Market Analysis – December 7

The New Zealand Dollar is closing out the week with impressive strength, positioning NZD/USD for a nearly 3% gain over the last two weeks. This upward momentum has been driven largely by broad U.S. Dollar weakness, as market participants shift their focus to the Federal Reserve’s upcoming policy decision. With traders widely expecting a 25-basis-point rate cut next week and anticipating two to three additional cuts in the year ahead, the shifting interest-rate landscape is reshaping sentiment across major currency pairs—NZD/USD included. As expectations tilt toward a more accommodative Fed, the Kiwi continues to benefit from the resulting pullback in the Dollar.

NZD/USD Key Levels

Demand Levels: 0.58, 0.59, 0.60

Supply Levels: 0.57, 0.56, 0.55

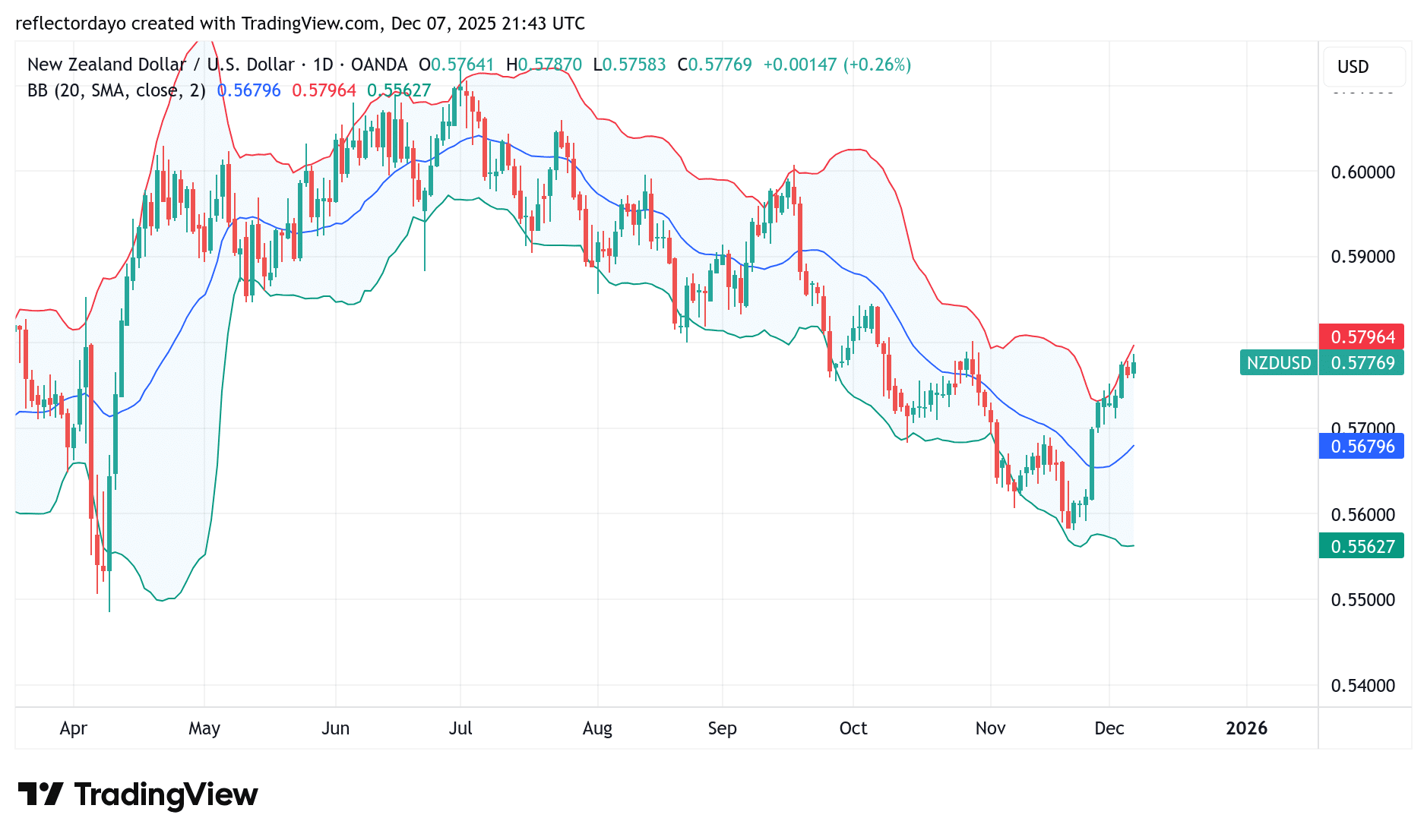

NZD/USD Exhibits Bullish Recovery

The NZD/USD pair has been in a gradual downtrend since July, declining from the $0.61 region. However, bearish momentum appears to have met a pivotal support zone around the 0.57 price level in November. As buying interest strengthened near 0.56, the pair rebounded sharply, breaking above the 0.57 barrier and sustaining its gains.

