Market Analysis – December 29

The NZD/USD pair is currently navigating a delicate balance between shifting monetary policy expectations in the United States and improving economic signals from New Zealand. After several sessions of subdued price action, the pair remains under pressure as the US Dollar finds renewed support, driven largely by technical recovery and cautious market positioning ahead of key Federal Reserve communications. With investors closely watching upcoming signals from the Fed, short-term sentiment around the greenback remains fragile but influential.

At the same time, the broader macro backdrop suggests that downside pressure on NZD/USD may not be entirely one-sided. In the United States, expectations of further interest rate cuts in 2026 continue to cap aggressive USD strength, even as markets reassess the Fed’s near-term stance following its recent rate reduction. This evolving outlook has kept traders on edge, particularly as they await clearer guidance from the Federal Open Market Committee’s meeting minutes.

NZD/USD Key Levels

Supply Levels: 0.5800 , 0.58500, 0.5900

Demand Levels: 0.57000, 0.56500, 0.5600

NZD/USD Shows Strength Above 0.5800

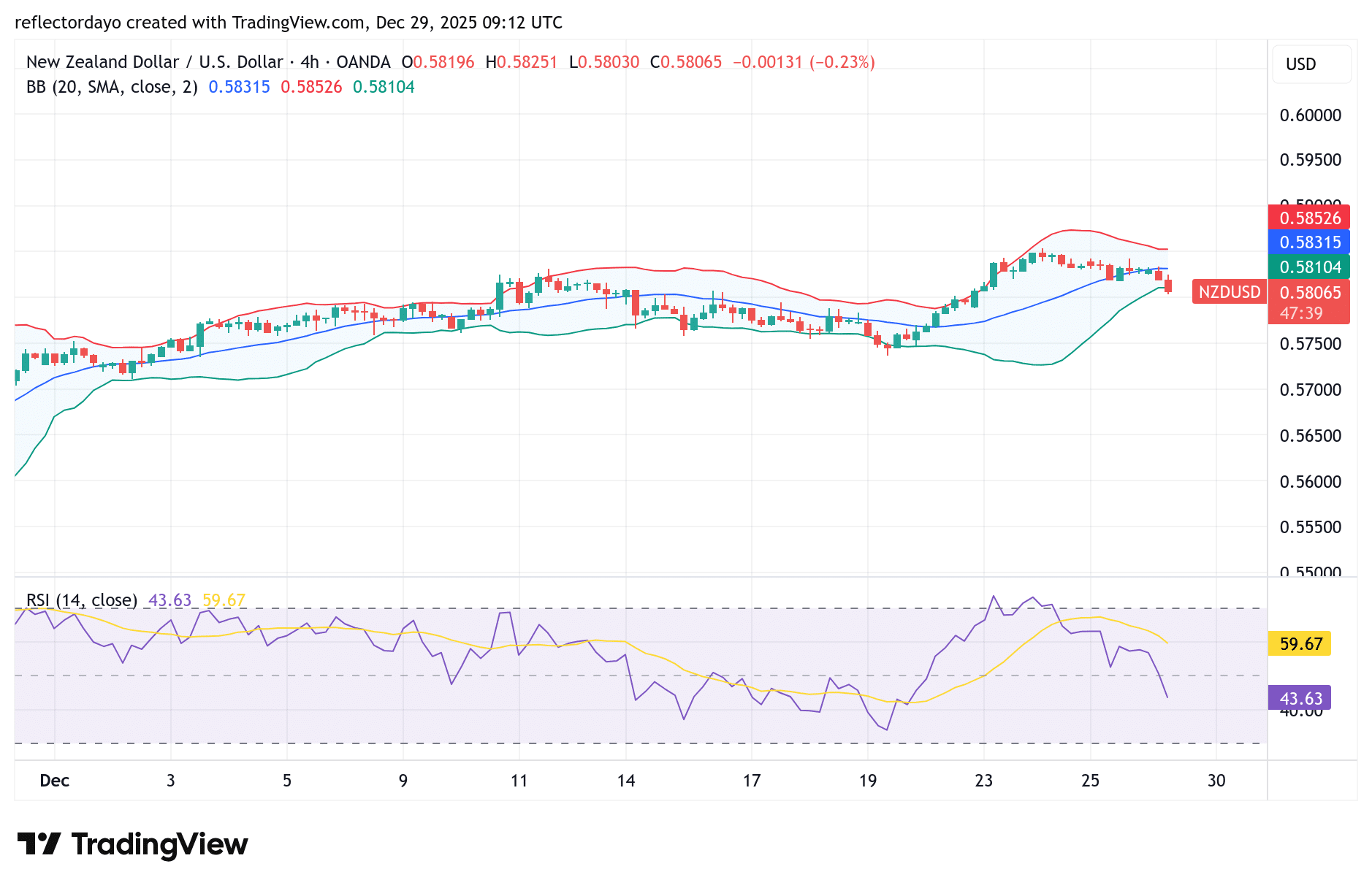

In recent trading sessions, the NZD/USD market has gained notable strength, surging above the critical 0.5800 price level—a major achievement for the bulls. After breaking above this level, the market extended its move toward the next key resistance at 0.5850. However, bearish pressure around this zone led to a rejection, causing price to pull back.

Despite the pullback, the 0.5800 level now appears to be acting as a support zone. Since bulls have successfully reclaimed this area, selling pressure may be limited at this point, as traders could be viewing the level as a potential re-entry zone for bullish positions.

NZD/USD Short-Term Trend

Zooming into the smaller timeframe, specifically the 4-hour chart, bearish momentum is becoming more pronounced as price declines sharply toward the critical 0.5800 level. This accelerating bearish move suggests increasing selling pressure in the short term.

However, this downward momentum may begin to fade as the market approaches the 0.5800 support zone, where optimistic traders could step in. While technical indicators currently point to strong bearish momentum, the proximity to this key support level raises the likelihood of a slowdown or rejection in price action. If bulls re-enter the market at this level, a short-term rebound could emerge.

Make money without lifting your fingers: Start using a world-class auto trading solution.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.