NZDUSD Analysis – November 6

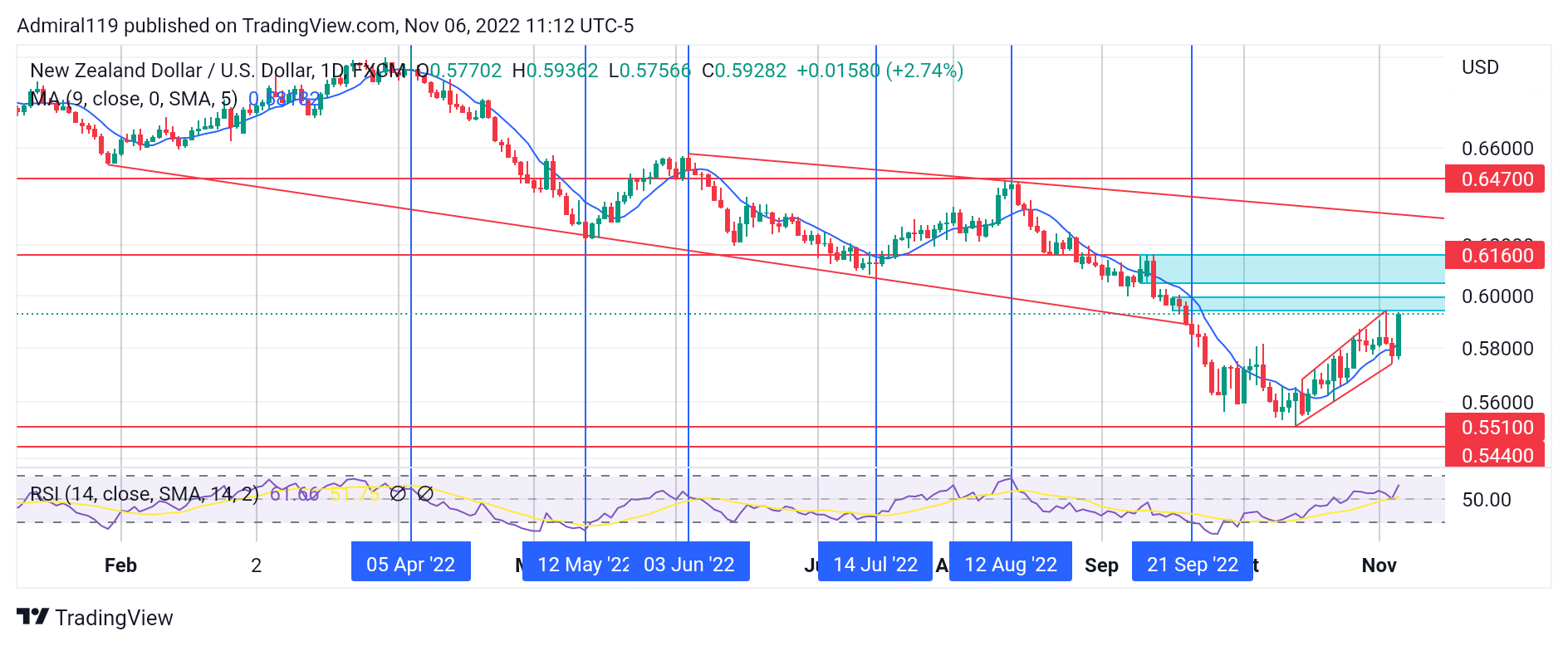

NZDUSD begins an uptrend within an ascending channel. Though the overall outlook of the market on higher time frames is bearish, the daily chart reveals an impending drastic change in the market environment.

NZDUSD Significant Zones

Demand Zones: 0.5510, 0.5440

Supply Zones: 0.6160, 0.6470

NZDUSD Long-term Trend: Bullish

Algorithmically, NZDUSD has been providing opportunities for the bulls and the bears, occasionally. With expansions, retracements, consolidation, and reversals, the market’s order flow remains institutional and attractive to both bulls and bears. The bears seem to have been quite dominant in the market ever since the year’s high was reached on April 5, 2022. Following the attainment of this high, the price depreciated into an oversold region. With the 0.6470 previous resistance trying hard to hold the price, the selling pressure at the level seemed overwhelming as the price struck, broke, and finally retested the level.

