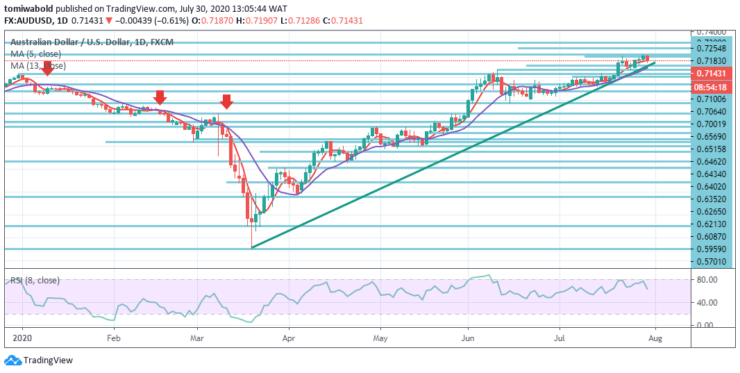

AUDUSD Price Analysis – July 30

The AUDUSD pair added, however during the early European session, to existing intraday losses and renewed daily lows around the 0.7140-35 zone. The Australian dollar further retreated from the recent 15-month high (0.7196) level as investors made gains after buyers were unable to crack the barrier of 0.7200 round-level. New weakness has led to a greater than anticipated decline in Australia’s exports and imports in Q2 and suspected cases of coronavirus.

Key Levels

Resistance Levels: 0.7295, 0.7254, 0.7200

Support Levels: 0.7100, 0.7064, 0.6777

The daily MAs and RSI have corrected from the overbought territory and travel south, while bullish traction is declining and reinforcing near-term picture. Larger bulls perceive present weakening as preparing forward of intensified aim at level 0.7200, with initial support at level 0.7100 (ascending trendline peak) and level 0.7064 (higher low July 24).

Prolonged declines may not surpass horizontal support to hold bulls intact at 0.7031 level. Conversely, a good ascent over the peak of 15 months (level 0.7196) might pave the way up to the resistance level of 0.7295, drawn from the peak of February 2019. After that, the hurdle of 0.7395 level, defined by the December 2018 high, may draw attention next.

After notching higher to 0.7196 level, AUDUSD retreated again and the intraday bias is altered neutral again. As long as 0.7064 support level holds, a further increase is predicted. The increase from 0.5506 level to long-term resistance level at 0.7295 next will continue beyond 0.7196 level.

Conversely, on the downside, a strong breach of 0.7064 support level might well imply topping for the short term. Instead, the intraday bias is switched back to the downside for a support level of 0.6777. Overall, in the short to medium term image, AUDUSD retains a bullish phase.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.