NZDUSD Analysis – October 30

NZDUSD flips bullish after hitting the 0.5510 demand zone. Until the old high at 0.5800 was broken, the market’s overview was typically bearish. The NZDUSD bears were predominantly in control, as indicated by the MA Cross.

NZDUSD Significant Zones

Demand Zones: 0.5600, 0.5510

Supply Zones: 0.6060, 0.6230

NZDUSD Long-term Trend: Bullish

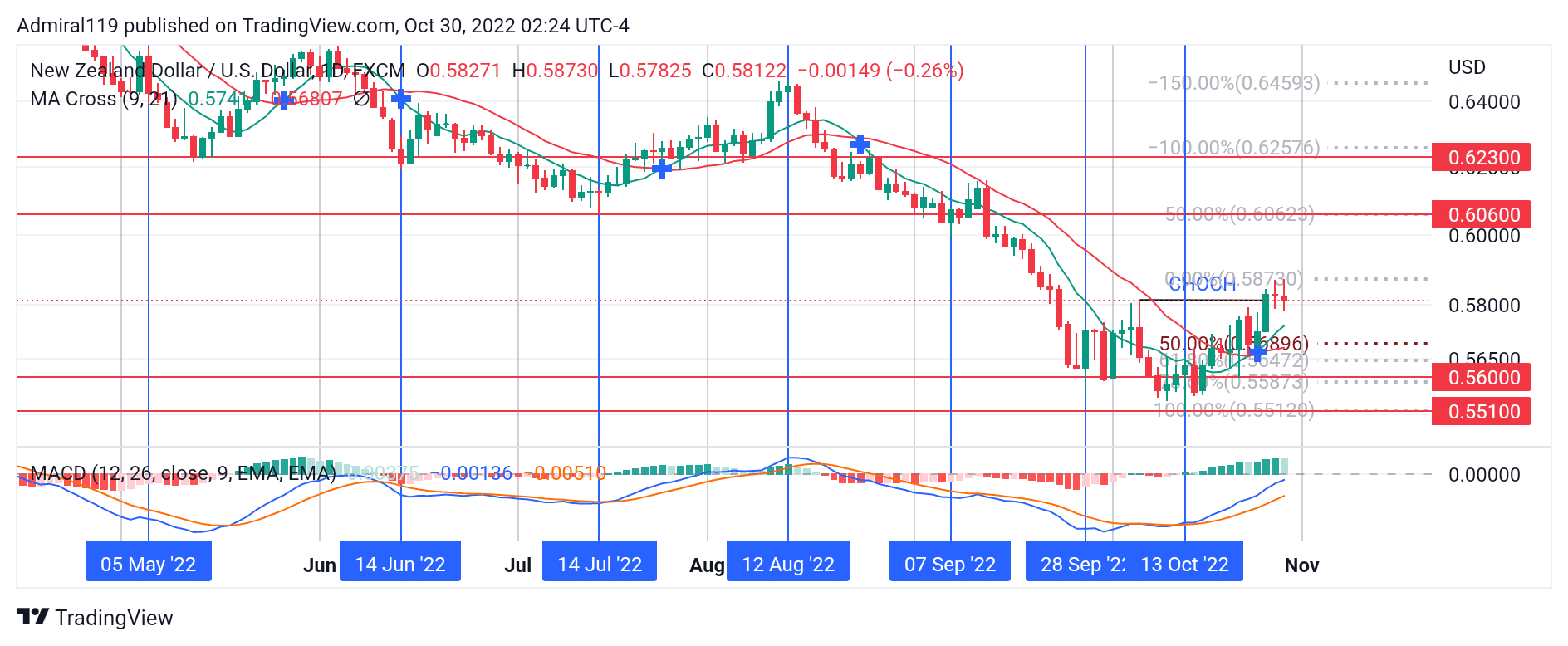

The 0.6230 price level had been a repulsive price until it was broken in August 2022. NZDUSD began to fall in June 2022 after hitting the rejection block formed on the 5th of May, 2022. The price fell from this point until it reached the previous support level of 0.6060. The retracement at the 0.6230 level in June 2022 caused NZDUSD to create a short-term high that got invalidated when the price reacted to the 0.6060 previous support on the 14th of July, 2022. The price began a new course downward after breaching the short-term high on the 12th of August, 2022.

