Uniswap (UNI) has become the most traded asset among Ethereum whales, also known as the 1,000 largest addresses in the network, beating Chainlink out of the position. According to analytics platform WhaleStats, one of the whale wallets holds over $100 million worth of UNI.

Apart from this, UNI remains the most held token on the market, as virtually every large wallet holds at least one Uniswap token.

Reports show that the reason for this increased popularity of UNI among whale wallets is because of the nature of the asset as a utility for the Uniswap decentralized exchange. To use the network, users need to spend their UNI tokens after purchasing them with Ether.

Uniswap’s key competitor, LINK, also occupies a significant number of Ethereum whale wallets, with large addresses holding over $250 million. While these crypto-assets remain the highest holdings of whales, they still do not level up to the 1.1 million wallets recently reached by Shiba Inu.

Meanwhile, analysts have called UNI the SHIB of early 2021, as the token gained over 1,100% between January and April 2021. However, the token has lost over 60% ever since, following several bearish events in the crypto industry and increased competition in the DeFi space.

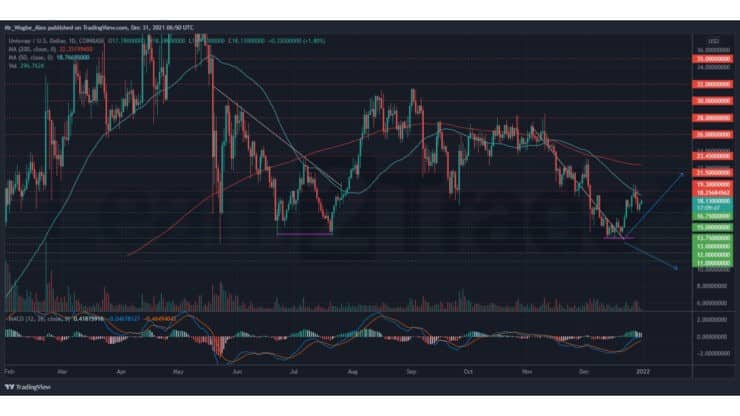

Key Uniswap Levels to Watch — December 31

UNI recently suffered a sharp -16% correction from the $20.00 region to the $16.75 support between Monday and Thursday, amid a reemergence of bears across the broader market. Despite the recent crash, the cryptocurrency maintains a bullish outlook on my daily chart and remains on course to $21.50.

That said, I expect to see a steady recovery towards the $20.00 psychological resistance mark over the coming days. Nonetheless, this recovery could take a while, given the current volume drought in the market as we head into the new year.

Meanwhile, my resistance levels are $18.25, $19.20, and $20.00, and my support levels are $16.75, $15.00, and $14.00.

Total Market Capitalization: $2.21 trillion

Uniswap Market Capitalization: $11.2 billion

Uniswap Dominance: 0.50%

Market Rank: #18

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.