On the 12th of May this year, the bears decided to keep their movement within a descending channel. This descending channel was valid until the 21st of September, 2022. Before the descending channel became invalidated, the price had made intriguing bounces on both boundaries on the 3rd of June, 14th of July, and 12th of August, in that order. For the first time in the year, NZDUSD might be heading into the overbought region, which is above the 70.0 level of the Relative Strength Index. This will most likely stir the bulls up as they prepare for the next entry.

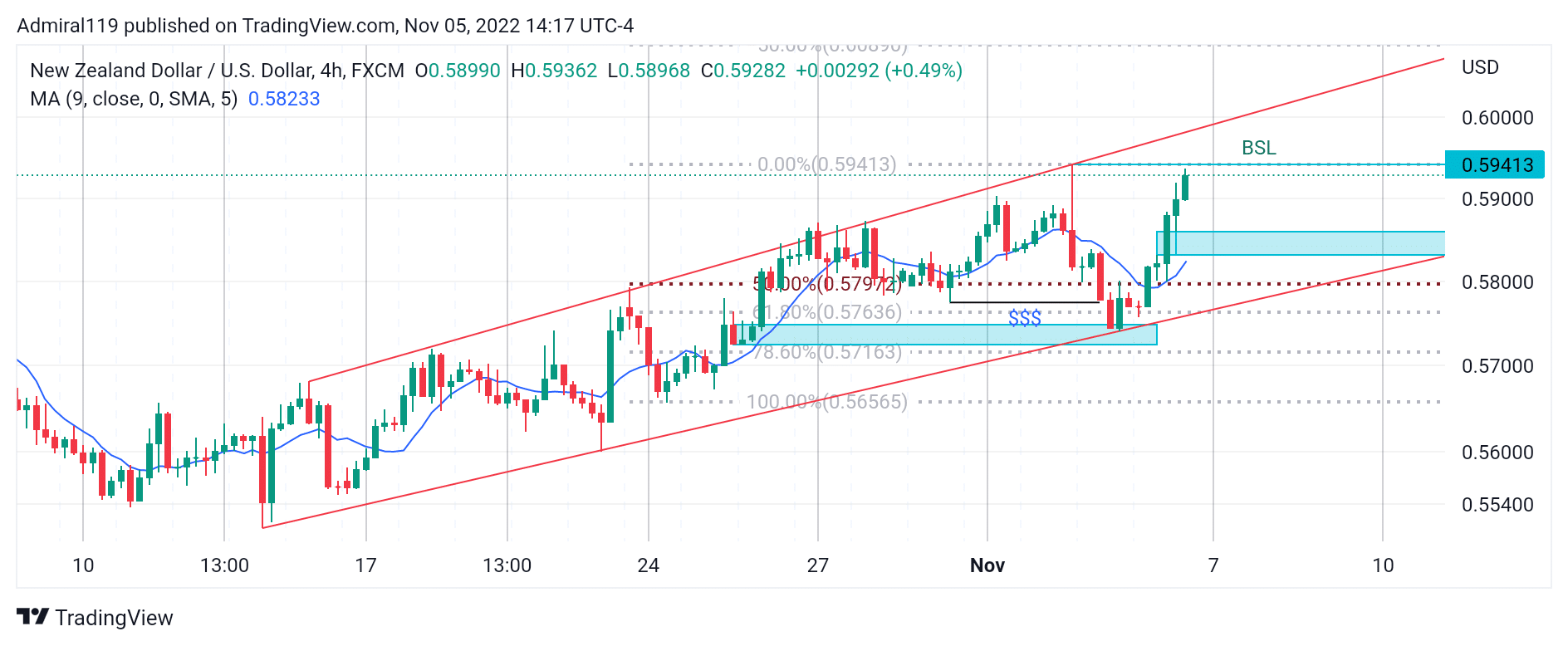

NZDUSD Short-term Trend: Bullish

The market has been surging upward within an ascending channel on the four-hour chart. NZDUSD looks bullish as it creates higher highs and higher lows. After inducing sell-side liquidity and filling the bullish order block, the price heads upward to clear the previous high. Should the price retrace downward at this point, the four-hour fair value gap is expected to be a re-entry level for the bulls.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.