In a recent Fitch Ratings report, the Nigerian naira is grappling with a challenging future, hampered by a substantial backlog in foreign exchange demand and a burdensome debt load.

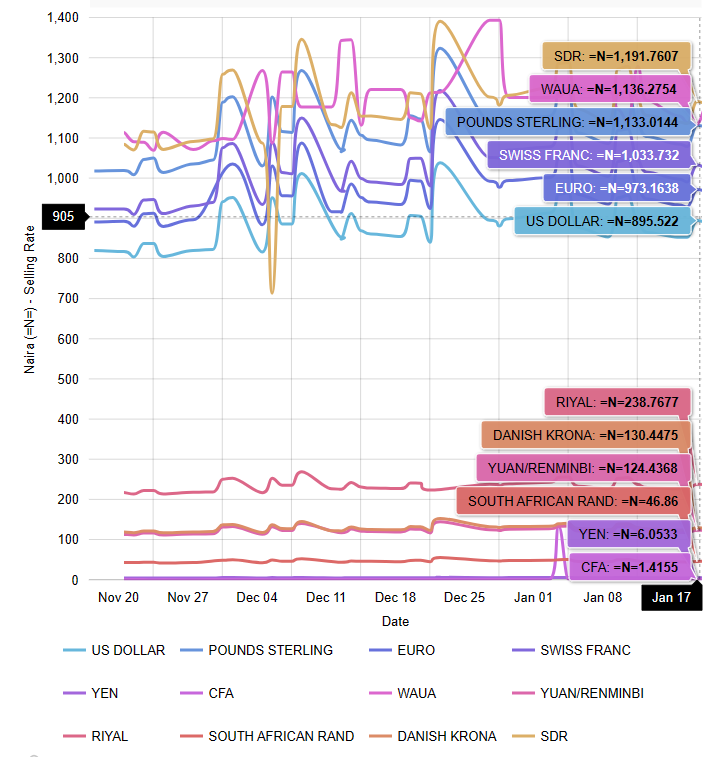

The official market sees the naira trading at approximately 895 to the dollar, but on the parallel market, it weakens considerably, fetching around 1,350 naira per dollar.

This disparity underscores the acute scarcity of hard currency in Nigeria, which is heavily reliant on oil exports for foreign exchange earnings.

Naira Continues to Falter Despite Best Efforts By the CBN

According to Reuters, the Central Bank of Nigeria (CBN) has only managed to clear $2 billion of a staggering $7 billion forex backlog. This development comes eight months after President Bola Tinubu assumed office and initiated vital fiscal reforms, including fuel subsidy cuts and a more flexible naira exchange rate.

Although there was a marginal improvement when Nigeria secured a $2.3 billion loan from the African Export-Import Bank (Afreximbank) to bolster the naira and address the forex backlog for 14 banks, the currency remains under strain. Mainly, exporters, the primary source of dollar supply, prefer parallel market rates.

Gaimin Nonyane, Fitch’s Director of Middle East and Africa Sovereigns, highlighted that the central bank requires more foreign exchange to meet the private sector’s external financing needs and alleviate naira pressure.

In a recent webinar, Nonyane emphasized:

“We think that the central bank is still very well short of the amount it needs to be able to clear the foreign exchange backlog and also meet the extremely large external financing by the private sectors.”

Additionally, Nonyane raised concerns about Nigeria’s high interest payment-to-revenue ratio, reaching 83% in 2022, negatively impacting its sovereign credit rating, which is currently standing at B- with a negative outlook.

Fitch predicts the naira to close the year slightly above 900 to the dollar but cautions about potential reversals in fuel subsidy reforms initiated by President Tinubu in May. Despite global oil market fluctuations and naira depreciation, fuel prices have remained unchanged since the subsidy reforms were introduced.

Try Out Our Trading Bot Services Today. Get Started Here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.