EURUSD Price Analysis – November 2

The selling bias around the EURUSD increased for another session on Monday and drags the pair to fresh 2-month lows in the 1.1625/20 region. Increasing cautiousness ahead of the US presidential elections due on Tuesday gives extra attention to the pair. The decline is driven by strong risk aversion as traders continue to flee into safety on growing fears over fresh lockdown measures across Europe.

Key Levels

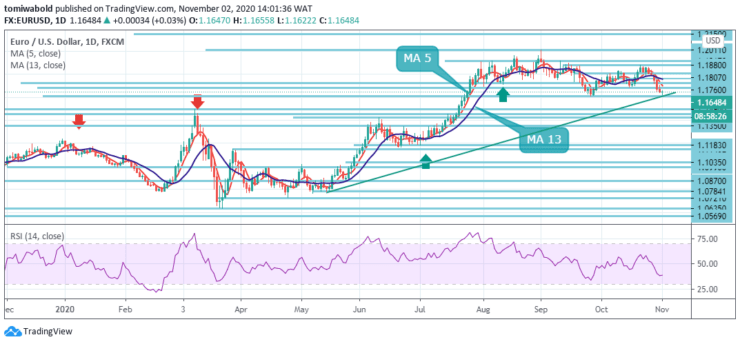

Resistance Levels: 1.2011, 1.1917, 1.1808

Support Levels: 1.1612, 1.1495, 1.1350

At the moment, the pair is up 0.05% to 1.1648 and will face the next support at 1.1622, followed by the 1.1612 low and finally the 1.1495 (high). On the other hand, a break of 1.1880 would target 1.1917 (high) en route to 1.1965 (monthly high). A bearish RSI, combined with bearish 5 and 13 moving averages, indicates a strengthening bearish bias.

In a broader context, the rise from 1.0635 is seen as the third phase of the trend from 1.0339 (low). At the next level at 1.2011, a further rally towards cluster resistance can be seen. This will remain a preferable case as long as the 1.1422 resistance turned into support is held.

The fall in EURUSD continues today and the intraday bias remains lower towards the 1.1612 support level. A breakthrough will confirm the resumption of the correctional decline from the level of 1.2011. Further decline is expected to 38.2% retracement from 1.0635 to 1.2011 at 1.1485.

On the other hand, a break above the minor resistance level of 1.1725 will primarily change intraday sentiment. But the risk may stay downtrend as long as the 1.1880 resistance level is held in case of a recovery. In the short term, EURUSD is trading lower, with 1.1612 anticipated to offer immediate support for additional losses.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.