Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

Sub-Saharan Africa has become the world’s third-fastest-growing crypto region.

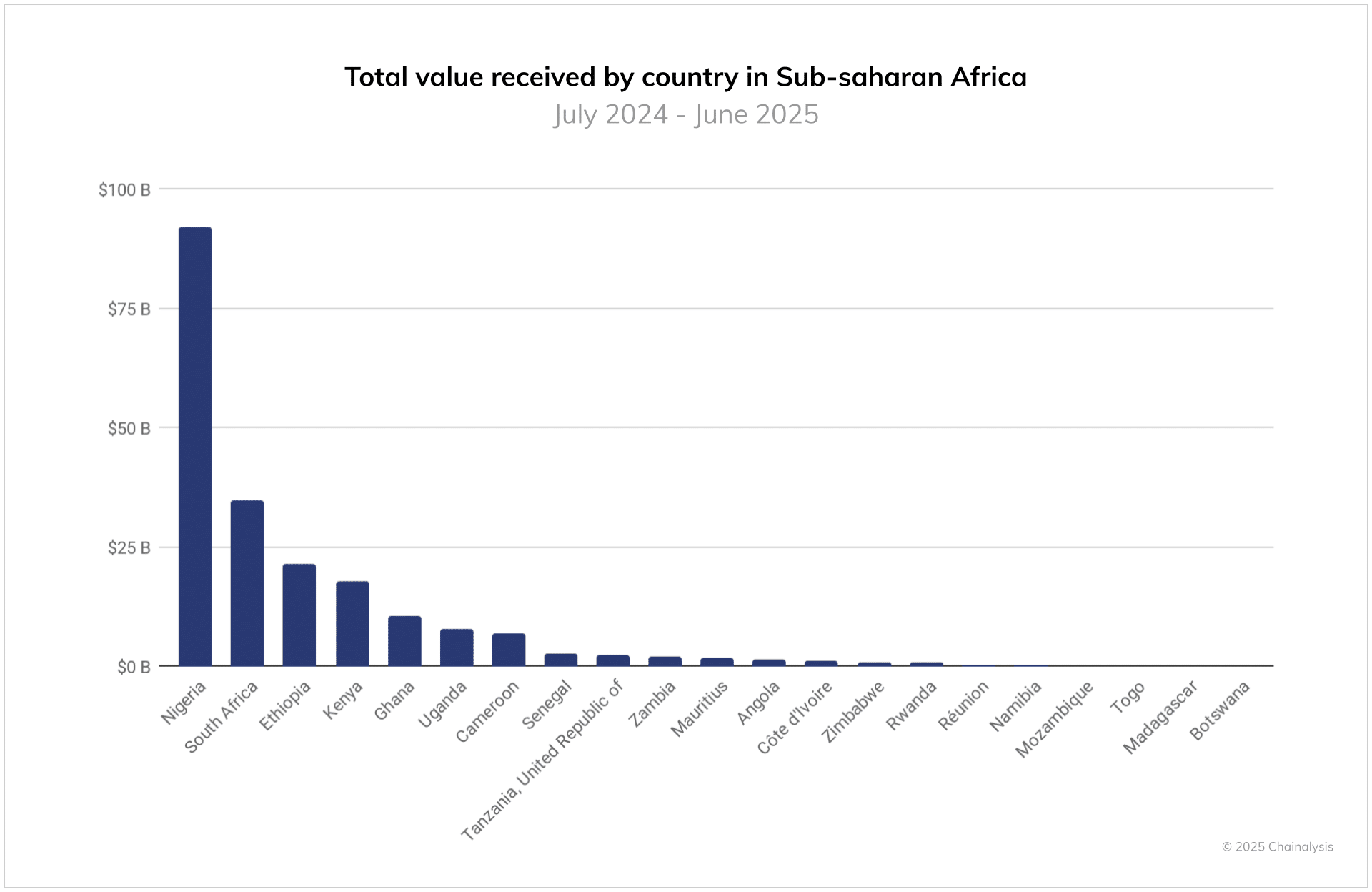

Between July 2024 and June 2025, it received over $205 billion in on-chain value. That’s a 52% jump from the previous year, according to a recent Chainalysis report.

This growth puts Africa right behind Asia-Pacific and Latin America. Nigeria leads the charge with $92.1 billion in crypto activity. That’s nearly three times more than South Africa, the second-largest market in the region.

Currency Troubles Drive Crypto Adoption

March 2025 marked a turning point for African crypto users. Monthly trading volume hit nearly $25 billion during a month when other regions saw declines. Nigeria’s currency crisis sparked this surge.

When local currencies lose value, people turn to crypto for protection. Bitcoin becomes their digital safe haven. In Nigeria, where access to US dollars is restricted and inflation stays high, Bitcoin serves as both a hedge and a savings tool.

The numbers tell the story clearly. Over 8% of all crypto transfers in Sub-Saharan Africa are under $10,000. Compare that to just 6% globally. This shows everyday people are using crypto for daily financial needs.

