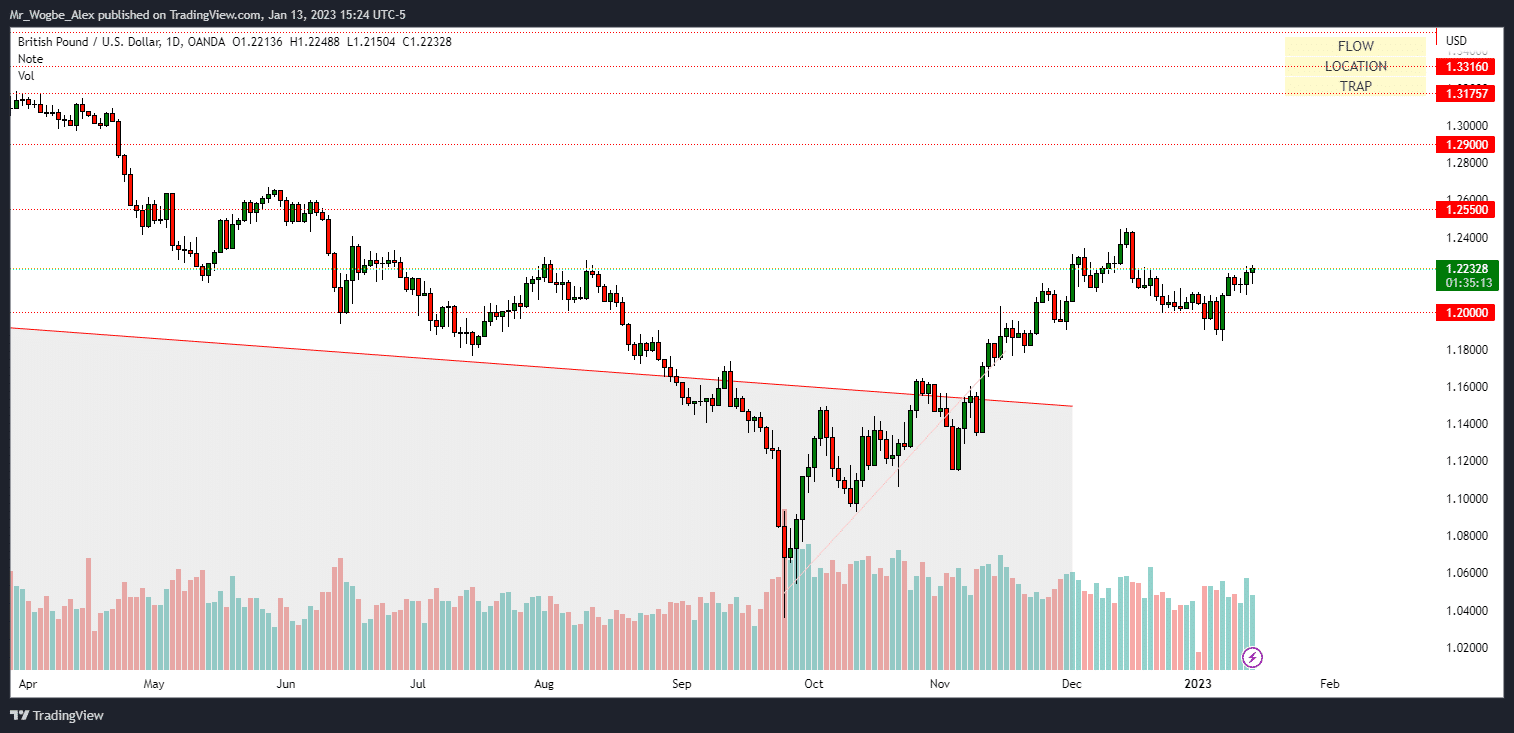

On Friday, the British pound (GBP) strengthened against the US dollar (USD) as a result of more moderate inflation figures from the world’s largest economy and some unexpected domestic growth.

In December, US price increases slowed for a sixth consecutive month, according to official statistics released on Thursday. Since the majority of interest rate increases are now behind us, traders and investors are more confident than ever that the pace of future increases will drop. This viewpoint differs from that of many other developed economies, particularly those that are more vulnerable to price increases related to the conflict in Ukraine, such as the Eurozone.

Rates are expected to climb more there, and following the US data, both the euro (EUR) and the pound surged.

Pound Enjoyed a Minor Domestic Boost

The pound had some unusual domestic excitement on Friday when it was revealed that, albeit barely, its own economy grew in November. Gross domestic product growth came in at 0.1%, while the markets were anticipating a 0.2% decline. Nevertheless, because manufacturing and industrial production fell short of forecasts, excitement has to be conservative.

The UK economy doesn’t appear to be one that can handle significantly higher borrowing costs, and when the economy’s figures start to trickle in, interest rate support for the pound is likely to remain erratic. The pound will remain a cautiously bullish bet due to persistently bad labor relations, the possibility of a recession, maybe accompanied by some “stagflation,” and these factors. The next policy announcement from the Bank of England won’t come until February 2.

The fact that London-listed stocks have risen with their international rivals in anticipation of the US rate-hike cycle coming to an end is noteworthy. On Friday, the blue-chip FTSE 100 index came very close to reaching all-time highs. However, given the number of prestigious worldwide brands that make up this index, it is questionable to what extent it represents any kind of wager on the UK economy.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.