Ethereum (ETH) Price Analysis – October 8

Ethereum has displayed an impressive move over the past few hours, touching $185 after a consistent climb and correcting a gain of +4.12% at the moment. Currently, ETH is priced at $180 after seeing a slight drop. The price would continue to swing high if the bulls can continue to sustain pressure in the market.

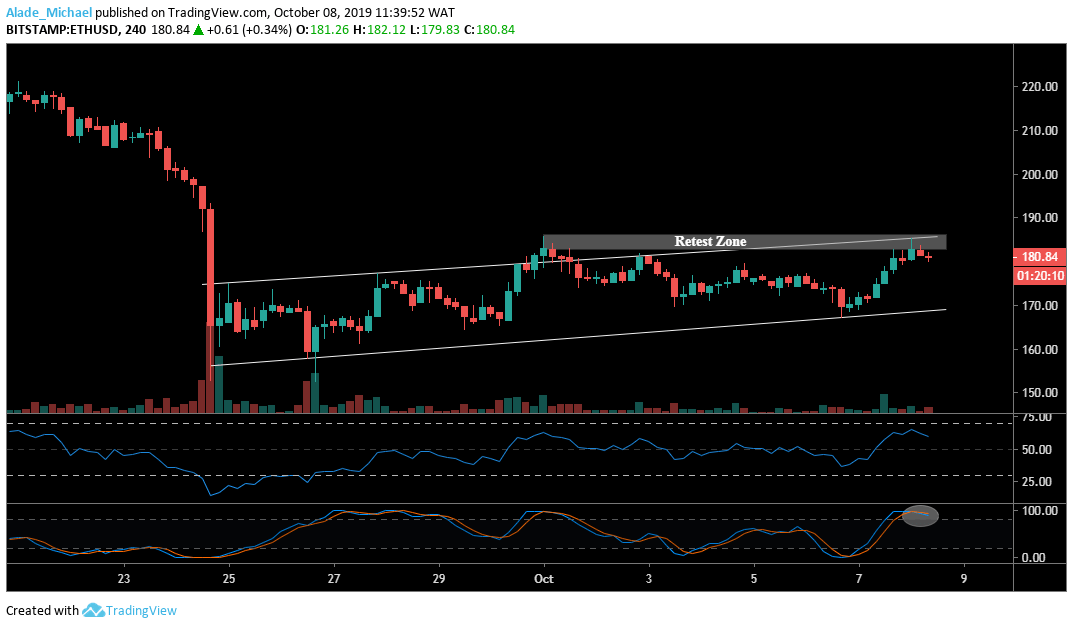

Ethereum (ETH) Price Analysis: 4H Chart – Bullish

Key resistance levels: $185, $190, $199

Key support levels: $178, $175, $170

Looking at the 4-hour chart, the price of ETH was rejected after retesting the October 1 high zone at $185, followed by a drop to $180. Now, the price is attempting to fall on the Stochastic RSI. And if a bearish cross plays out, Ethereum may slowly sell to the channel’s support at $178, $175 and $170.

Meanwhile, the crypto trading signals a bullish momentum on the RSI, although now aiming its 50 levels. Should this level produce a rebound for the market, Ethereum could retest the $185 resistance zones before surging to $190 and perhaps $199. However, the price is more likely to show weakness if the token slip beneath $180.

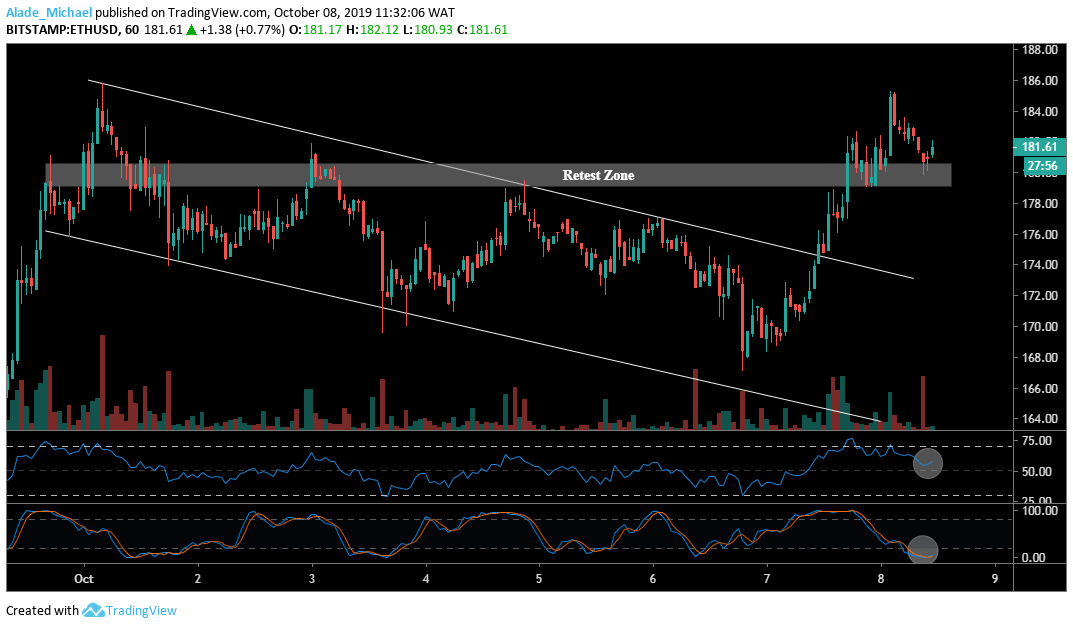

Ethereum (ETH) Price Analysis: Hourly Chart – Bullish

On the hourly time frame, Ethereum is looking bullish after breaking through the 7 days descending channel pattern, during yesterday’s trading. As appeared on the chart, the price has slightly bounced off at the retest zone of $180. We can expect the market to continue to buy at $185 $187 and $190 resistance if the price can hold above the retest zones.

As suggested in the technical indicators, the crypto trading signals a potential buy on the Stochastic RSI; Ethereum has remained bullish on the RSI with a possible bounce back. Otherwise, a lower drive may cause the price to sell heavily to the lowest region, corresponding to $180 break-down to $178, $176 and $174 support. For now, the bulls are still showing strength.

ETHEREUM SELL SIGNAL

Buy Sell: $179

TP: $175 / $171

SL: 186

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.