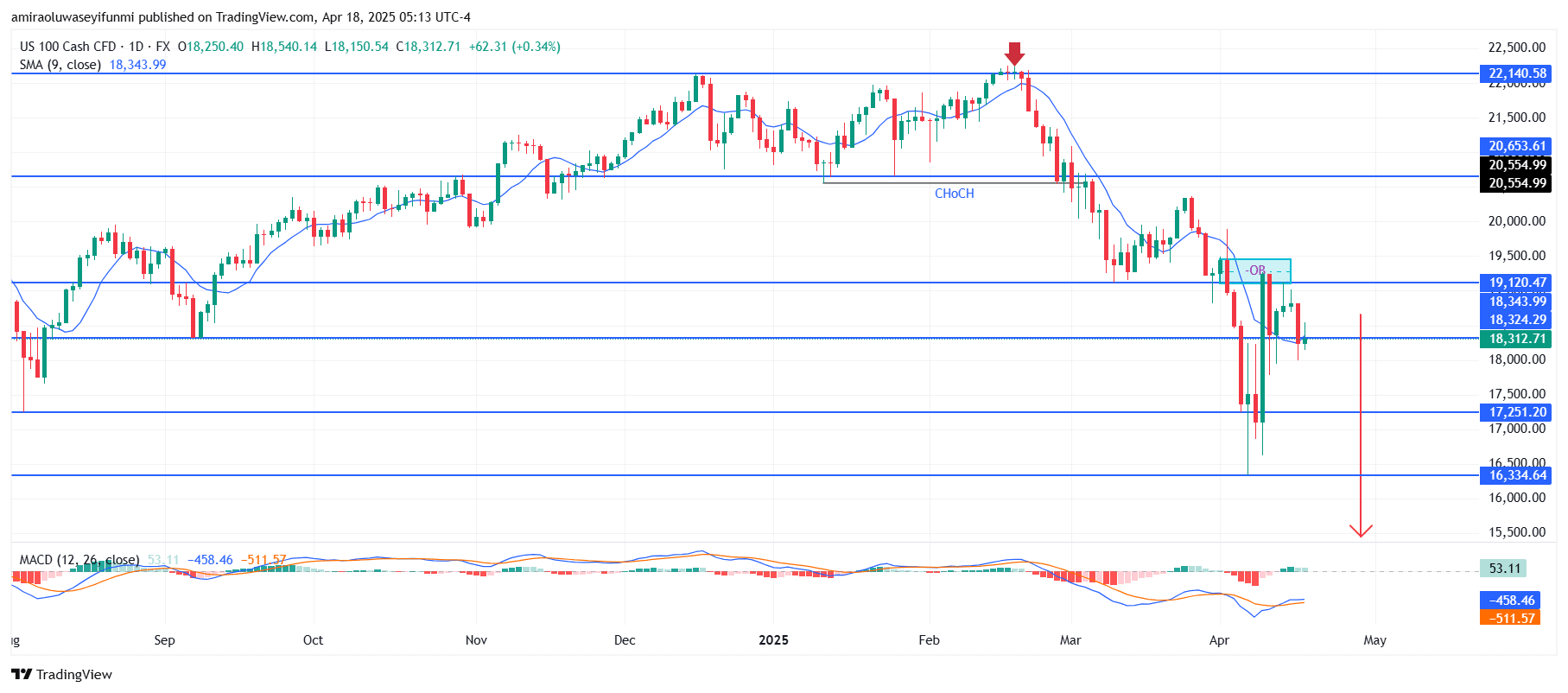

NAS100 Analysis – April 20

NAS100 continues to face bearish pressure following a failed bullish recovery near a key resistance level. The 9-day Simple Moving Average (SMA) has turned downward, now serving as dynamic resistance and capping recent bullish attempts. The MACD (Moving Average Convergence Divergence) indicator remains in bearish territory, with the signal line still trailing below the MACD line and no clear bullish crossover in sight. This indicates a sustained bearish momentum. Although there are minor positive histogram bars, the overall trend remains weak, suggesting that the rally lacks the strength for a sustained recovery.

