Market Analysis – July 24th

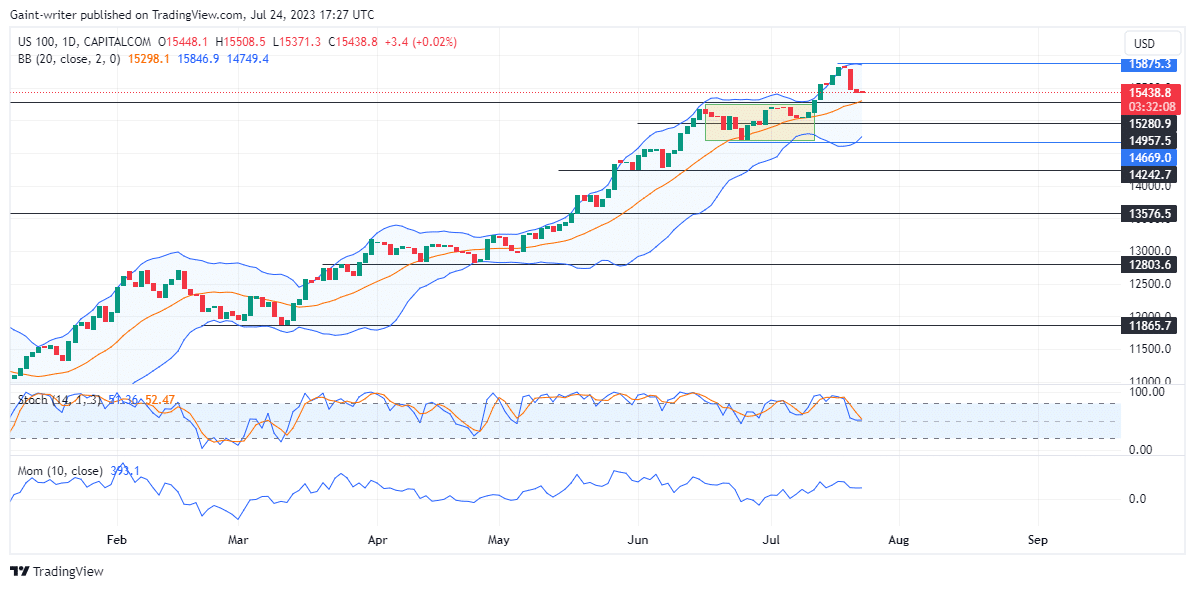

Nasdaq 100 (NAS100) faces downward pressure as sellers keep turning up the heat. The bearish momentum has been increasing lately, indicating a shift away from the buying trend. Despite the downward pressure, buyers have not given up, and their presence in the market is still visible. The daily chart shows that buyers have maintained consistent bullish activity. This has been since February when the trend was set up from the 116865.00 market zone.

Nasdaq 100 (NAS100) Important Levels

Resistance Levels: 15875.30, 15280.90

Support Levels: 14242.70, 11865.70

Nasdaq 100 (NAS100) Long-Term Trend: Bullish

Buyers have gained strength since then and managed to push prices up to 15875.30 this month. This is a testament to their resilience and strength in the face of bearish pressure. However, the momentum indicator shows that the buyers have been slowing down lately, signifying a decrease in momentum. This could be an indication that the bearish pressure is having an effect on the market. It also means that buyers may be losing their grip on the market.

It is important for buyers to stay vigilant and continue to strive for a bullish outcome. This is because the current situation is highly volatile and could change at any moment. The Nasdaq 100 (NAS100) market has seen a significant decline in recent weeks, and this presents an interesting opportunity for traders. Traders should carefully watch the market to identify the best time to enter or exit a trade.

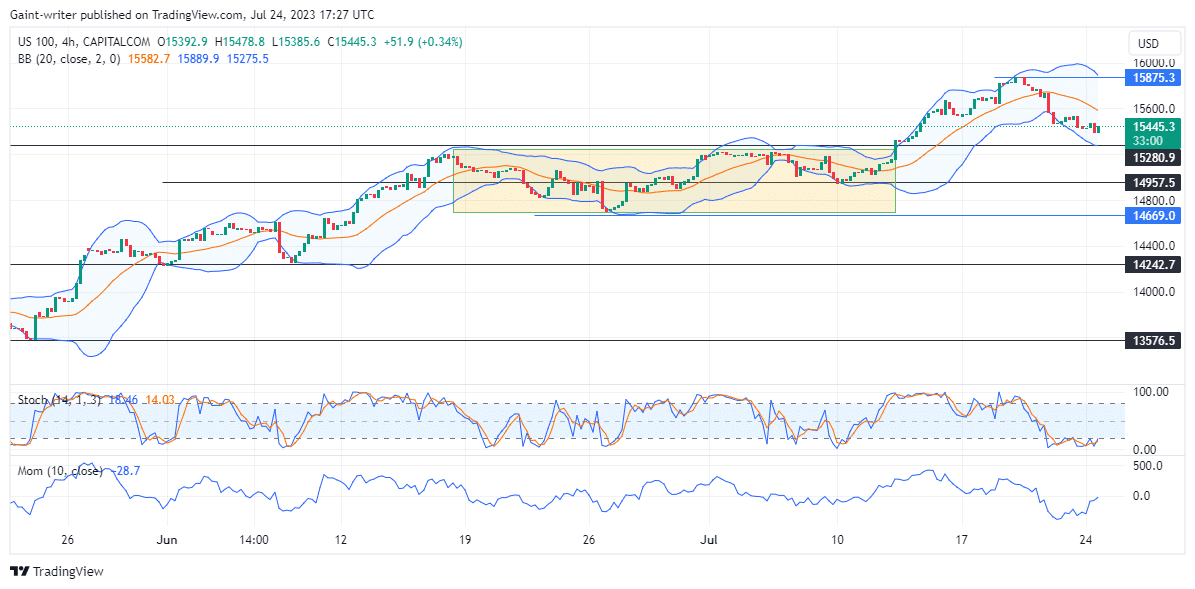

Nasdaq 100 (NAS100) Short-Term Trend: Bearish

The recent crossover in the oversold region of the 4-hour time frame indicates that buyers are preparing for further action. This suggests that despite the current sell-off, buyers may be able to take advantage of the situation. This means they will make profitable trades in the near future. The decline in the Nasdaq 100 (NAS100) market could be advantageous for traders. It, therefore, presents a chance for them to enter the market at a lower price.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.