NEO Price Analysis – November 02

In case the bulls can push up the price to penetrate the two dynamic resistance levels upside, then the resistance level of $16 will be reached, further increase of bullish pressure may break up the confluence at $16 and resistance levels at $19 and $22 may be tested. Failure to break the confluence at $16 may reverse the price.

NEO/USD Market

Key Levels:

Resistance levels: $16, $19, $22

Support levels: $14, $12, $10

NEO/USD Long-term Trend – Bearish

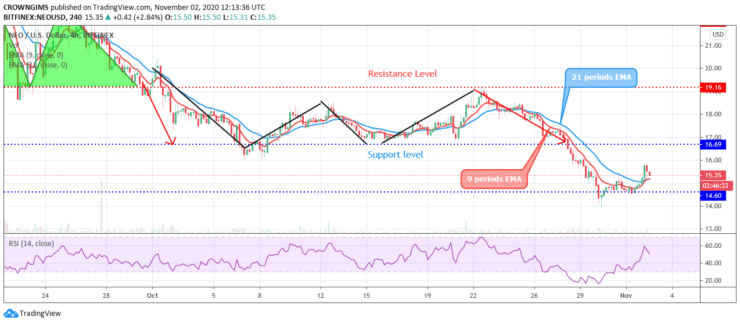

The coin was under the control of bears for many days, the bearish momentum was strong pushing down the price. Formation of strong bearish candles confirmed the strong sellers’ pressure in which the former support level of $16 was penetrated downside and the support level of $14 was reached on October 31. The bears were unable to break down the level. Yesterday, the coin gains 1.04%, meaning that there was a change of $0.1535 in price.

The above chart is reflecting the intention of the bulls to take over the NEO market soon as the level is gradually rejecting the price. Nevertheless, the price is trading below the two EMAs trying to break up the dynamic level. In case the bulls can push up the price to penetrate the two dynamic resistance levels upside, then the resistance level of $16 will be reached, further increase of bullish pressure may break up the confluence at $16 and resistance levels at $19 and $22 may be tested. Failure to break the confluence at $16 may reverse the price. The support levels below the current price levels are $14, $12 and $10. However, the relative strength index period 14 is bending up at 30 levels to indicate buy signal.

NEO/USD Medium-term Trend – Bullish

NEO is bullish in the medium-term outlook; the bears’s momentum is getting weaker when the price test the support level of $14. The level was tested twice and the price is bouncing towards the resistance level at $16.

The 9 periods EMA is crossing the 21 periods EMA upside while the price is trading above the two EMAs. At the moment, the coin is pulling back to retest the broken level. However, the relative strength index period 14 is below 60 levels bending down to indicate a sell signal which may be a pullback.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.