Latin American crypto activity just proved skeptics wrong. The region processed nearly $1.5 trillion in transactions between July 2022 and June 2025, according to Chainalysis.

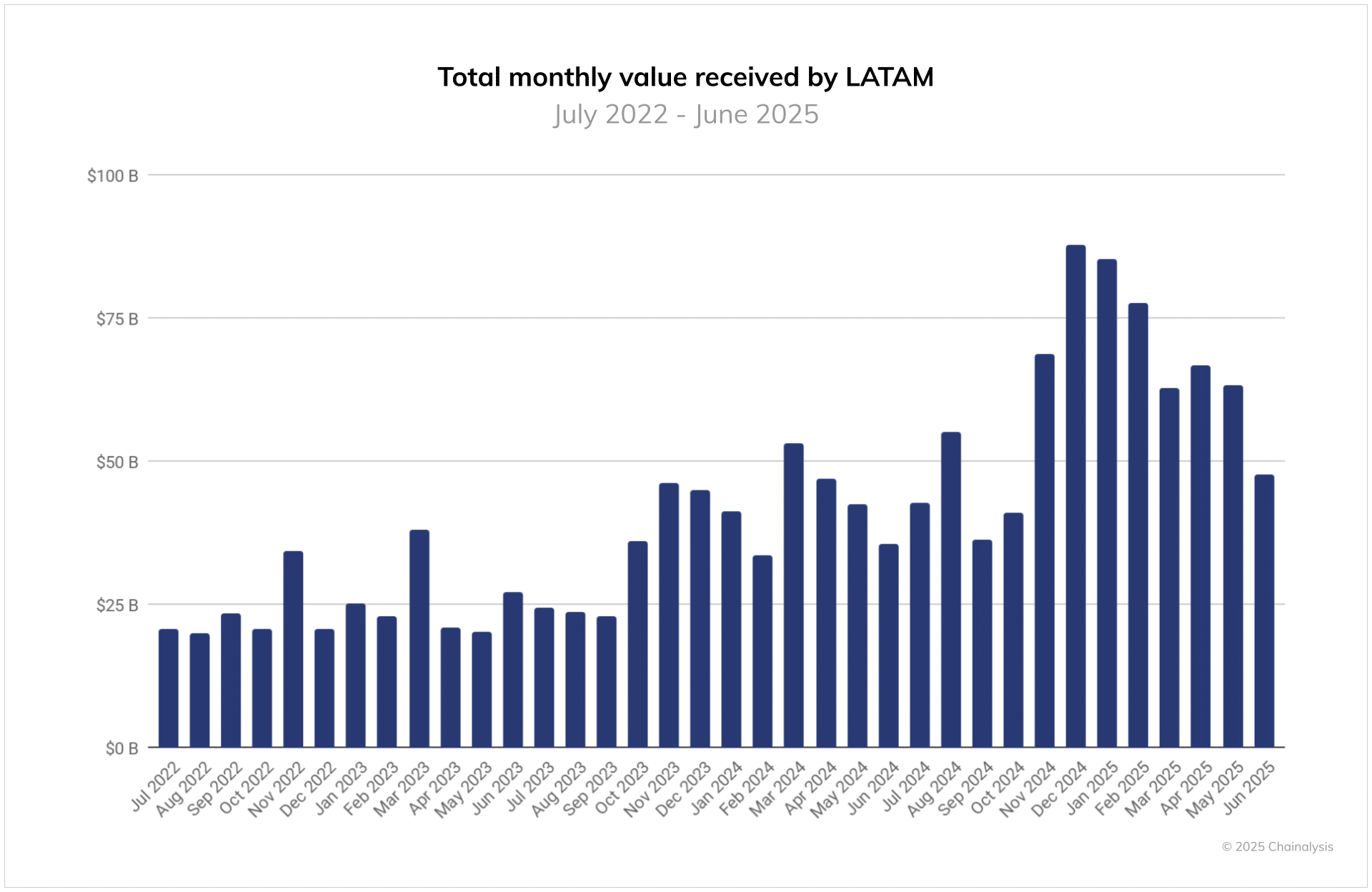

Monthly volumes tell an impressive story. They jumped from $20.8 billion in July 2022 to $87.7 billion in December 2024. Even after cooling to $47.9 billion by June 2025, the numbers dwarf earlier periods.

Why the Surge in the Latin American Crypto Market?

The answer is quite straightforward: economic instability drives people to digital assets. In economically unstable regions, inflation keeps eroding purchasing power, currencies lose value, and capital controls trap money inside borders. Crypto offers an escape route from all these.

