Investors’ sentiment remains under pressure over the second fiscal stimulus package and the ever-increasing number of COVID-19 infections across the globe.

The 4% dip in oil prices yesterday resonated with the current risk-averse sentiment in the markets as more countries come under intense economic pressure as the pandemic rages. As a result of the dip, Energy (SPNY) was the worst-performing sector on Thursday.

Moving on, the Non-Farm Payrolls report will be one of the major focuses in today’s trading session. Economists expect to see about 850,000 new non-farm jobs created in September, a notable decline from 1.37 million in August. Also, the Unemployment rate is expected to drop by 0.2% from last month’s 8.4% figure.

Meanwhile, the major headline today will be the latest development with the President of the United States, Donald Trump. The President announced via Twitter (TWTR) that himself and the First Lady have both tested positive for the Coronavirus disease.

All these and more will be rocking the markets today.

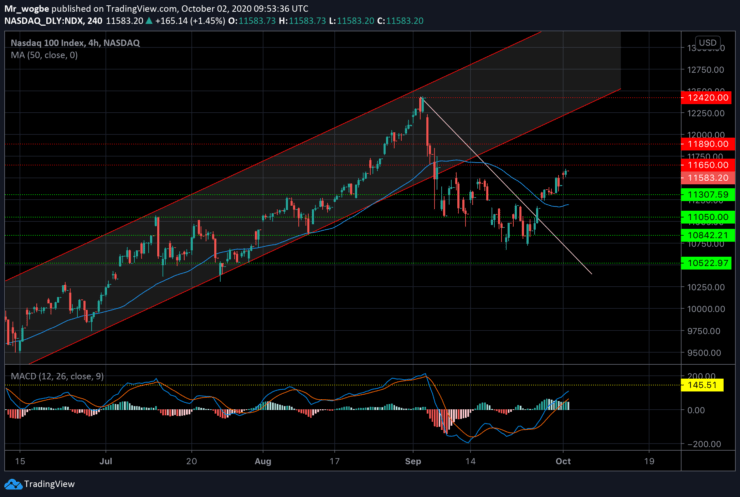

Nasdaq 100 (NDX) Value Forecast — October 2

NDX Major Bias: Bullish

Supply Levels: 11650, 11890, and 12000.

Demand Levels: 11307, 11200, and 11050.

The NDX has recovered firmly from its recent drop to the 10670 area and is now trading close to the key 11650 resistance. The index has shown strong bullishness over the past few days, and we could see the 12000 price level once again.

In the near-term, the NDX has to remain standing after all economic reports drop later today, to confirm this bullish bias. It would be interesting to see how the market fares with today’s fundamentals.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.