NAS100 Key Levels

Resistance Levels: $19,120, $20,650, $22,140

Support Levels: $18,320, $17,250, $16,330

NAS100 Long-Term Trend: Bearish

Price action confirms a clear change of character (CHoCH) after the sharp rejection from the $20,550 level, which coincides with a bearish order block near $19,120. The recent bullish retracement was halted precisely at this supply zone, resulting in a sharp pullback below the $18,340 level. The market structure has shifted to lower highs and lower lows, reinforcing the prevailing bearish trend alongside strong resistance levels. Continued failure to maintain levels above $18,340 highlights increasing selling pressure in that region.

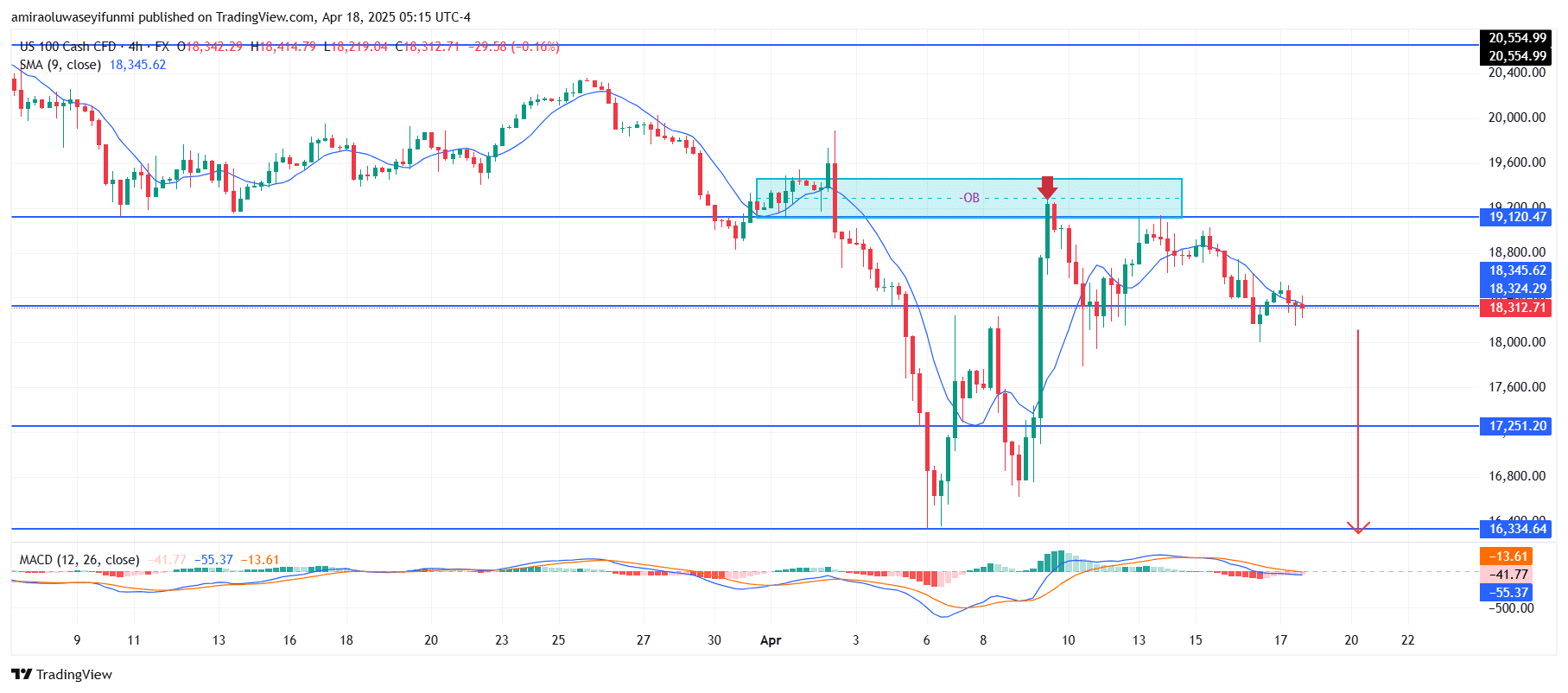

NAS100 Short-Term Trend: Bearish

NAS100 is currently trading below the 9-period SMA, which is now sloping downward—an indication of continued short-term weakness. Price was decisively rejected at the $19,120 order block and has since failed to retake that level, further confirming the bearish structure.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block – Guide, Tips & Insights | Learn 2 Trade

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.