NAS100 Analysis – October 19

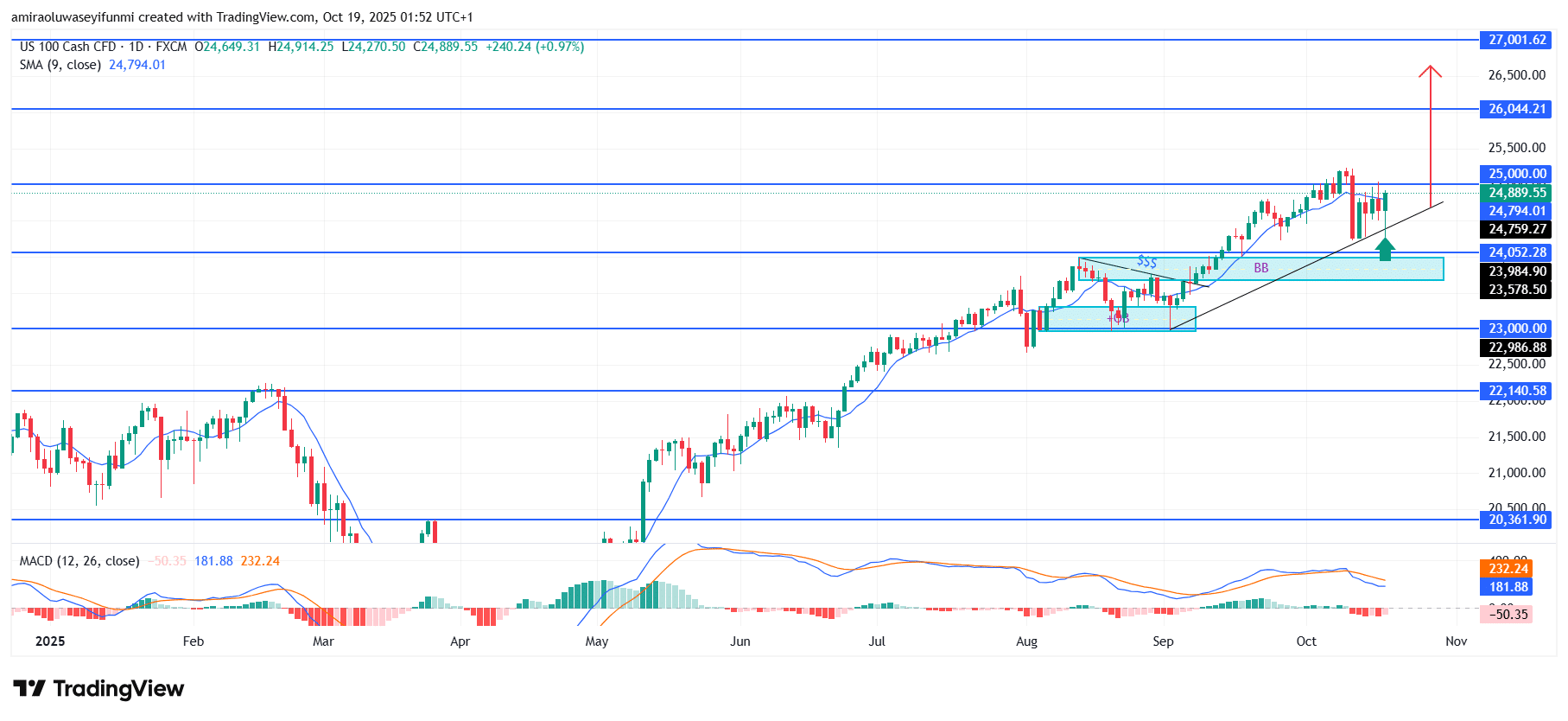

NAS100 shows renewed momentum toward key resistance levels. Strong market confidence is reflected in the sustained upward momentum as NAS100 consolidates above the 9-day Simple Moving Average (SMA) at $24,790. The Moving Average Convergence Divergence (MACD) indicator displays narrowing histogram bars, signaling a potential bullish crossover as buying pressure builds. Despite occasional profit-taking, the index continues to maintain higher lows, indicating resilient market sentiment and sustained bullish strength.

NAS100 Key Levels

Resistance Levels: $25,000, $26,040, $27,000

Support Levels: $24,050, $23,000, $22,140

NAS100 Long-Term Trend: Bullish

Price action has successfully reclaimed the $24,050–$23,580 support zone, marking it as a key accumulation region. The ascending trendline remains intact, providing dynamic support and reinforcing the persistent buying interest. The psychological $25,000 mark now stands as a crucial short-term resistance level, while the ongoing recovery aligns with the broader bullish structure that has persisted since May.

