NAS100 Analysis – October 26

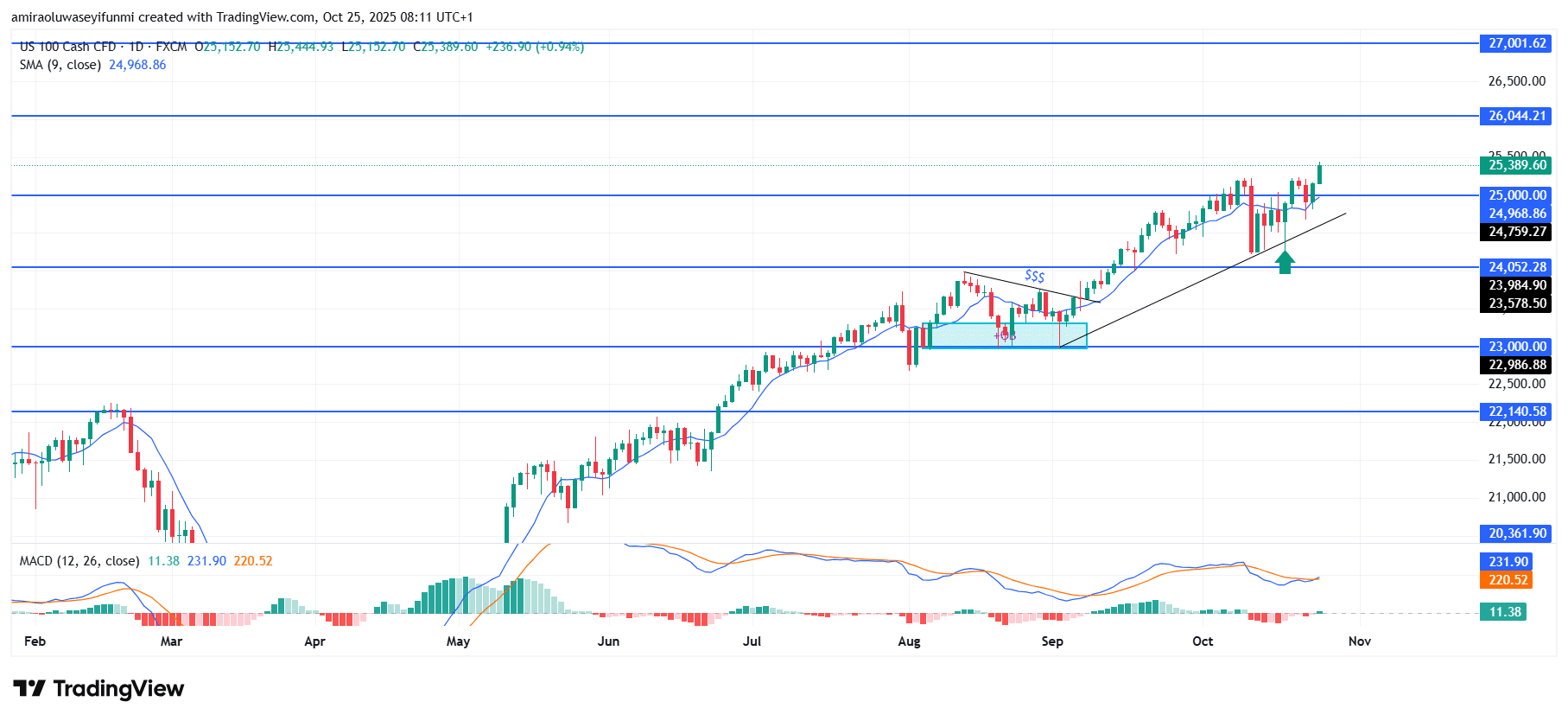

NAS100 extends its uptrend amid strengthened buying interest. The NAS100 Index continues to demonstrate a solid upward trajectory, with overall sentiment remaining bullish. Price action holds above the 9-day moving average near $24,970, indicating strong buyer control and a favorable short-term bias. The MACD reading reinforces this outlook as its lines show improving momentum, suggesting that upward pressure is gaining consistency. Overall, the technical picture reflects a market supported by steady participation and firm interest around key demand zones.

NAS100 Key Levels

Resistance Levels: $25,000, $26,040, $27,000

Support Levels: $24,050, $23,000, $22,140

NAS100 Long-Term Trend: Bullish

Structurally, the index has rebounded from its ascending support line and regained footing above the $25,000 region. The earlier decline toward $24,050–$24,000 served as a corrective retest that allowed buyers to re-enter the market with renewed strength. Recent price movement has broken out from a tight consolidation phase, maintaining a sequence of higher highs and higher lows that confirms the prevailing bullish structure. The consistent defense of lower levels and alignment with the short-term moving average further emphasize ongoing upward momentum.

