In the aftermath of the crypto industry’s rebound in 2023, the recently released Crypto Crime Report by Chainalysis reveals some interesting shifts in illicit activities within the digital asset space.

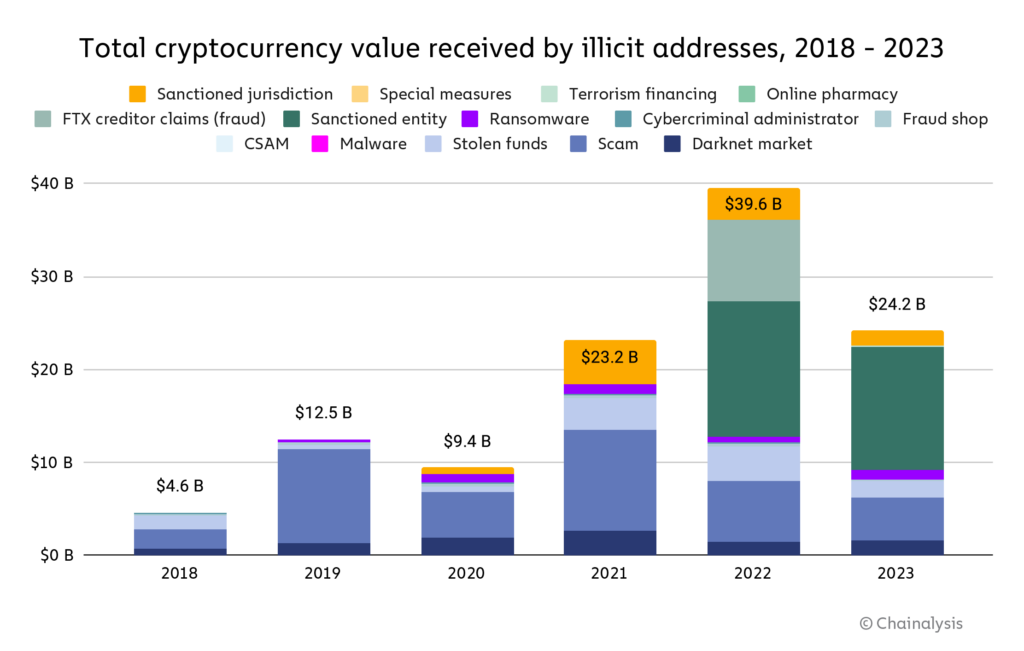

While the total value of transactions involving illicit cryptocurrency addresses plummeted to $24.2 billion, down from previous estimates, a nuanced examination of the data exposes an evolving landscape.

Crypto Crime in 2023 was a Mixed Bag of Ups and Downs

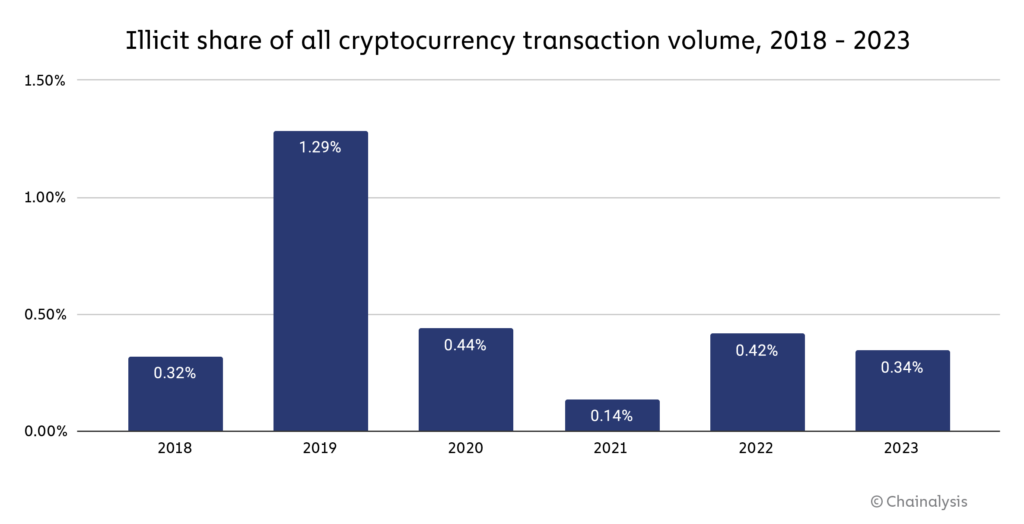

It’s worth mentioning that the share of all crypto transaction volume associated with illicit activities decreased to 0.34%, signaling a positive trend. However, the report highlights a surge in ransomware and darknet market activities, underscoring the resilience of these nefarious schemes despite an overall decline in illicit revenue.

Crypto scamming and hacking, on the other hand, experienced significant setbacks, with a remarkable 29.2% and 54.3% drop in illicit revenue, respectively. Chainalysis attributes this decline to a shift in scam tactics, with cybercriminals adopting romance scam methods to exploit unsuspecting individuals.

While global reports of crypto investment scams have increased, on-chain metrics suggest a downtrend in scamming revenues since 2021.

Crypto hacking, a more visible form of illicit activity, witnessed a decline primarily due to a sharp reduction in DeFi hacking. This downturn suggests potential improvements in the security practices of decentralized finance protocols, although the report emphasizes the sensitivity of stolen fund metrics to outliers.

The resurgence of ransomware and darknet market activities poses a concerning trend, indicating adaptability among cybercriminals. The report raises questions about the effectiveness of organizations’ cybersecurity measures against evolving threats, particularly in the case of ransomware attacks.

One striking revelation from the Chainalysis report is the dominance of transactions with sanctioned entities, accounting for 61.5% of all illicit transaction volume in 2023.

Sanctioned cryptocurrency services, operating in jurisdictions where U.S. sanctions are not enforced, contributed significantly to this figure.

The Chainalysis report emphasizes the need for crypto platforms under U.S. or U.K. jurisdiction to remain vigilant in screening for exposure to such entities to ensure compliance.

The Takeaway

As the crypto landscape continues to evolve, these trends underscore the importance of proactive measures by both industry stakeholders and regulators to curb the rising tide of ransomware and darknet market activities, ensuring the long-term health and legitimacy of the cryptocurrency ecosystem.

Try Out Our Trading Bot Services Today. Get Started Here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.