NZD/USD seems ready to get out from a minor range signaling more gains ahead. The price action has developed a Double Bottom reversal pattern. So, the pair could come back higher in the short term.

The US data has come in mixed on Friday signaling that the USD could depreciate in the short term. It remains to see how the pair will react after today’s economic figures.

The ISM Services PMI, Factory Orders, and the Final Services PMI may bring high action. Some poor US data should send the pair higher.

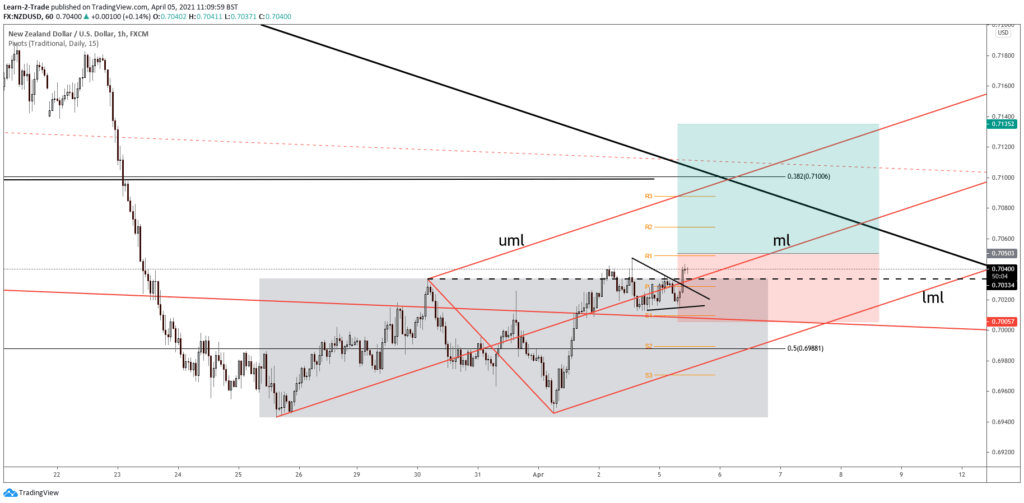

NZD/USD H1 Chart Analysis!

It’s traded back above 0.7033 static resistance approaching the 0.7047 former high. A new higher high and a bullish closure above the R1 (0.7048) signals bullish momentum.

NZD/USD failed to stabilize under the pivot point and below the median line (ML) indicating strong buyers. The upside scenario could be invalidated by a drop below the S1 (0.7009).

Conclusion!

An upside breakout from the current range may activate a Double Bottom pattern. Stabilizing above the median line (ml) indicates strong buyers and further gains.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.