The Moving Average Indicator revealed in August that the market was bearish. This downtrend remained for the next 8 weeks until the 0.5510 demand zone was reached. The Moving Average Convergence Divergence indicator could be seen crossing beyond the zero line upward. Following the rebuff at the 0.5510 demand zone, the bulls raided the market with their long positions, thereby causing a change of character (CHOCH) to the upside. The 0.55120 and 0.58730 price levels define the current trading range for NZDUSD.

NZDUSD Short-term Trend: Bullish

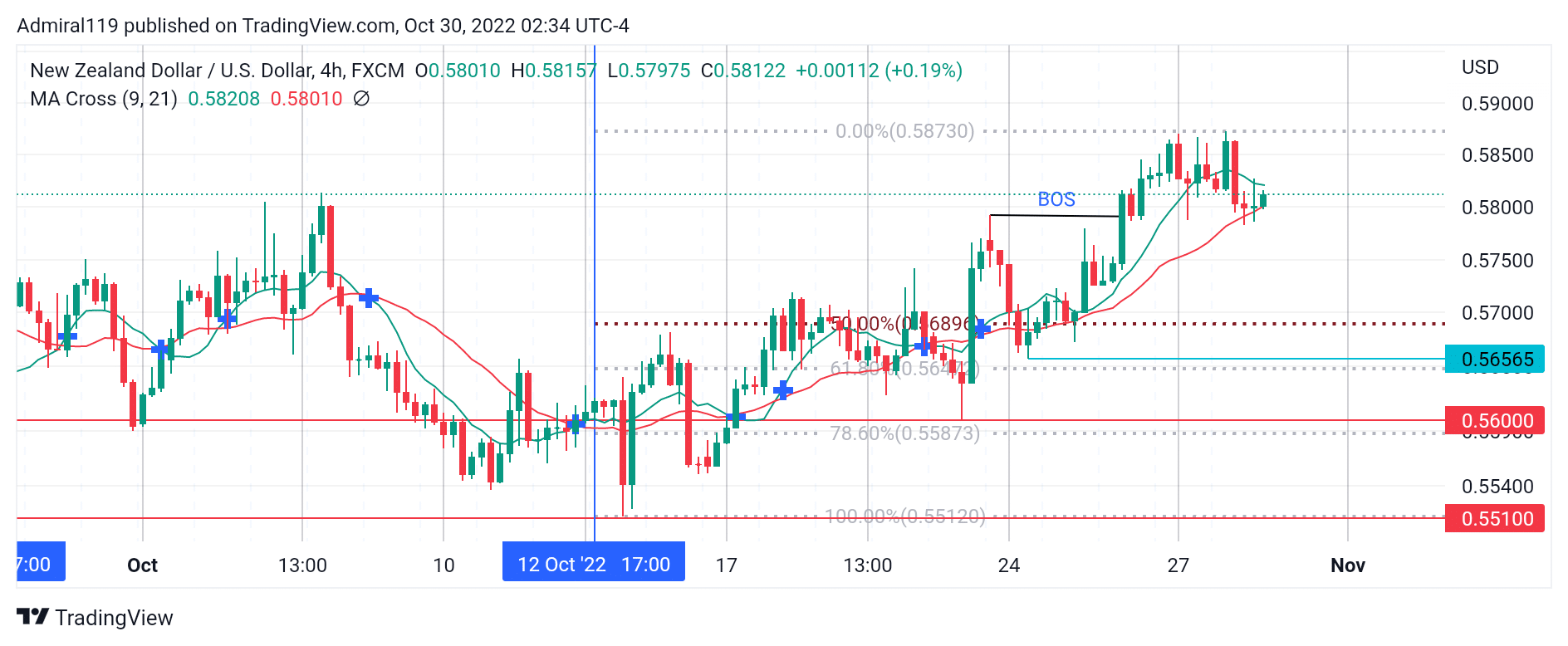

NZDUSD remains bullish on the four-hour chart as it keeps breaking market structure to the upside. After the change of character (CHOCH) to the upside, the price is expected to retrace into a discount zone before expanding further upward.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.