Bitcoin (BTC) Price Analysis – October 9

For the past 15 days now, Bitcoin has been undergoing a consolidation phase after bouncing off at $77000 area in late September. With -0.29% loss over the past hours, the BTC price now fluctuates at around the $8200 zones. As the market waits for the next shock-wave, Bitcoin’s price may roll to $6400 – the April 2 surge level if a bearish surge resurfaces.

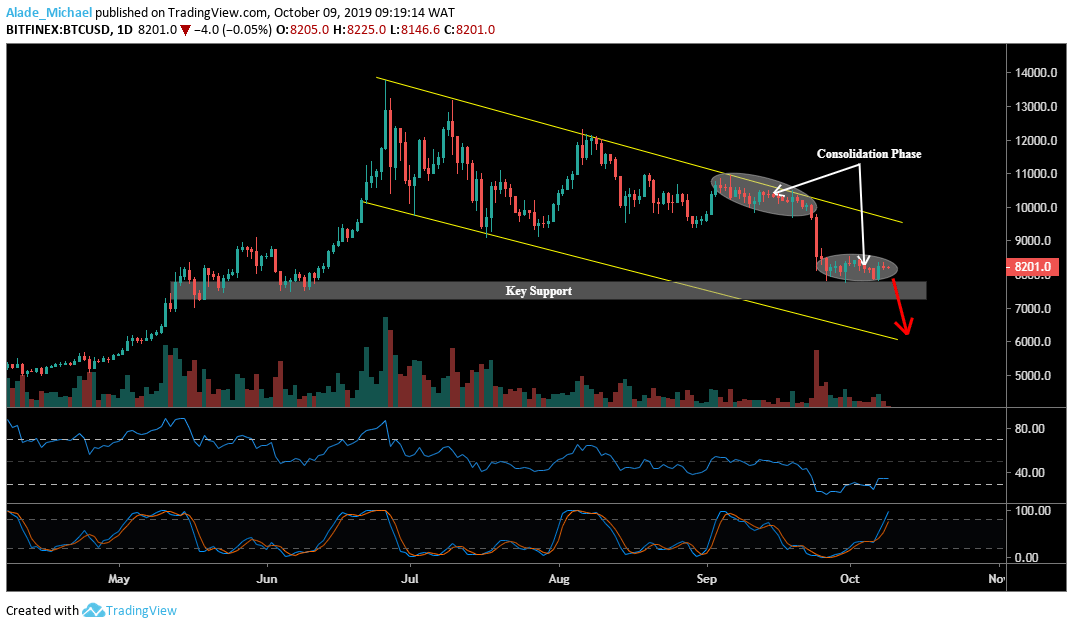

Bitcoin (BTC) Price Analysis: Daily Chart – Bearish

Key resistance levels: $8370, $8533, $8770. $8997

Key support levels: $7733, $7300, $7000, $6400

Following the September 30 sharp bounce at $7700, Bitcoin is currently fragile – subduing with choppy price action on the daily time frame. Again, the market is sensing a big move lurking around the corner. Breaking the key support zones at $7733 – $7300, BTC may plummet to $7000 and $6400 to meet the 4-months channel’s support.

Currently, the price is still consolidating above the $8000 price zones. Should the bulls act upon these mentioned zones, Bitcoin may further correct to $8370, $8533, $8770 and $8997 resistance before we can continuing bearish rally. To top that, the crypto trading signals a strong bearish trend on the RSI but the market has managed to rise up on the Stochastic RSI since the beginning of the month.

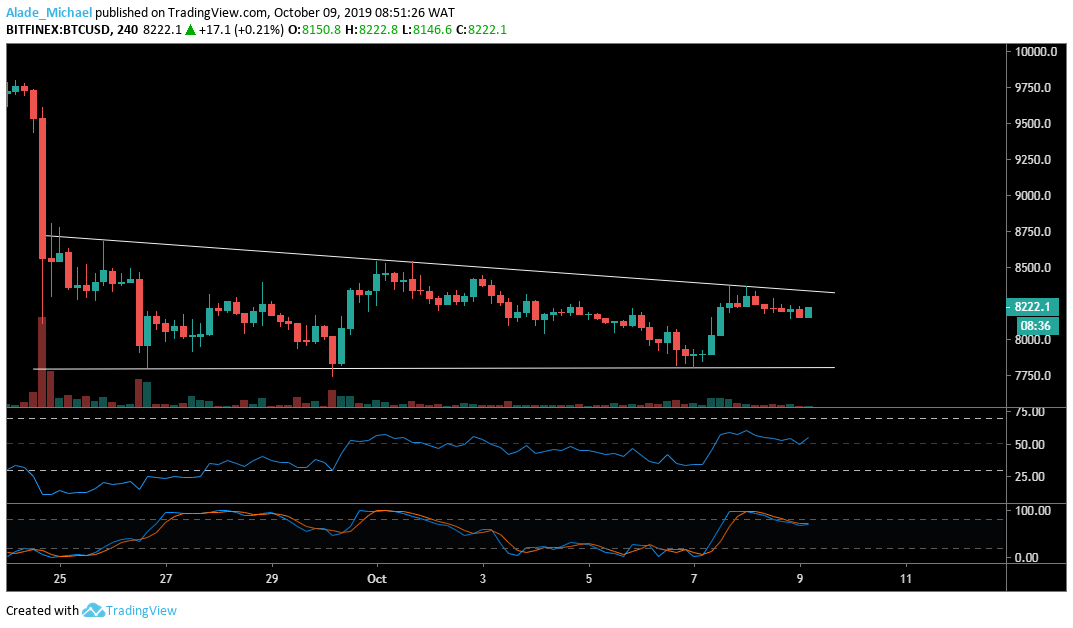

Bitcoin (BTC) Price Analysis: 4H Chart – Neutral

Bitcoin has been shaping in a triangle pattern on the 4-hour chart and has remained indecisive for the past two weeks. The crypto trading signals that a potential surge in volatility may play out sooner or later. This pattern is a bearish formation with close supports at $7750 – a breakout area. A clear drive beneath the triangle might send the price to $7500, $7300 and $7000 support.

But as it appeared now, Bitcoin is bullish on the RSI indicator, making its price to trade at around the triangle’s upper boundary. The price could float above $8000 if the RSI 50 can hold. Nevertheless, the $8400, $8533 and $8700 resistance could play out if a bullish surge occurs. Inversely, the crypto trading signals a bearish move on the Stochastic RSI to show that the sellers may step back in the market.

BITCOIN SELL SIGNAL

Sell Entry: $8197

TP: $7750

SL: $8350

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.