Market Analysis – July 31st

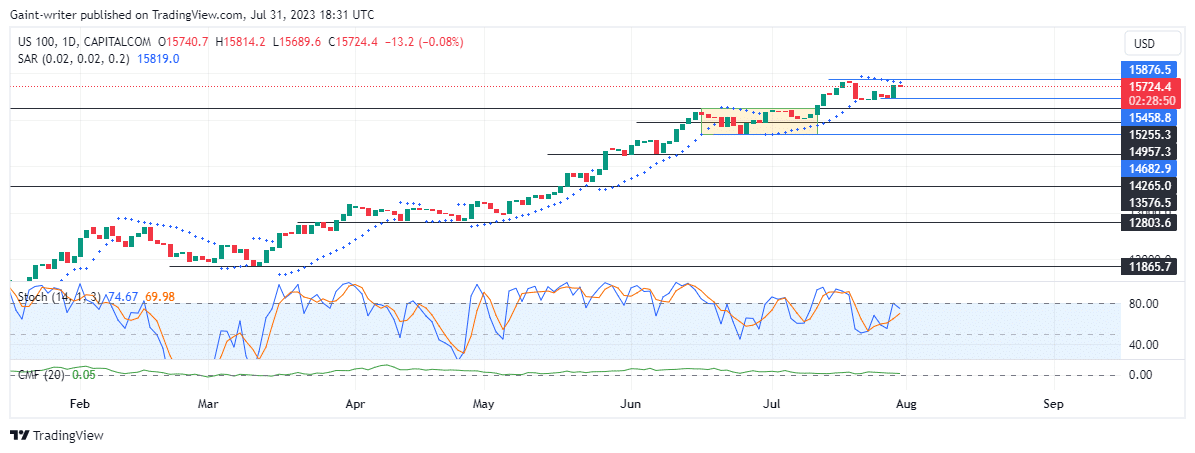

Nasdaq 100 (NAS100) bullish strength is in check as it is managing to fight back. The bullish market is experiencing a tumultuous period as the stock price has been steadily progressing forward. The buyers have yet to break through the 15876.50 key level. Last month, a surge in the Nasdaq 100 (NAS100) price drove the market close to the 15876.50 level. This, therefore, provides an opportunity for the buyers to make headway.

Nasdaq 100 (NAS100) Key Levels

Resistance Levels: 15876.50, 15458.80

Support Levels: 14957.30, 15255.30

Nasdaq 100 (NAS100) Long-Term Trend: Bullish

Unfortunately, that momentary surge wasn’t enough to break the resistance, and the buyers have been kept in check ever since. This bullish market has been on the rise since March 2023, with new highs and lows being created as more traders enter the market. As a result, buyers are gaining more power. The 15876.50 level is becoming increasingly significant. However, the buyers have yet to break through, and the market remains in limbo.

The new month is just around the corner, and traders are looking for any sign of a resurgence in buyers. If they can break through the 15876.50 level, it could signal a major shift in the market. It would provide a huge boost to the buyers. Until then, the buyers will have to remain patient. They need to wait for the right moment to make their move.

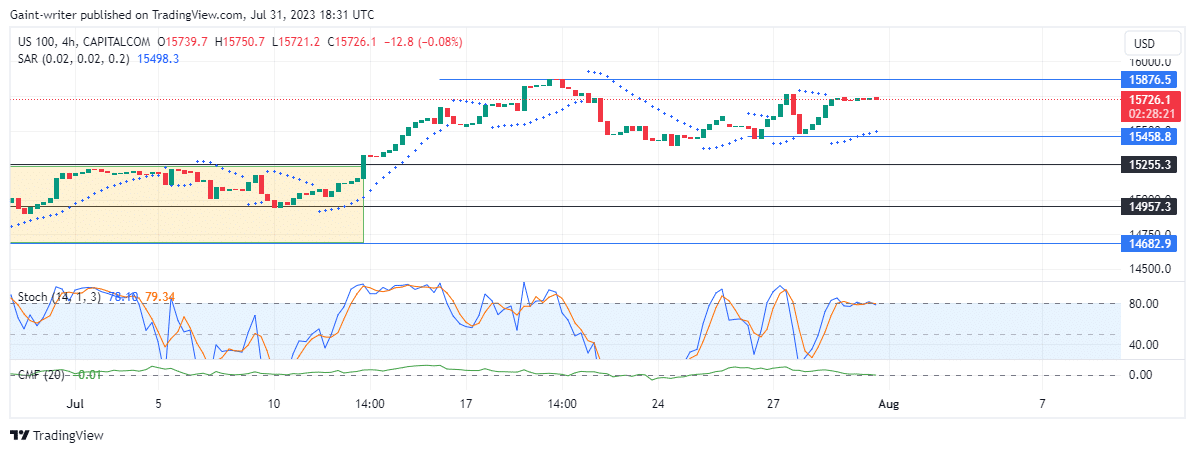

Nasdaq 100 (NAS100) Short-Term Trend: Bullish

The Nasdaq 100 (NAS100) market could be in for a new adventure this August. Buyers may be encouraged to push harder to surpass the 15876.50 key zone. The market remains steady on the 4-hour chart. This suggests that buyers are not currently showing much momentum. The Chaikin Money Flow indicator has not given any clear indication of price directional flow. But the Parabolic SAR (Stop and Reverse) indicator is still bullish in the short term. Meanwhile, the Stochastic Oscillator is showing bearish headway and staying in overbought territory.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.