the trendline from the year’s high. Prices entered the rejection block at the previous high after rejection at the trendline on May 12th, 2022. On the 14th of July, 2022, the previous diagonal support and the previous horizontal support coincided. This coincidence caused a rejection back to the immediate major resistance. The doji candlestick, formed on the 12th of August, 2022, confirmed the dominance of the NZDUSD sellers at the 0.6470 resistance level.

The price fell further after the rejection, only to bounce off the previous support level of 0.6060. The bounce-off could not cause a rapid rally upward due to the increased volume of sell orders by the NZDUSD sellers at the bullish reclaimed order block. The bullish reclaimed order block was used to continue the market’s trend to the downside, which ended up breaking the eight-month trendline. Recently, the market formed a continuation pattern, which led the price into the continuation of the downtrend.

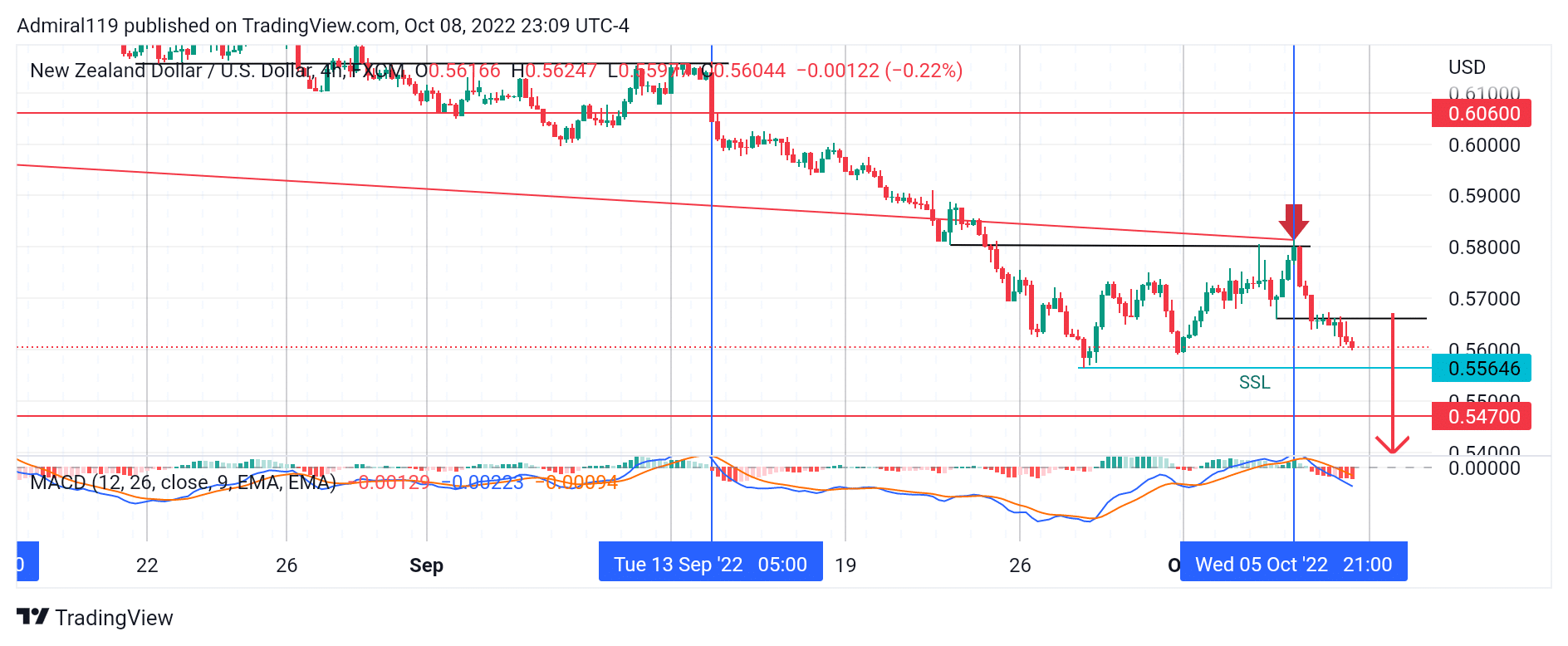

NZDUSD Short Term Trend: Bearish

The market’s order flow has remained bearish since the sharp drop in price caused by NZDUSD sellers. On October 5, 2022, price-induced sell orders from the bearish order block, led the market into its current wave. The market is projected to retrace back into the breaker block before or after clearing off the sell-side liquidity (SSL) at the old lows in the four-hour time frame.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.