AUDJPY Analysis – November 7

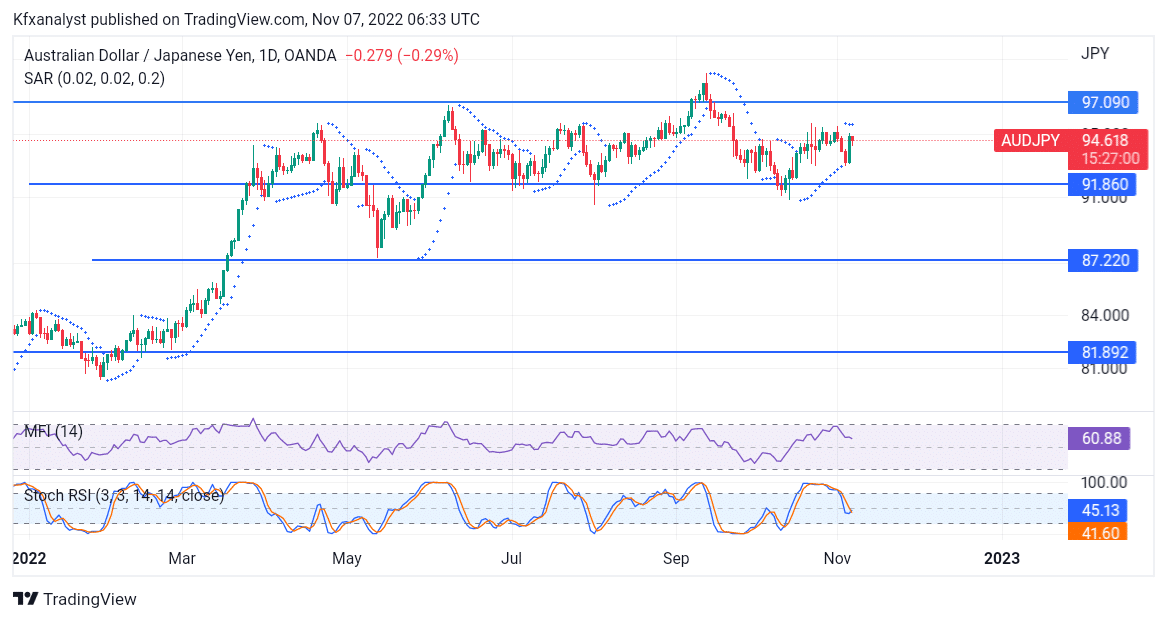

AUDJPY buyers Hold defense amid price consolidation. The buyers have been constantly making offensive movements against the price trend, despite its range. No doubt the currency pair has been showing a sideways tendency since the beginning of the second quarter of the year. Nevertheless, the buyers have always been making every available attempt to push higher but have been unable to break with much impact beyond the 97.090 key zone.

AUDJPY Key Zones

Resistance Zones: 97.090, 91.890

Support Zones: 87.220, 81.890

AUDJPY Long-Term Trend: Bullish

The buying action, however, succeeded once to break beyond it in the middle of September, but the immediate effect was a price reversal. Therefore, the price consolidation observed implies that the market is not yet charged with enough strength to push further. The buy traders first had their checkmate as bullish strength made its way outside of the 81.890 key zone with strong liquidity vigor.

The bullish rise broke outside of the 87.220 key zone with ease before riding forward above the 91.860 key zone. It appeared that at this stage, the buying tendency began to move with the price as AUDJPY activity made a decline back to the 87.220 key zone.

The bulls regained consciousness but were unable to ride much further as buildups began to consolidate in the market. Last week’s “pushing the up” shows buyers were previously charged with pushing the price tendency from 91.860 back to the 97.090 key zone. The buyers are currently correcting price pullbacks despite being in a sideways movement.

The stochastic oscillator shows a cross-section at the middle level as buyers still plan to take over their buying stance in the market. The buy traders still plan to fight their way back amidst consolidation in the market.

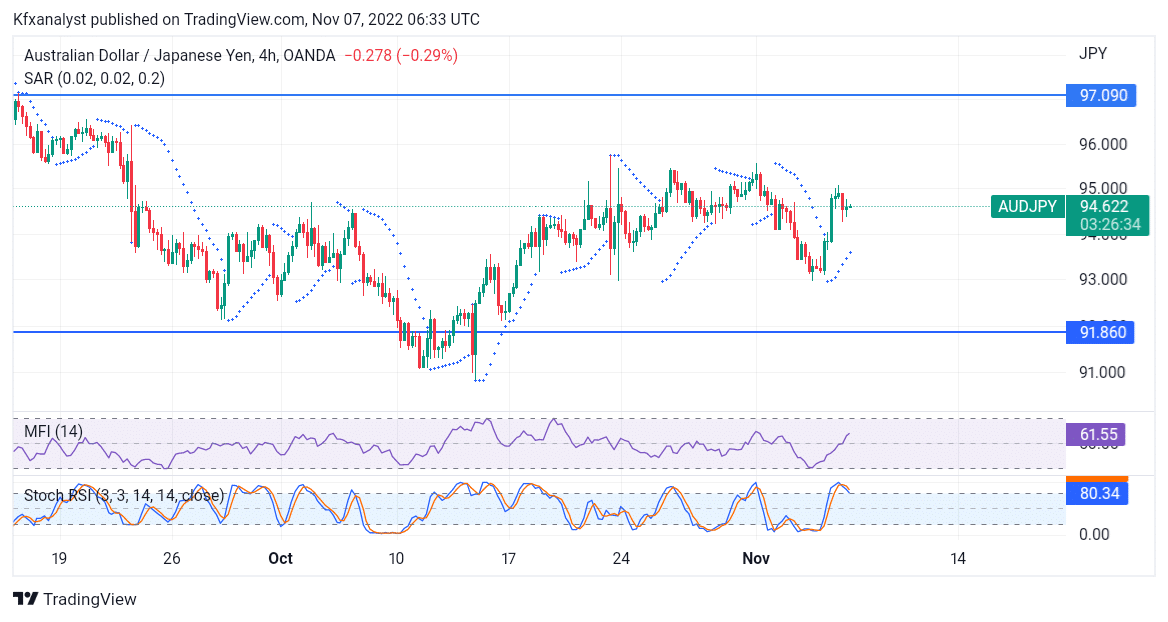

AUDJPY Short-Term Trend- Bullish

The bulls are gathering vigor to shoot back to the 97.090 key zone following the market pullback. However, the market still appears to be in a consolidation phase at the moment. The Money Flow Index indicator is also spiking upward as buyers hold positions in the market at the moment. Buyers still plan to maintain their stance on the 97.090 key zone.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.