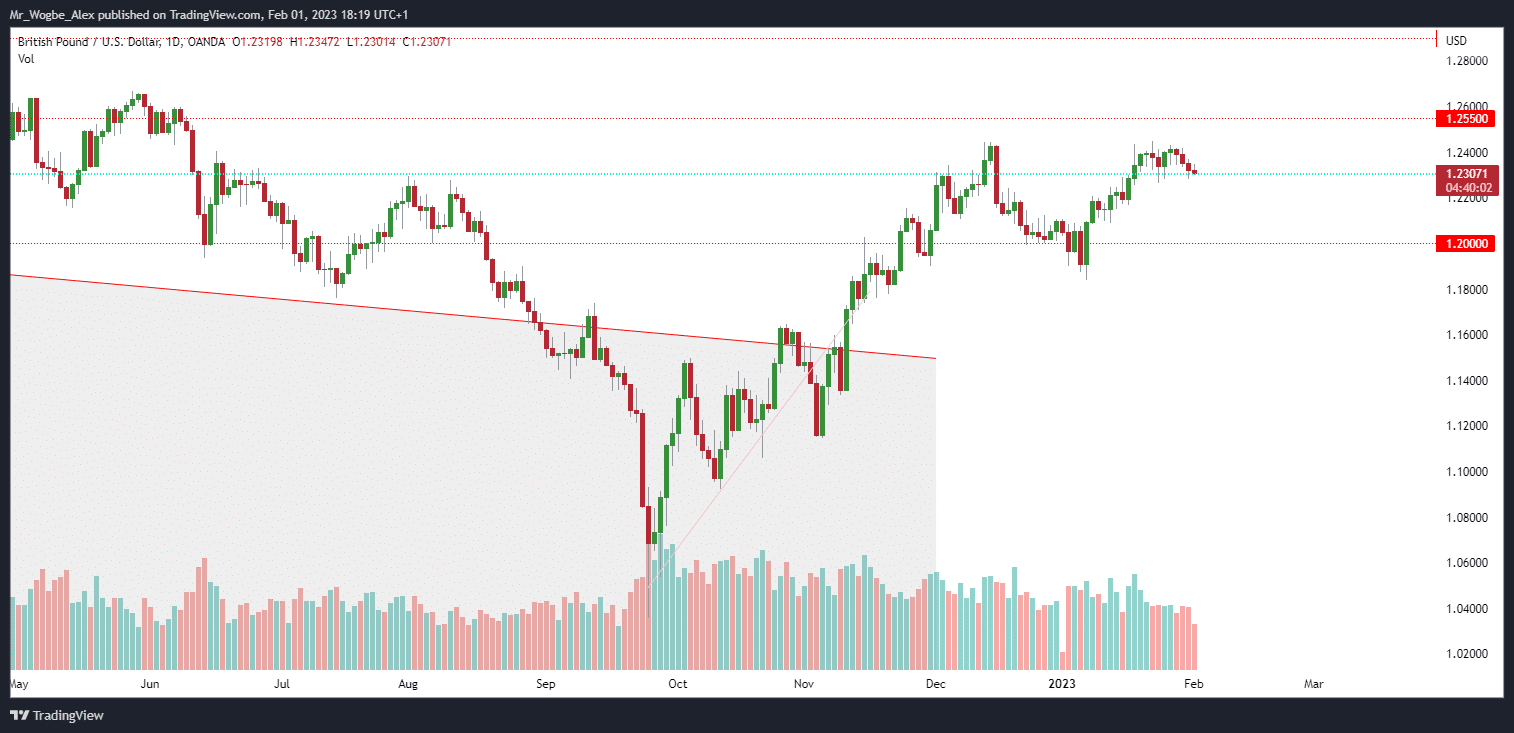

The GBP/USD pair has struggled to make a comeback against the dollar, as price action remained largely unchanged during the Asian and early European sessions on Wednesday. Yesterday’s sell-off in the pair saw it reach a low of 1.2300, and analysts predict that this may not be the end of the downward trend.

Nationwide Housing Price Data Putting Pressure on the GBP/USD Pair

Housing price data in the UK has contributed to the fall in the GBP/USD pair, with nationwide housing prices showing a 0.6% monthly fall and a 1.1% annual growth rate, well below the peak of 2.8% in December. The increase in mortgage rates has also caused a decrease in house purchase approvals as potential buyers become wary of the rising cost of servicing a mortgage.

Despite some signs that mortgage rates are normalizing, the Chief Economist of Nationwide, Robert Gardner, stated that it is still too early to tell whether the housing market has begun to recover. He also warned that the economic headwinds are strong and that real earnings are expected to fall, leading to a weaker labor market as the economy shrinks.

The UK is facing its most significant day of industrial action in a decade, with the “Walkout Wednesday” strikes expected to cause significant disruption. Up to 500,000 civil servants, teachers, and train drivers are walking out simultaneously over jobs, pay, and conditions, which will likely have a negative impact on the economy and the GBP/USD pair.

The Federal Reserve’s meeting later today is expected to result in a 25 basis point interest rate hike. The focus will be on the policy statement and remarks from Fed Chair Powell as market participants look for an update on the path moving forward. The outcome of the meeting will likely have a significant impact on the GBP/USD pair, further adding to the uncertainty in the market.

Overall, the GBP/USD pair is facing multiple challenges that are likely to cause further volatility and downward pressure in the short term. The release of nationwide housing price data, the upcoming industrial action, and the Fed meeting are all factors that are expected to have a significant impact on the pair.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.