Looking ahead, if the market sustains its current strength, NAS100 could advance toward $25,580, with potential extensions toward $26,040 and $27,000 in the coming sessions. Consistent closes above $25,000 are expected to attract additional investor confidence and sustain buying interest. Conversely, a drop below $24,760 could prompt a temporary pullback before the trend resumes. Overall, the market remains constructive as long as price action adheres to the established rising framework, supported by insights from forex signals that highlight continued bullish sentiment in major indices.

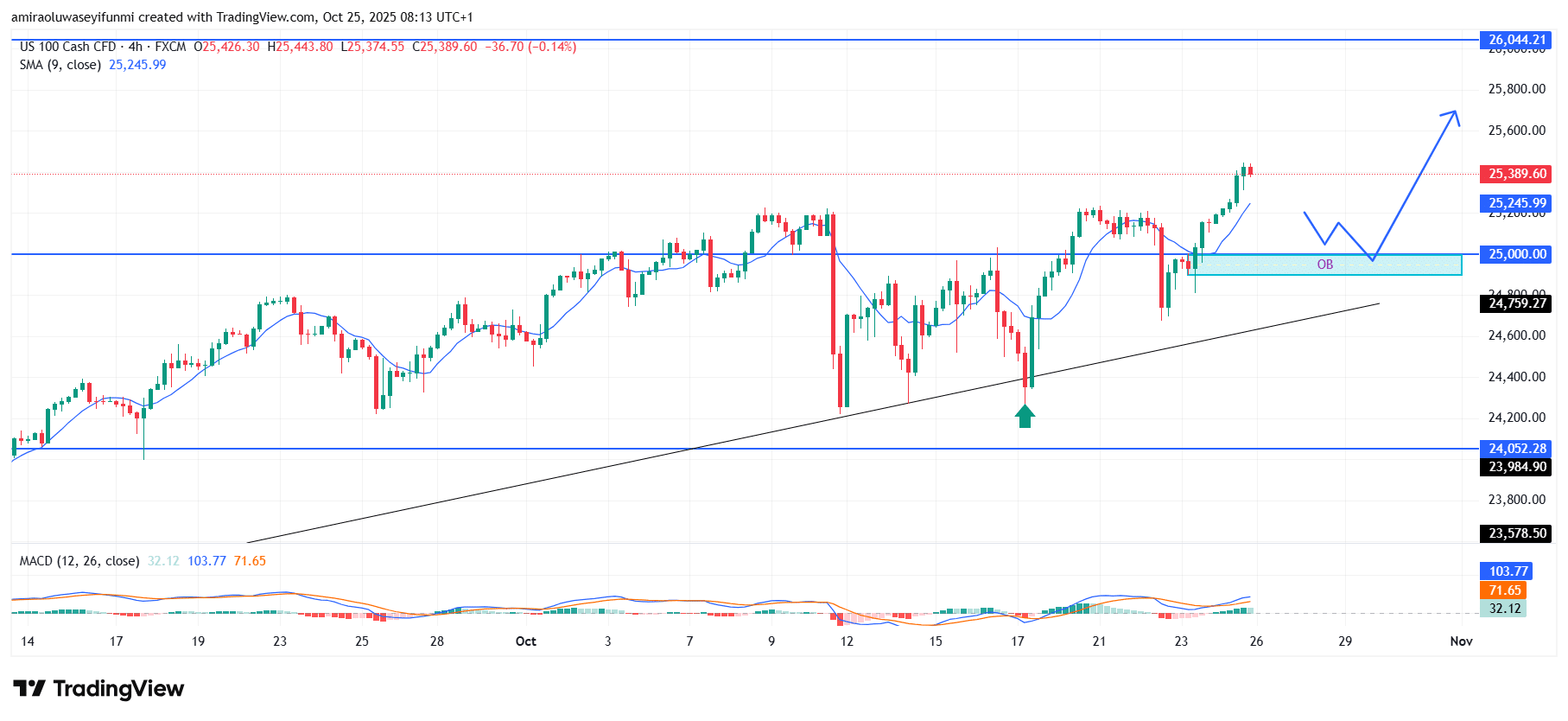

NAS100 Short-Term Trend: Bullish

NAS100 maintains its bullish outlook on the four-hour chart as price continues to trade above the $25,000 support zone and the 9-period moving average near $25,250. The recent breakout from consolidation indicates renewed buyer commitment, reinforcing strength along the ascending trendline. A slight retracement toward the $25,000–$25,250 order block could precede further upward movement. If momentum persists, the index may rise toward $25,600 and potentially $26,040 in the short term.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.