EURUSD Price Analysis – April 5

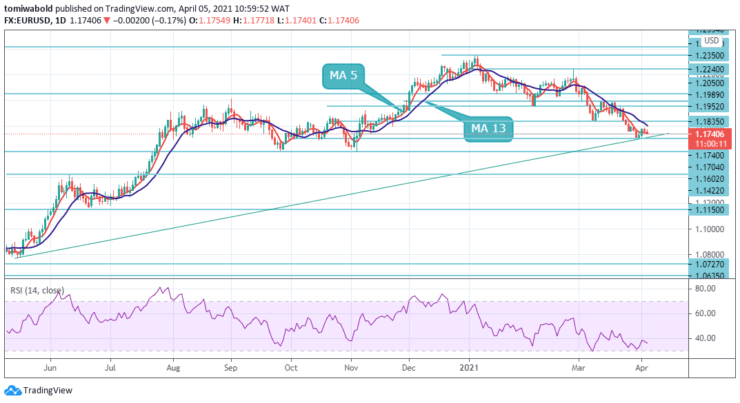

Early in the European session, the EURUSD pair surrenders its uptick beneath the mid 1.1700 level. The pair extended its decline in attempting to plunge the 1.1700 floors. Investors focused on quicker economic growth after the US employment report released Friday overtook forecasts, keeping the market upbeat.

Key Levels

Resistance Levels: 1.2050, 1.1952, 1.1835

Support Levels: 1.1704, 1.1602, 1.1422

Any subsequent fall is likely to find decent support and attract buyers near the 1.1704 horizontal support and the ascending trendline, according to the daily chart’s technical pattern. Following sell-offs could speed up the corrective slide towards 1.1602, but it’s more likely to be capped around the 1.1700s.

A sustained break below, on the other hand, will be interpreted as early signs of bullish fatigue, leaving the pair exposed to further falls, potentially challenging the psychological 1.1602 levels. Near the 1.1800 marks, we’re keeping a close eye on the stop signs. A sustained breakout, on the other hand, may have long-term bullish implications.

Meanwhile, the intraday bias in EURUSD stays on the downside for the moment. The breach of ascending trendline support may validate the start of the third phase, with a temporary low firmed at 1.1703, just ahead of 38.2% retracement of 1.0635 to 1.2348 at 1.1694. On the upside, above 1.1835 minor resistance level may alter intraday bias neutral first.

On the other hand, European session highs around 1.1771 now seem to act as immediate resistance. It is followed by last week’s swing high, around 1.1807 areas, which, if cleared decisively, may set the stage for further short-term appreciation. The pair may then breach beyond 1.1835 and aim to test the next major obstacle near the 1.1989 congestion zone.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.