The multiple time frames trading strategy is a Forex trading strategy that works by following a single currency pair over different time frames. By following the price chart we can see the highs and lows and establish the overall and temporary trend. However, by looking at the different time frames we can see changes and patterns that we were not able to spot by using a single time frame.

3

Payment methods

Trading platforms

Regulated by

Support

Min.Deposit

Leverage max

Currency Pairs

Classification

Mobile App

Min.Deposit

$100

Spread min.

Variables pips

Leverage max

100

Currency Pairs

40

Trading platforms

Funding Methods

Regulated by

FCA

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Average spread

EUR/GBP

-

EUR/USD

-

EUR/JPY

0.3

EUR/CHF

0.2

GBP/USD

0.0

GBP/JPY

0.1

GBP/CHF

0.3

USD/JPY

-

USD/CHF

0.2

CHF/JPY

0.3

Additional Fee

Continuous rate

Variables

Conversión

Variables pips

Regulation

Yes

FCA

No

CYSEC

No

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

No

CBFSAI

No

BVIFSC

No

FSCA

No

FSA

No

FFAJ

No

ADGM

No

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

Min.Deposit

$100

Spread min.

- pips

Leverage max

400

Currency Pairs

50

Trading platforms

Funding Methods

Regulated by

CYSECASICCBFSAIBVIFSCFSCAFSAFFAJADGMFRSA

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Etfs

Average spread

EUR/GBP

1

EUR/USD

0.9

EUR/JPY

1

EUR/CHF

1

GBP/USD

1

GBP/JPY

1

GBP/CHF

1

USD/JPY

-

USD/CHF

1

CHF/JPY

1

Additional Fee

Continuous rate

-

Conversión

- pips

Regulation

No

FCA

Yes

CYSEC

Yes

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

Yes

CBFSAI

Yes

BVIFSC

Yes

FSCA

Yes

FSA

Yes

FFAJ

Yes

ADGM

Yes

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

Min.Deposit

$50

Spread min.

- pips

Leverage max

500

Currency Pairs

40

Trading platforms

Funding Methods

What you can trade

Forex

Indices

Actions

Raw Materials

Average spread

EUR/GBP

-

EUR/USD

-

EUR/JPY

-

EUR/CHF

-

GBP/USD

-

GBP/JPY

-

GBP/CHF

-

USD/JPY

-

USD/CHF

-

CHF/JPY

-

Additional Fee

Continuous rate

-

Conversión

- pips

Regulation

No

FCA

No

CYSEC

No

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

No

CBFSAI

No

BVIFSC

No

FSCA

No

FSA

No

FFAJ

No

ADGM

No

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

Find out more about Trend Trading – Forex Trading Strategies

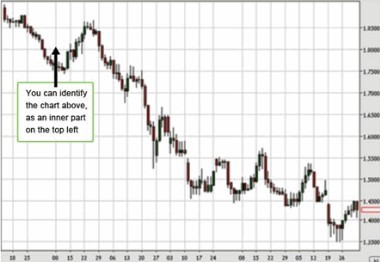

In the chart above every candlestick represents 2 hours. The chart consists of 360 candlesticks that altogether constitute 1 full month.

Learn more about Candlestick – Forex Trading Strategies

On the left side of the chart, marked with purple markings, are mini-trends. If we would have looked at a shorter time frame we would have seen these mini-trends but would not have seen the bigger picture which shows a much larger bullish trend.

Now let’s look at an even larger time frame and see how it affects our understanding of the trend.

This is a chart of a half-year time frame. Each candlestick on this chart represents 1 day. As you can see, what we analyzed as a bullish trend appears in this time frame to be just a small pullback of an overall bearish trend.

Clearly, when looking at a single time frame you can’t know the whole story. As a rule, it is critical to know the whole story before making an investment. Examining the price change over numerous time frames can act as an indicator in telling us when to enter or exit a trade.

Standard time frames to focus on are time frames in which each candlestick represents 15 minutes, 30 minutes or 1 hour. These time frames fall right in the middle as they allow the trader enough time to examine the market before making a move but are not too long-term, making them profitable over relatively short periods of time.

To sum up, each time frame has its benefits. Long time frames allow us to understand the bigger picture and identify the overall trend. Average time frames present the short term trend and show us what is happening in the market right now. Short time frames are our way of recognizing the exact window for when to make our move.

To successfully execute multiple time frame analysis, the suggested working process is to choose a time frame to work in and then verify your move with a longer time frame. Working with three different time frames is possible. However, be careful when working with three or more time frames as it can cause a great deal of confusion and chart mix-ups.