NAS100 is expected to break above the $25,000 resistance and advance toward $26,040, with the potential for an extension beyond $27,000 if bullish momentum continues. Sustained trading above the moving average and trendline may strengthen buyer confidence and attract additional institutional participation. Before the next upward phase unfolds, a temporary pullback toward $24,050 could offer renewed buying opportunities for traders monitoring forex signals and other growth-oriented positions.

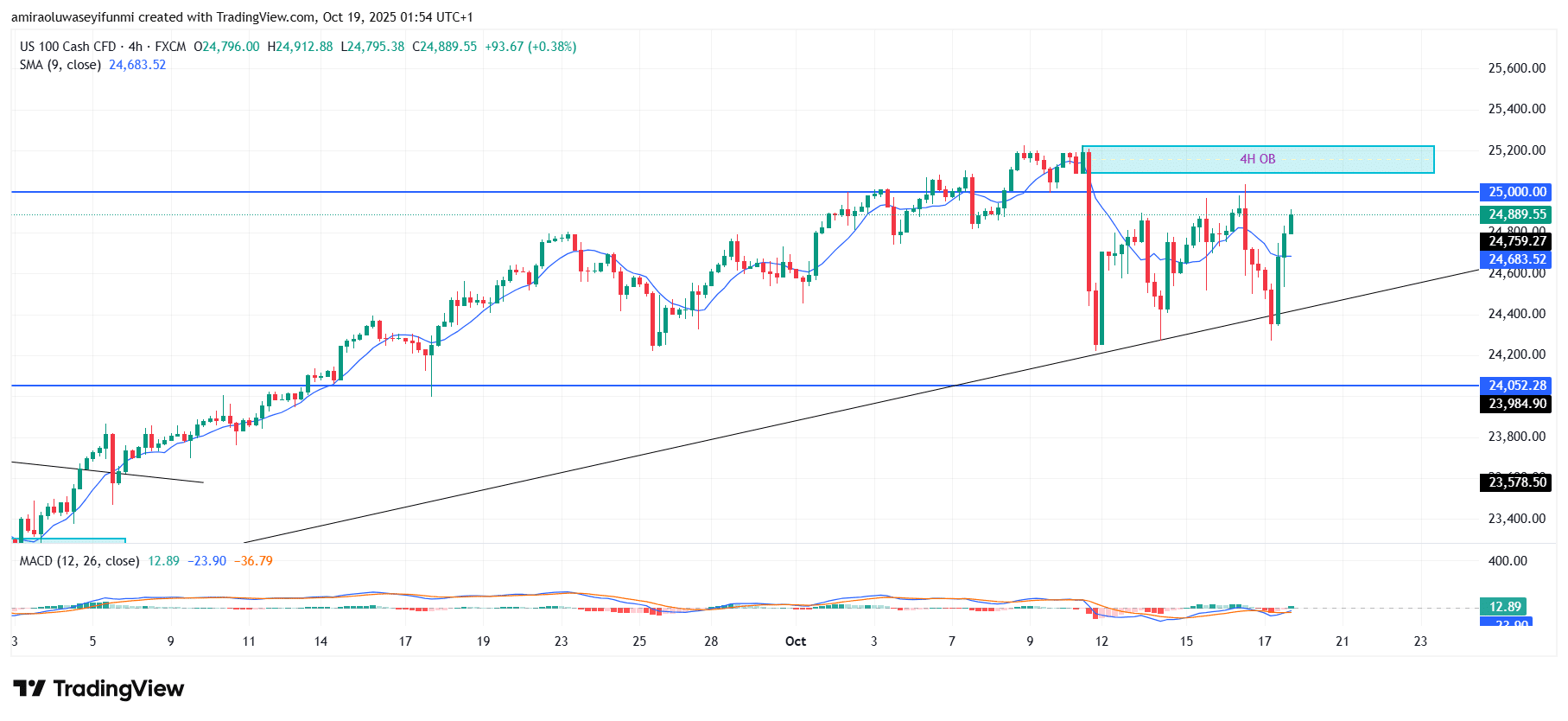

NAS100 Short-Term Trend: Bearish

NAS100 is currently trading around $24,890 after encountering resistance near the $25,000 zone, defined by a 4-hour order block. Although price remains above the ascending trendline, weakening momentum and a flattening 9-period SMA indicate possible short-term fatigue.

The MACD histogram continues to contract, suggesting a decline in buying strength. A retracement toward the $24,680 or $24,050 support levels may occur before the next bullish continuation develops.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.