What Makes This Crypto Region Different?

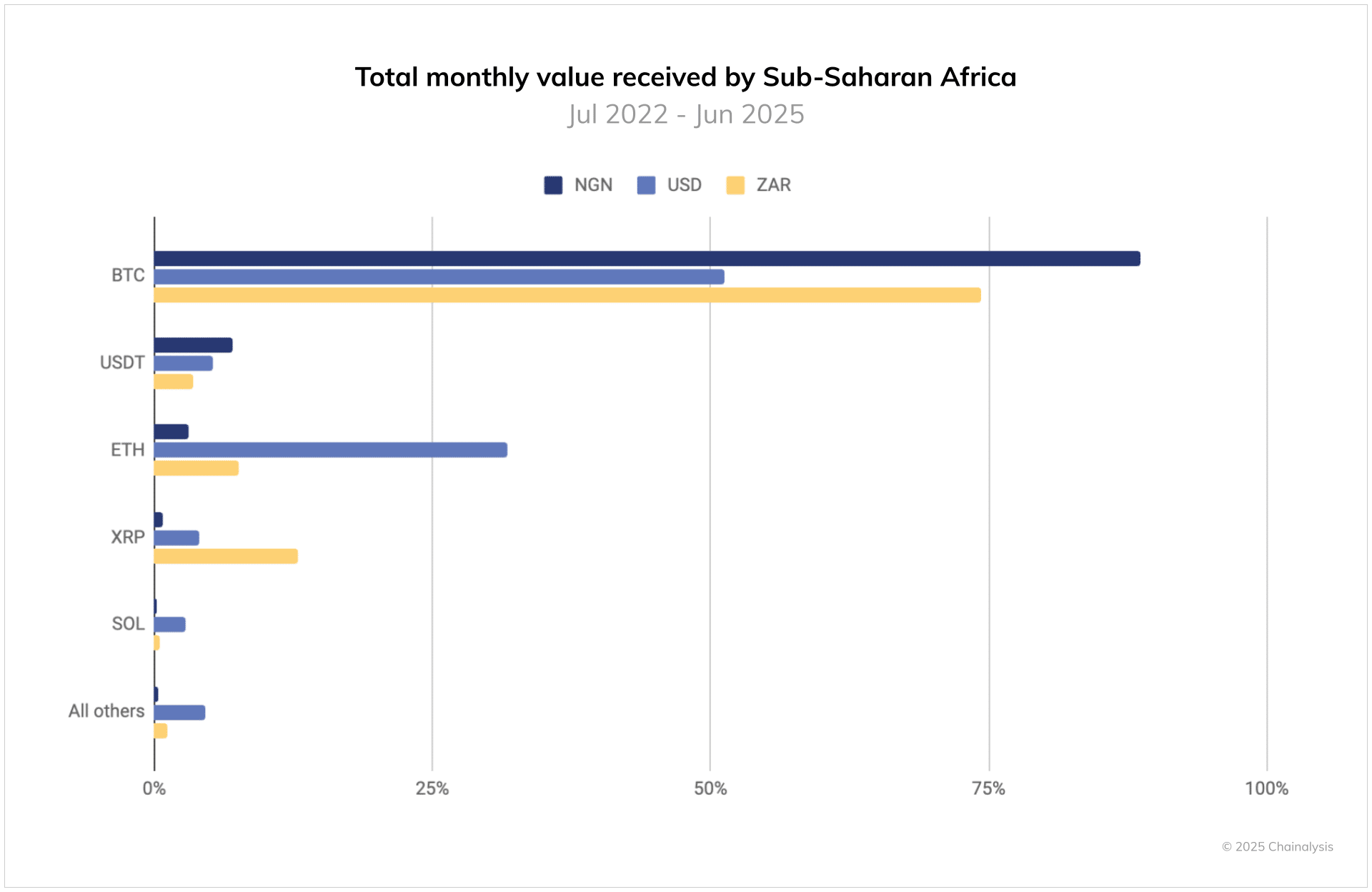

Bitcoin holds massive appeal across the region. In Nigeria, it makes up 89% of all crypto purchases. South Africa follows at 74%. These figures dwarf the global average of 51% for USD-based purchases.

Stablecoins are gaining ground too. USDT accounts for 7% of purchases in Nigeria versus 5% globally. People use these digital dollars when official exchange rates don’t match black market prices.

Banks and financial institutions are taking notice. South Africa leads with hundreds of registered crypto service providers. Major banks like Absa are developing products for institutional clients.

Cross-border payments drive much of this institutional interest. Companies use stablecoins for multi-million dollar transfers between Africa, the Middle East, and Asia. Energy and merchant sectors especially benefit from these crypto payment rails.

The region’s crypto revolution goes beyond speculation. Digital assets solve real problems in challenging economic environments. As regulations mature and institutions engage more deeply, Africa is rebuilding its financial infrastructure from the ground up.

Interested In Trading The Market With A Trustworthy Partner? Try Eightcap Today.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.