Ripple (XRP) has suffered huge bearish blows over the past week as sell waves ravage the crypto market. The total crypto market valuation has slid by over 23% since May 4, when it peaked at $1.8 trillion.

The aggressive bearish sentiment in the market came after the US Federal Reserve announced a more hawkish monetary stance in its recent FOMC meeting, as the central bank fights to get rising inflation under control.

The bearish sentiment worsened over the past 24 hours following a heart-wrenching crash in Terra (LUNA) and TerraUSD (UST). The persisting bearish sell-off has seen XRP drop to the $0.4000 low, a level not seen since February 2021. Many crypto investors have been liquidating their holdings and trooping into Stablecoins.

Ripple is now on track to record six consecutive weekly drops, its longest weekly losing streak on record. With so many challenges ahead of it, 2022 is starting to shape as a bearish year for XRP. However, winning the ongoing lawsuit against the US Securities and Exchange Commission could turn things around dramatically for the cryptocurrency.

Additionally, it is worth mentioning that the last time XRP witnessed a price action like this, it entered an aggressive bullish cycle shortly, which sent it to its all-time high of $3.40 in early January 2018.

Key Ripple Levels to Watch — May 11

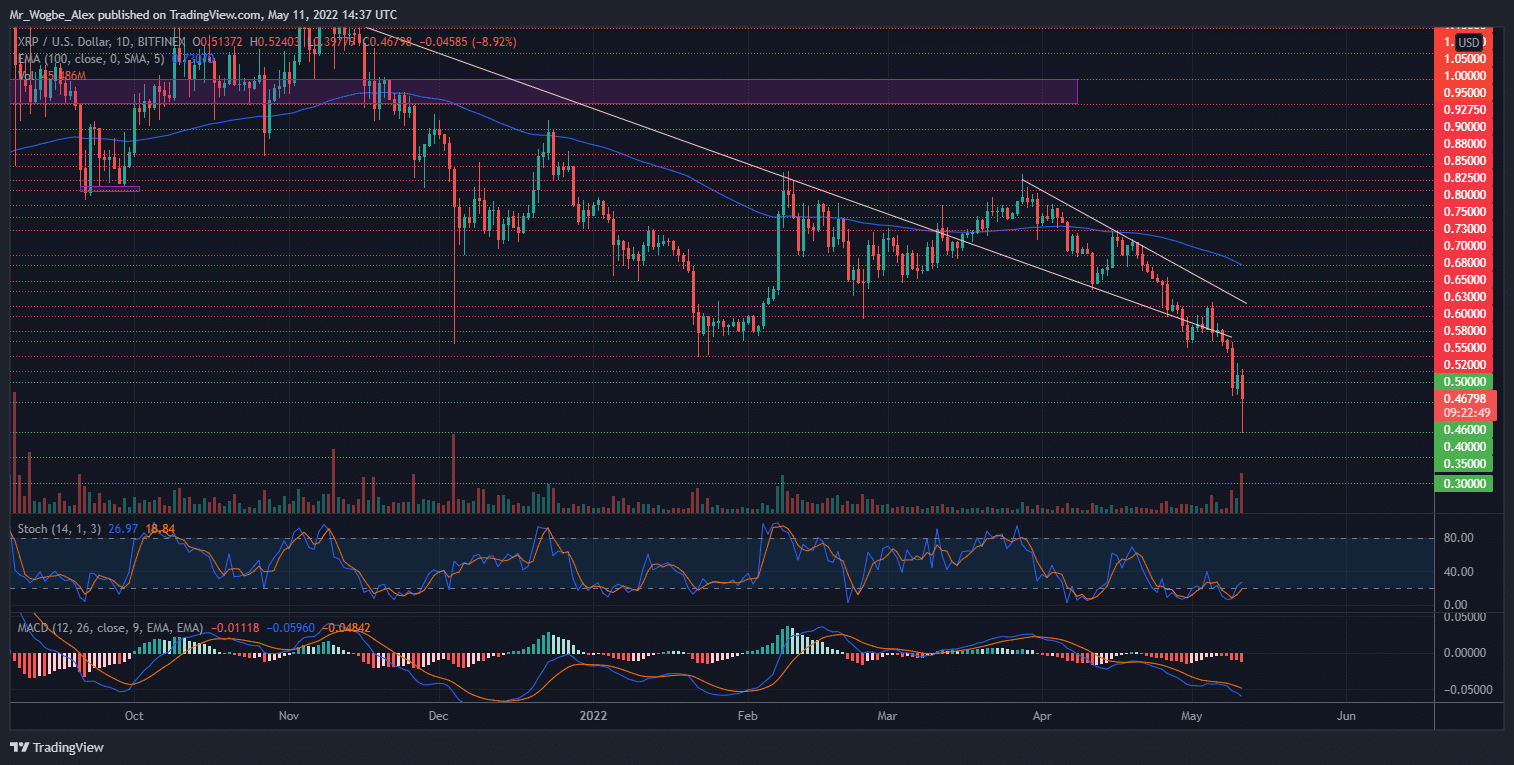

Ripple has found itself in a precarious position after losing its grip on the $0.5000 level and slumping to the $0.4000 low in the London session on Wednesday.

The cryptocurrency has since rebounded near the $0.5000 level but that will not suffice to keep bears from pushing for a retest. That said, the cryptocurrency needs to plant its foot around the $0.5200 top before the end today or risk a bearish retest and continuation in the coming days.

With the cryptocurrency market momentum being determined by LUNA and TerraUSD, developments around these tokens will drive the near-term price action for XRP.

Ripple has fallen into a sideways bias between $0.6000 and $0.6300 as traders resign to the sidelines ahead of the US Fed interest rate decision later today.

Meanwhile, my resistance levels are $0.5000, $0.5200, and $0.5500, and my support levels are $0.4600, $0.4000, and $0.3500.

Total Market Capitalization: $1.38 trillion

Ripple Market Capitalization: $22.7 billion

Ripple Dominance: 1.64%

Market Rank: #6

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBlock

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.