While the Fed’s stance could cause the US dollar to drop even further and—based on the reaction in the market yesterday—cause the Nasdaq 100 (NDX) to clear further gains.

That said, the market will be given just a little time to get stabilized as some of the major tech stocks queues to report their earnings at the close of the market today.

Combined, Amazon (NASDAQ: AMZN), Apple (NASDAQ: APPL), Google (NASDAQ: GOOGL), and Facebook (NASDAQ: FB) account for about 35% of the entire Nasdaq 100 and have been some of the top gainers in the Coronavirus era. Consequently, it can be expected that the earnings report is likely to be quite bogus, which would precipitate further gains for the NDX in the near-term.

That said, market participants will be looking to double down on their bullish stance and ride the expected uptrend in the Nasdaq 100. However, some traders believe there are likely symptoms of overextension.

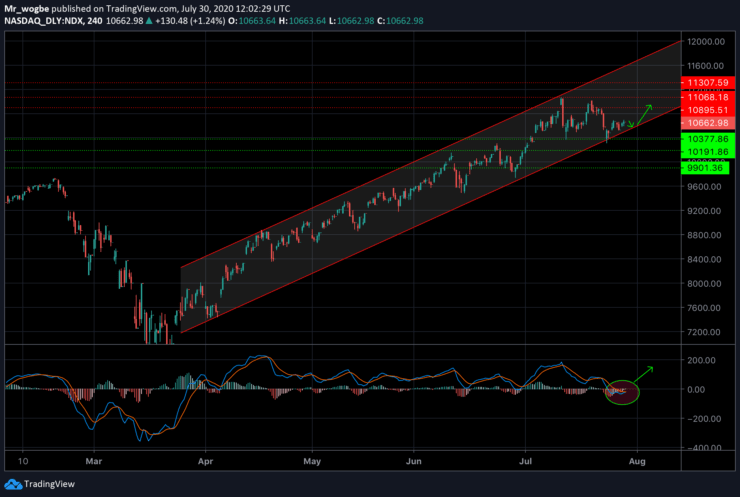

Nasdaq 100 (NDX) Value Forecast — July 30

NDX Major Bias: Bullish

Supply Levels: 10895.5, 11068.1, and 11307.5

Demand Levels: 10377.8,10191.8, and 9901.3.

The NDX continues to hold steady in our ascending channel and looks poised to taking on previous resistance levels. Given the fundamental factors surrounding the market, we are likely to see the 10800 price tag soon.

Immediate support can be found at the 10500 level, which is the base of our ascending channel. The NDX is likely to find dip-buyers at that level, which could push it to the anticipated high.

Furthermore, our MACD indicator paints a decent picture of the impending surge likely to be witnessed in the Nasdaq 100. However, a sustained break below 10191 could be dangerous for NDX bulls.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.