Remember Nokia (NOK), the pioneer in mobile that got killed by Apple’s iPhone? Well it’s back, and – unlike GameStop (GME) – the fundamentals are great.

In case you haven’t noticed, unloved legacy stocks have become quite the thing and we have the Redditors at the wallstreetbets sub to thank for it.

Although Nokia is not really a ‘short squeeze’ target in the fashion of GameStop (short interest 138%), with only around 16% of the float being shorted, it has nevertheless risen to second position in trending stock-ticker mentions on WSB.

This week the US-listed shares of the Finnish telecoms group rose 17% on Monday and 38% yesterday (Wednesday 27 January).

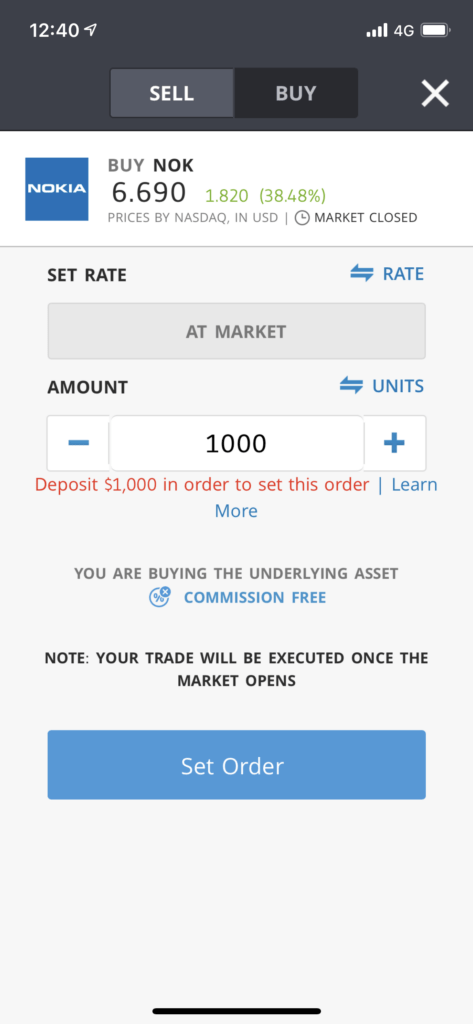

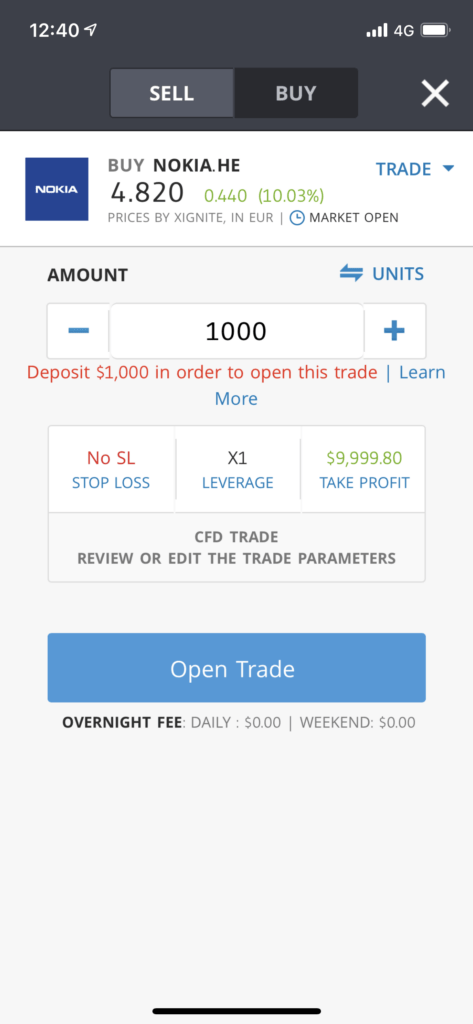

Currently in the US premarket action, NOK has pulled back but appears to be recovering at the time of writing, which is underscored by the Helsinki listing (Nokia.HE), which is trading up 10% at €4.82.

8cap - Buy and Invest in Assets

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Buy over 2,400 stocks at 0% commission

- Trade thousands of CFDs

- Deposit funds with a debit/credit card, Paypal, or bank transfer

- Perfect for newbie traders and heavily regulated

Unlike GameStop perhaps, Nokia has solid fundamentals. Certainly, a case could have been made for buying GameStop as a turnaround play (even before the current “insanity”), as Michael Burry of ‘The Big Short’ fame did at the end of last year.

But if that turnaround story only loosely fits GME, it is surely a snug one for NOK.

Nokia has long since left the mobile handset business behind, choosing to licence its brand name to a startup called HD Global instead, although it has a lot of IP to its name in the area that still provides an income stream. These days it is a serious player in 5G.

Nokia (NOK) leading in US 5G network build out

In the 5G department, it may not have the scale of Huawei but in western markets at least, it has at least one major thing going for it – it is not Huawei.

The fears about the Chinese telecom equipment manufacturer’s links to the military in its home country led the US to ban it from US networks and to pressure allies to do the same. That has opened doors for Nokia, although replacing already installed Huawei equipment is no straightforward matter.

But leaving that aside, Nokia has some state-of-the-art tech and rumours that it has a deal in the pipeline with NASA to install 5G connectivity on the Moon has also helped put the stock back on the map.

Nokia is a bidder in the latest C-band 5G mid-range spectrum auction in the US. The winners are not known, but Nokia is in pole position and its AirScale radio tech is for outdoor and indoor access is making waves.

The Finnish company recently inked a multi-billion dollar deal with T-Mobile and already supplies telecoms equipment to all the three major US carriers (Verizon and AT&T being the other two).

The stock trades on a PE of 44, so it is no longer as cheap as it was following the recent spike, and has a market cap of $36 billion. However, its price-to-book multiple is an excellent 2.07, well inside the ball park for value investors, who look for a reading of less than 3.0 before they consider buying.

Enterprise value to EBITDA is also healthy, at 5.96 compared to the S&P 500 average of 14.2. A reading under 10 is considered to be good.

EPS is a modest 0.15 but the stock is still way off its 52-week high at $9.79.

Buying at current prices still represents fundamental value despite the recent run-up.

Although NOK has been caught up in the short squeeze frenzy, it is not the same as a GameStop or Blackberry – other than in being a legacy name – although both of those companies have businesses that don’t deserved to be shorted to death, assuming in the case of GME it can execute a turnaround by repositioning for digital.

NOK is a speculative pick at this point because of the present volatility around the stock, but the upside far outweighs the downside risk, given the safety net of the 5G growth story.

You can buy NOK on eToro commission-free.

update 14:13 GMT 28 Jan 2021: Robinhood has blocked trading in AMC, NOK, BB, GME

8cap - Buy and Invest in Assets

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Buy over 2,400 stocks at 0% commission

- Trade thousands of CFDs

- Deposit funds with a debit/credit card, Paypal, or bank transfer

- Perfect for newbie traders and heavily regulated

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.