Futures tracking major US equity indexes fell early on Friday, as Wall Street looked set to round off the week with decent gains.

At press time, Nasdaq 100 (NDX) futures were down by -0.27%, while the Dow Jones (DJIA) futures and S&P 500 (SPX) futures fell by -0.28% and -0.34%, respectively.

Meanwhile, Disney shares climbed by more than 2% in the extended trading hours, following a better-than-expected earnings report for its fiscal first quarter of 2021. The entertainment behemoth revealed that it now has a whopping 95 million paid subscribers on its Disney+ streaming service.

Although February’s bullish momentum seen in Wall Street is beginning to wane, major indexes are still poised to end the week on a goodish note. The equity markets started losing bullish steam as investors remained optimistic for a smooth economic reopening and Covid stimulus distribution.

Brad McMillan, Chief Investment Officer at Commonwealth Financial Network, recently stated that “between the ongoing medical and economic improvements, markets continue to expect a much better 2021, and that has supported prices.” He added that “fourth-quarter earnings are coming in well ahead of expectations, and analysts are now adjusting their 2021 earnings estimates upwards.”

In other news, President Joe Biden announced yesterday that his administration has secured a deal for another 200 million doses of Covid-19 vaccines from Moderna (NASDAQ: MRNA) and Pfizer, bringing the country’s total vaccine count to 600 million. He added that the US should have enough vaccine supply for all 300 million+ Americans by the end of July.

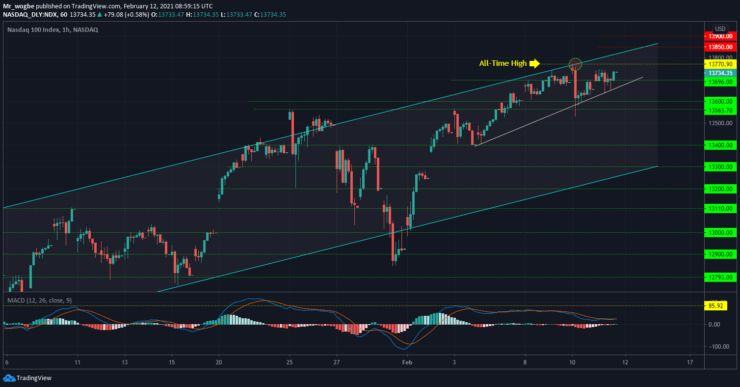

Nasdaq 100 (NDX) Value Forecast — February 12

NDX Major Bias: Bullish

Supply Levels: 13770, 13800, and 13850.

Demand Levels: 13696, 13600, and 13563.

The NDX appears to be losing bullish steam, following its recent rejection from the top-end of our ascending channel. The rejection sent the tech-heavy index to the 13500 area, where more dip-buyers likely came aboard and sent the price to the 13700 area, recording a healthy correction.

That said, the index will likely resume its bullish charge next week, towards the 13850 resistance.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.