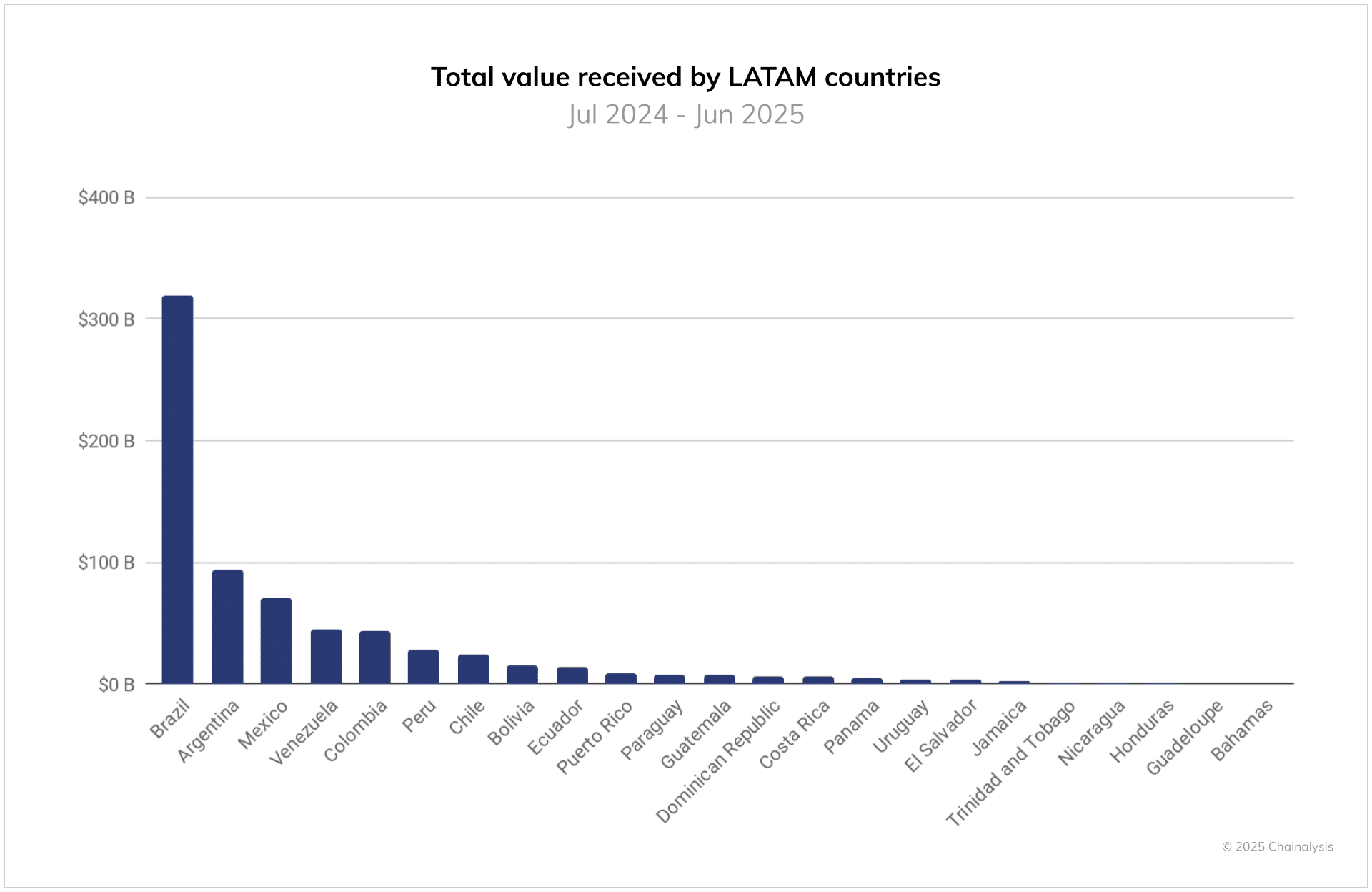

Brazil leads the pack with $318.8 billion in transactions. That’s one-third of all regional activity. The country’s 109.9% growth rate beats every major market in Latin America.

Argentina follows with $93.9 billion. Mexico adds $71.2 billion. Venezuela and Colombia each contribute over $44 billion. Even smaller markets like Peru and Chile show strong numbers.

Brazil’s success stems from smart regulation. The 2022 Brazilian Virtual Assets Law established clear rules. The Banco Central de Brasil now oversees crypto firms. New regulations should arrive by late 2025.

Traditional banks also joined the party. Itaú and digital banks like Nubank now offer crypto services. Over 90% of Brazilian flows involve stablecoins. People use them for payments and cross-border transfers.

Stablecoins Power the Economy

Centralized exchanges handle 64% of Latin American crypto activity. That’s higher than North America (49%) or Europe (53%). Local platforms like Mercado Bitcoin, Ripio, and Bitso built trust with users.

Stablecoins matter most here. They make up over half of exchange purchases in Brazil, Argentina, and Colombia. People treat them as digital dollars. They’re more stable than local currencies.

The remittance corridor benefits too. Crypto enables faster, cheaper international transfers. Families receive money in hours instead of days.

Looking ahead, institutional adoption should accelerate. Retail demand for stablecoins won’t slow down. But success depends on balanced regulation.

Countries following Brazil’s example will likely see similar growth. The region proved crypto isn’t just speculation. It’s solving real financial problems.

Interested In Trading The Market With A Trustworthy Partner? Try Eightcap Today.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.