By Friday’s close, NZD/USD had climbed to approximately 0.578, signaling renewed bullish sentiment. The latest candlestick pattern suggests that further upside may be possible. However, traders should note the wide Bollinger Bands, which indicate elevated volatility and the potential for strong price swings in either direction.

If bullish momentum weakens and the pair fails to hold above 0.578, a pullback toward the 0.57 support level remains likely. For now, buyers continue to hold the advantage, but volatile conditions call for cautious optimism.

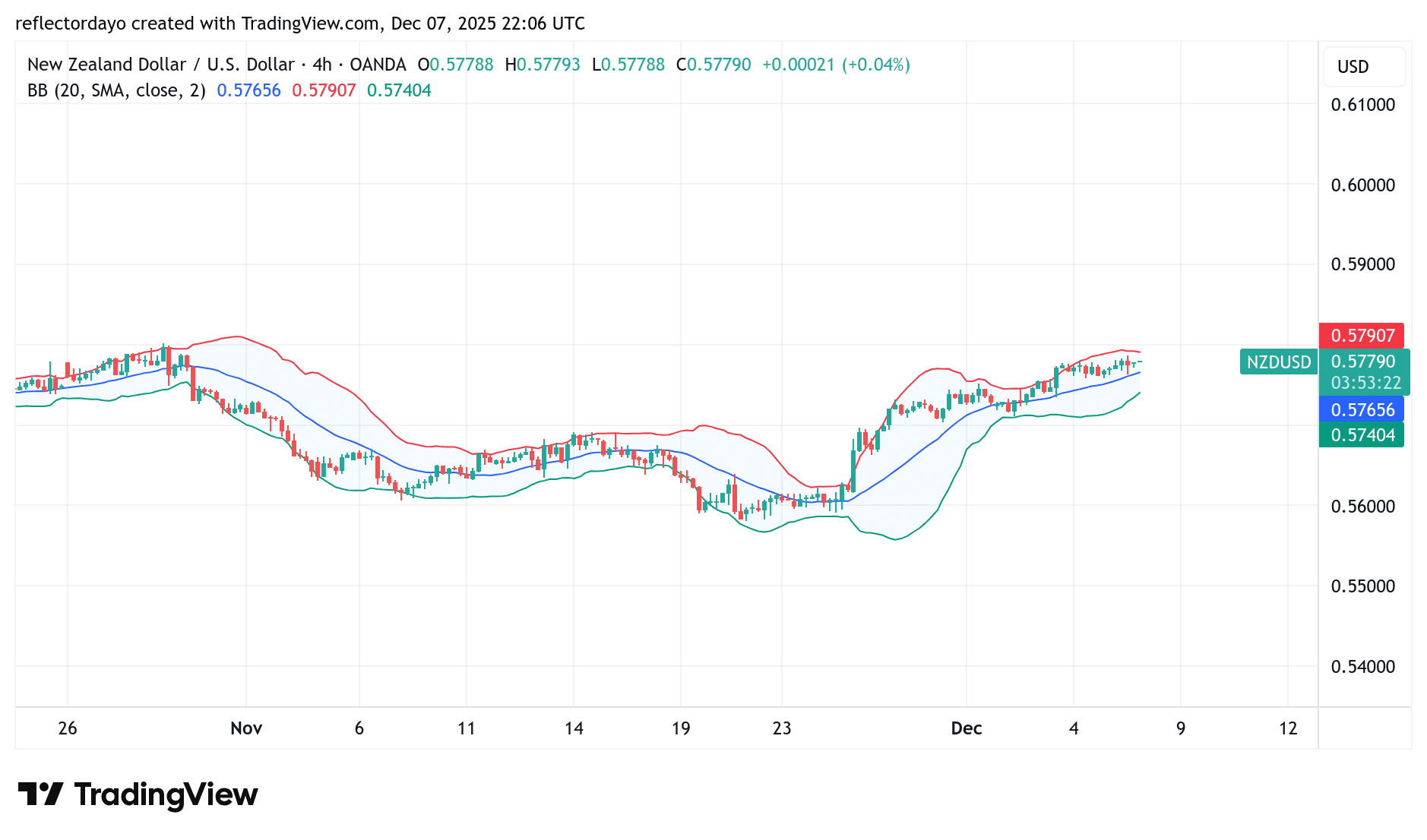

NZD/USD Short-Term Trend: Indecision

On the lower timeframes, NZD/USD continues to show a steady bullish recovery, with price pushing gradually higher. However, as the pair approaches the 0.58 level, momentum has slowed, and the market is beginning to consolidate. This behavior is expected, as 0.58 has historically acted as a key price zone, prompting traders to proceed with caution.

Interestingly, with the pair hovering near 0.58, a near-term support appears to be forming around 0.57. If this support continues to hold, bullish traders may gain enough strength to attempt a breakout above the 0.58 resistance. A confirmed break above this critical level could open the door for additional buying pressure, potentially driving the market further to the upside.

For now, the short-term outlook reflects indecision, but the bullish structure remains intact.

Make money without lifting your fingers: Start using a world-class auto trading solution.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.