Market Analysis – January 4

The NZD/USD pair has regained upward traction as shifting monetary policy expectations on both sides of the Pacific reshape market sentiment. A softer US Dollar, driven by growing anticipation of further Federal Reserve rate cuts in 2026 and political uncertainty surrounding future Fed leadership, has provided room for the New Zealand Dollar to recover. At the same time, improving domestic economic signals in New Zealand and rising expectations that the Reserve Bank of New Zealand may lean toward a tighter policy stance are offering additional support to the kiwi, setting the stage for renewed volatility in the pair.

NZD/USD Key Levels

Supply Levels: 0.5800 , 0.58500, 0.5900

Demand Levels: 0.57000, 0.56500, 0.5600

NZD/USD Shows Brief Correction, but 0.5800 Still Within Reach

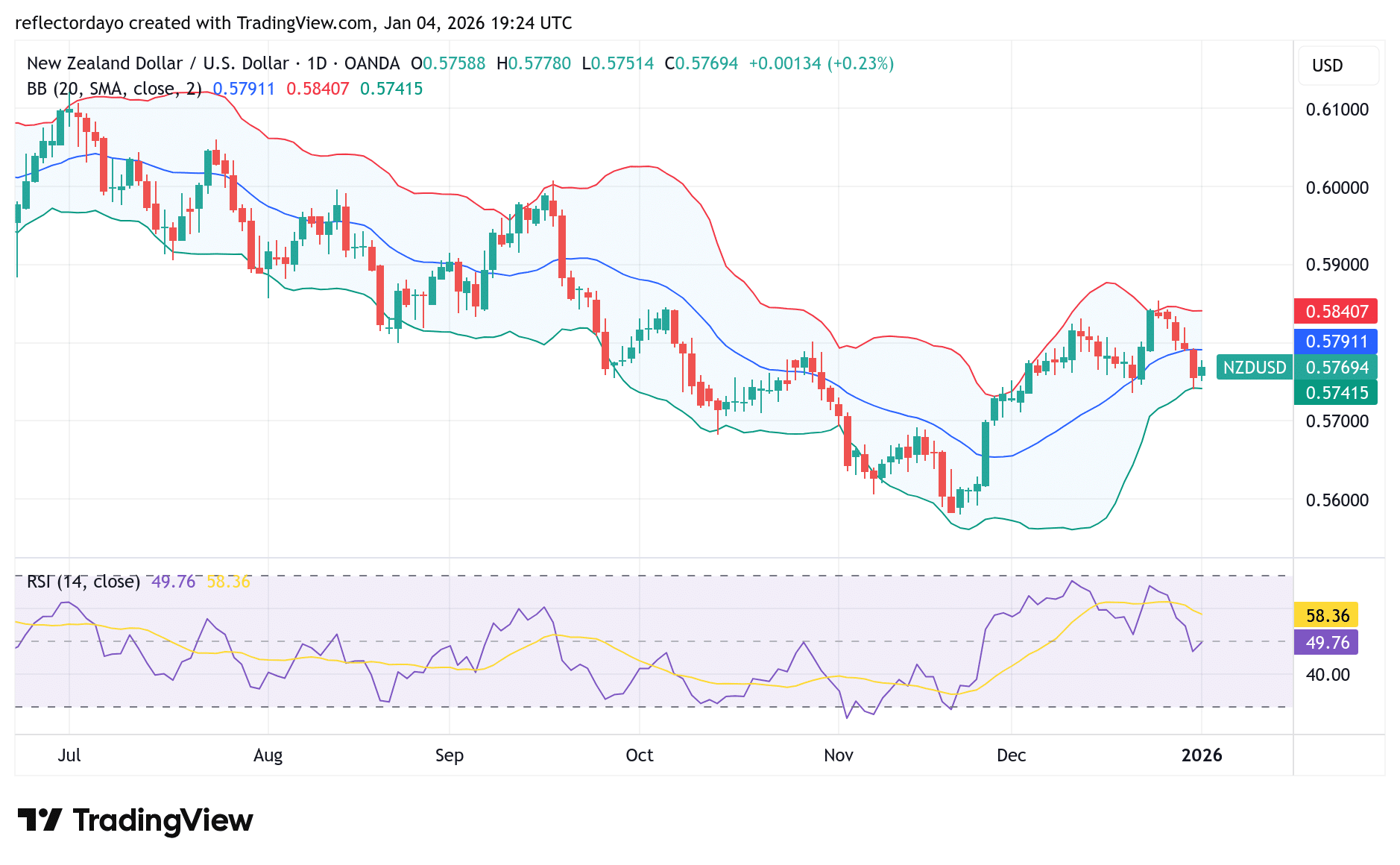

The NZD/USD pair has been consolidating around the 0.5800 price level over the past few weeks, reflecting a period of market indecision. Recently, price action experienced a corrective pullback after being rejected at the 0.5850 level on Christmas Eve 2025. Following this rejection, the pair retreated but found renewed buying interest near the 0.5750 support zone.

