The New Zealand dollar (NZD) soared against the US dollar (USD) on Wednesday, as the Reserve Bank of New Zealand (RBNZ) kept its official cash rate unchanged at 0.25% but hinted at further tightening in the future. The NZD/USD pair rose by more than 1% to peak at 0.6208, its highest level since August 1.

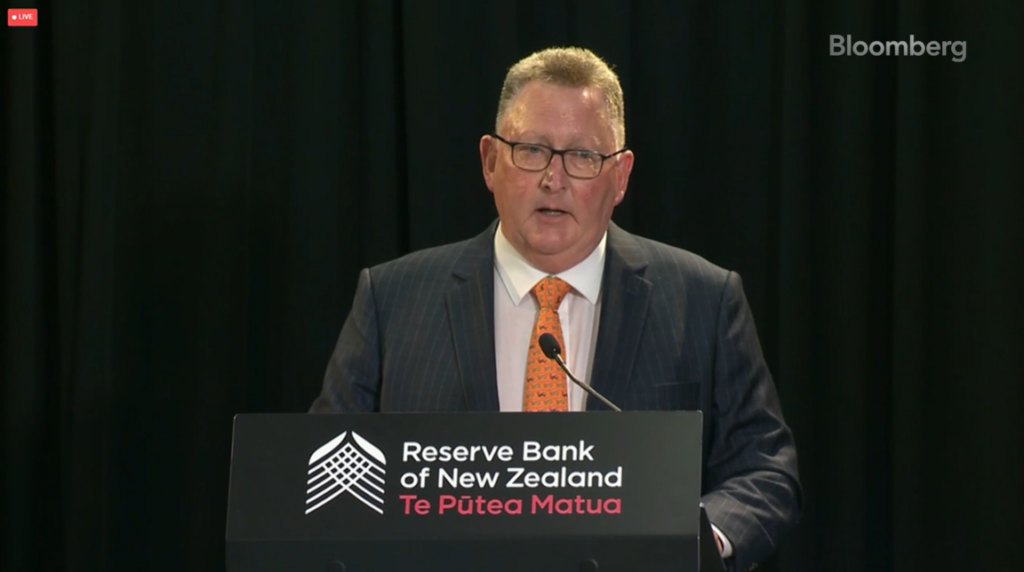

The RBNZ Governor, Adrian Orr, delivered a hawkish speech, expressing concern over the persistent inflationary pressures in the economy. He said that the central bank was “nervous,” that inflation had been outside the target range of 1-3% for too long, and that 10-year inflation expectations were “creeping higher.”

He also said that the RBNZ was “very tuned” to the global interest rate outlook and that it was not bound by policy meeting dates and could act on shocks if needed. He added that the banks should listen to the RBNZ’s guidance that rates need to be high for some time to come.

The RBNZ’s stance contrasted with the more dovish tone of the Federal Reserve, which weighed on the USD. The Fed’s Williams, one of the most influential policymakers, suggested that the Fed could pause or reverse its rate hike cycle if inflation continued to decline.

The market expectations of Fed rate cuts increased as the implied Fed funds futures showed a 25 basis point reduction by December 2024. The US Treasury yields also fell across the curve, reducing the appeal of the USD.

NZD/USD Traders Should Expect More Volatility Soon

The NZD/USD pair will likely face more volatility in the coming days, as the US GDP, Fed speakers, and the beige book will be released later today, followed by the core PCE inflation data tomorrow. The core PCE is the Fed’s preferred measure of inflation, and any deviation from the forecast could affect the Fed’s policy outlook and the USD’s direction.

Interested In Becoming A Learn2Trade Affiliate? Join Us Here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.