Market Analysis – April 9

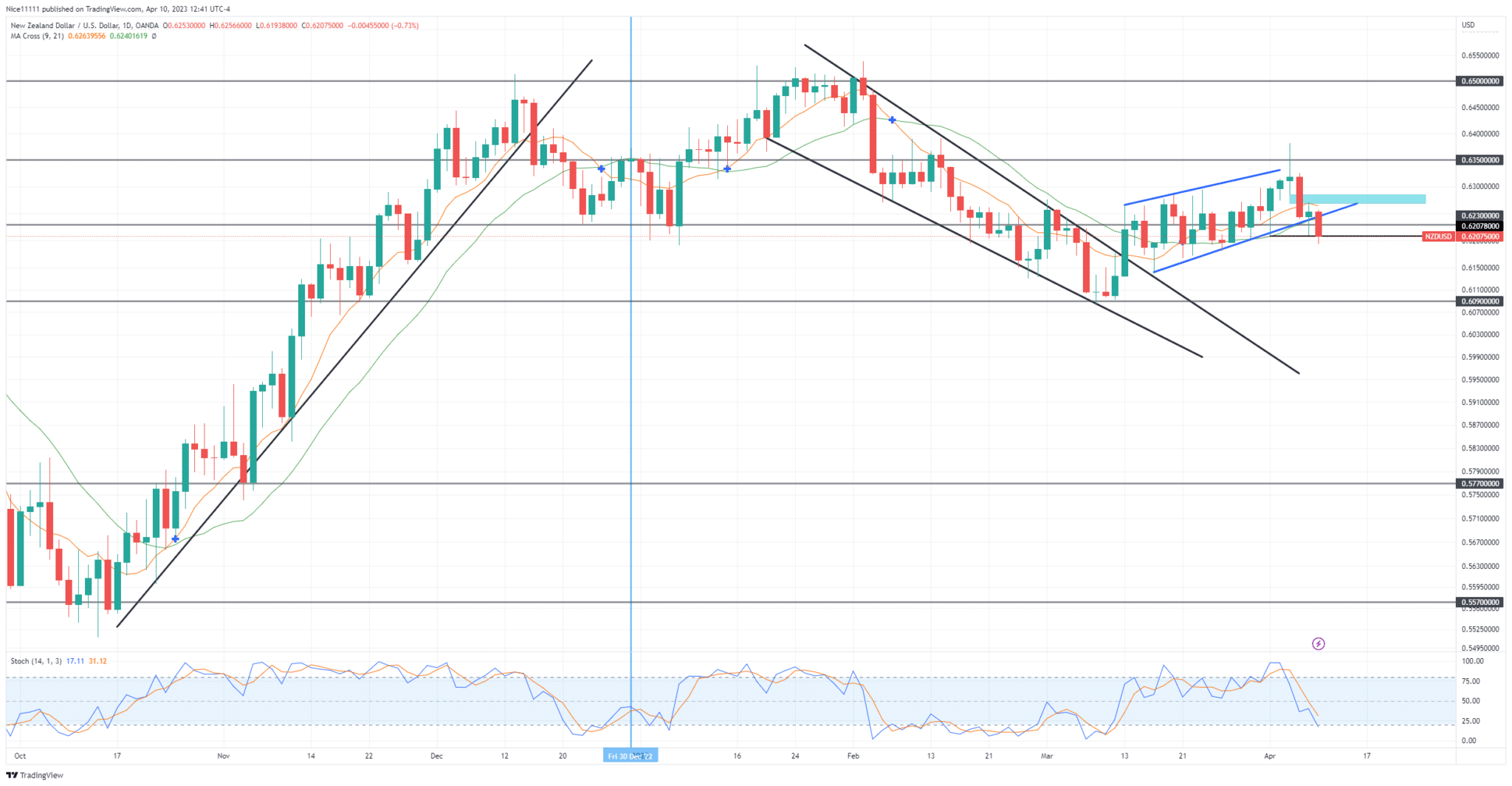

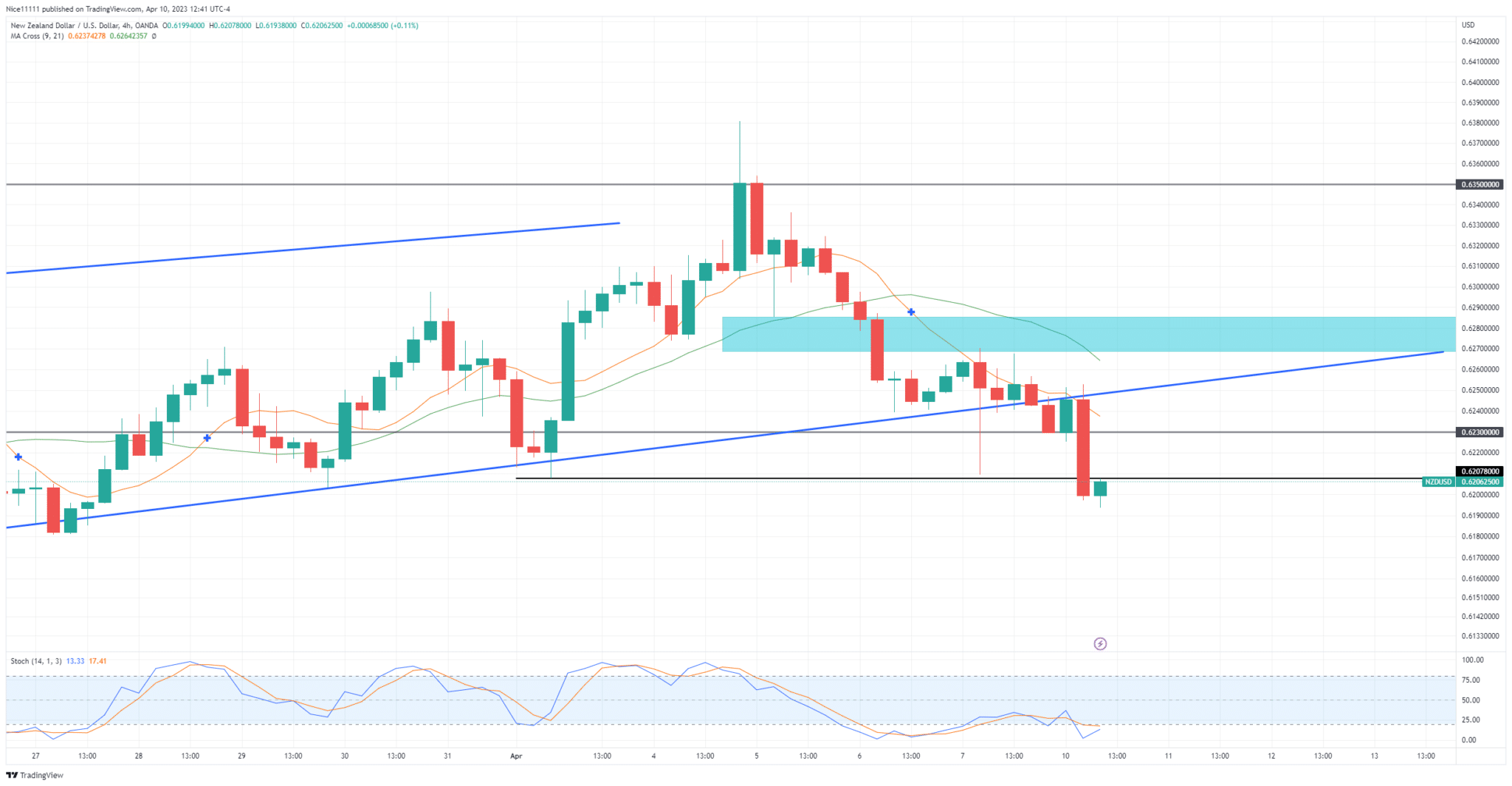

NZDUSD has experienced a bearish displacement after testing the supply level of 0.6350. A fair value gap above the key level of 0.6230 shows the sell side’s inefficiency, which can create more shorting opportunities for the Bears.

NZDUSD Key Levels

Demand Levels: 0.6350, 0.6500, 0.6600

Supply Levels: 0.6230, 0.6090, 0.5770

NZDUSD Long-term Trend: Bearish

NZDUSD market experienced an up-close day at 0.6500, which served as a trigger for a down trend. The Stochastic had already indicated the market was overbought. Shortly after, a prominently long daily candlestick caused a bearish shift in the market structure. The Moving Averages (Periods Nine and Twenty-one) crossed to show the change in market direction from bullish to bearish. The 24 hour candlesticks assembled accordingly within a descending wedge pattern in order to deliver to the support zone of 0.6090. A bullish breakout played out on the 13th of March.

The sellers have seized control by piercing below the swing low of 0.6200. The rising wedge that formed immediately after the bullish breakout from the falling wedge has been invalidated. The pin bar candle that formed on the 0.6350 resistance level revealed the sharp rejection of the sellers. The Stochastic indicator showed that the pin-bar candle that formed on the 5th of April was in the overbought region. This eventually fostered a purge in the market.

NZDUSD Short-term Trend: Bearish

A fair value gap has formed between 0.6350 and 0.6200. Since the Stochastic is oversold on both the daily and Since the stochastic is oversold on both the daily and 4-hour timeframes, a pullback to the fair value gap is anticipated to provide more shorting opportunities.

Do you want to take your trading to the next level? Join the best platform for that here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.