This week, NZD/USD rebounded once again from the 0.5750 level, further reinforcing it as a key support area. With multiple successful defenses of this zone, support strength continues to build, increasing the likelihood of a rebound rather than a downside breakdown in the near term.

NZD/USD Short-Term Trend

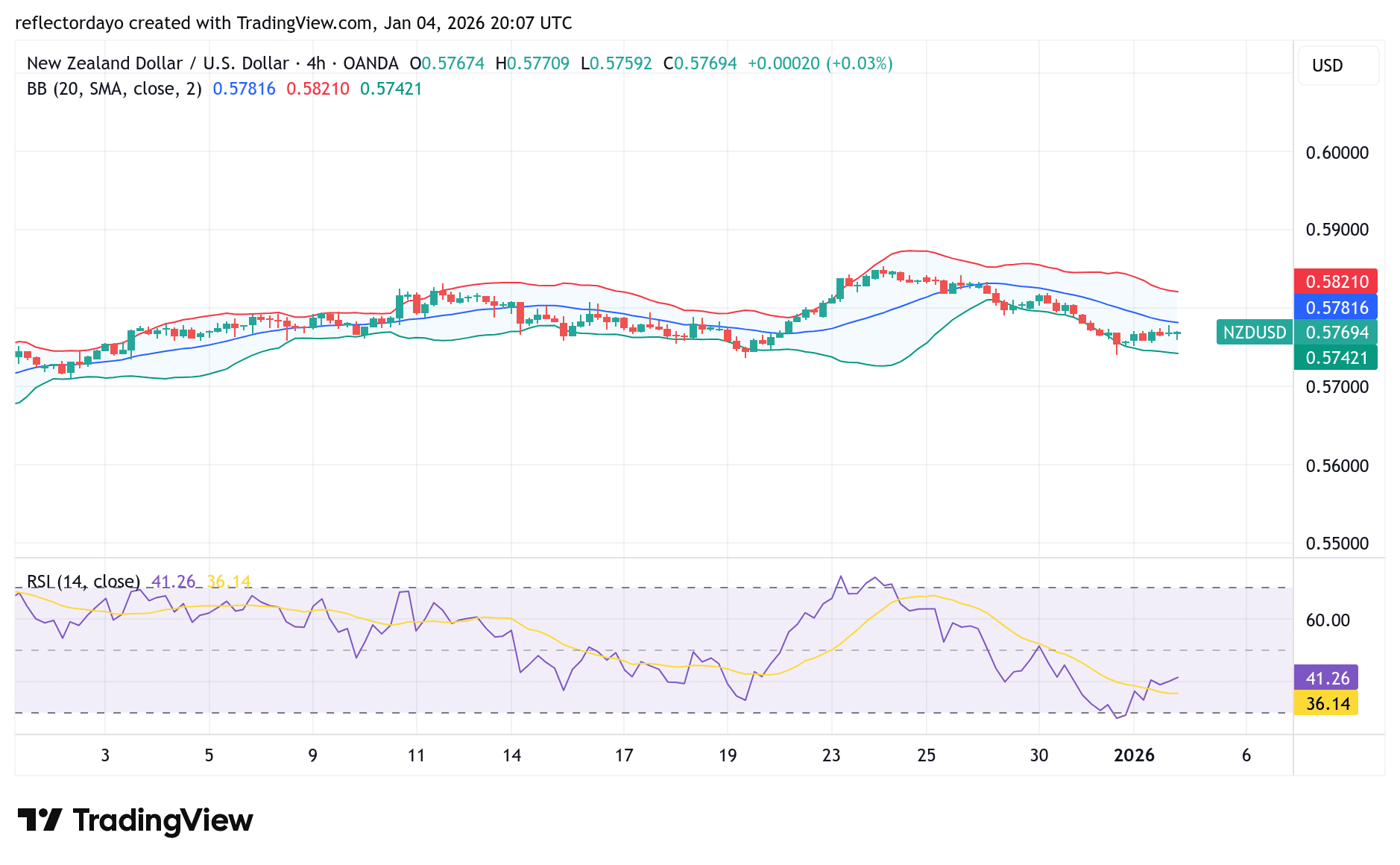

From the perspective of the 4-hour chart, the market has shifted into a consolidation phase following a bearish price move. Price action has flattened around the 0.5750 level, a critical support zone that has played a significant role in past market behavior.

When previously bearish momentum transitions into sideways movement at a key support level, it often signals a buildup of pressure for a stronger directional move. In this case, the prolonged consolidation around 0.5750 increases the likelihood of a bullish rebound, as traders may be positioning for a potential upside surge.

Make money without lifting your fingers: Start using a world-class auto trading solution.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.