AUDJPY Analysis- October 31

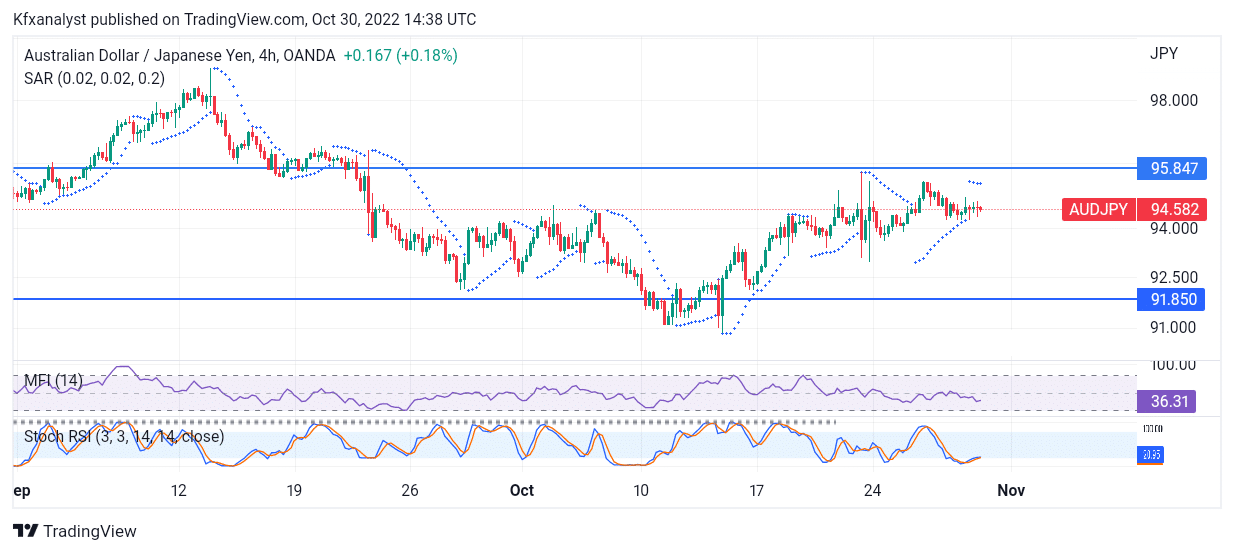

AUDJPY is set to flip sides as the price continues to consolidate. There has been no recent development in the AUDJPY market at the moment. Instead, the buyers and the sellers have been flipping sides as prices continue to range between 95.8470 and 91.850 psychological levels. The buyers are being given the benefit of the doubt as the price recently failed to smash up beyond the 95.8470 psychological level. This is a consequence of buyers’ having been rejected beyond this key zone. With price rejection from the buy side, sellers are now looking for an avenue to go lower as the flipping phase continues.

AUDJPY Key Levels

Resistance Levels: 95.8470, 91.8500

Support Levels: 87.2500, 81.8940

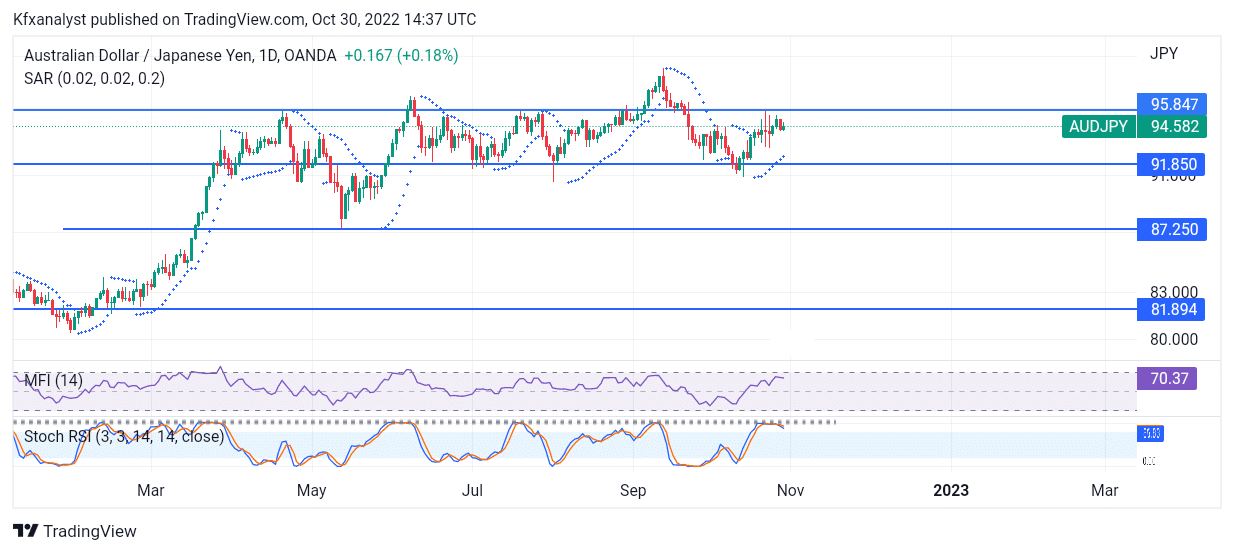

AUDJPY Long-Term Trend- Bearish

AUDJPY price began its ranging streak after buyers’ action to elevate the price. The bulls manipulated the price trend with a charge-up from the 81.8940 key zone. The buying tendency made the price move forward as the rally broke through the 91.850 key level in the market. Ever since the price made its ascent to the 95.870 key zone, the currency pair hasn’t made much impact to go up further beyond this order block. Instead, the price has been consolidating for a while.

The AUDJPY price has been flipping sides as buyers and sellers continue in the range. The Stochastic Oscillator registers price moments in an overbought region as buyers have traded price action close to the 95.8470 key zone. The Money Flow index shows price activity in buying strength on the daily chart.

AUDJPY Short-Term Trend- Bearish

The price is still stuck within the range of the market. The sellers are already picking up activities to flip sides in the market. The Parabolic SAR (Stop and Reversal) indicator shows the price trend lowering on a negative slope as sellers hope to take the price back to the 91.850 key zone.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.