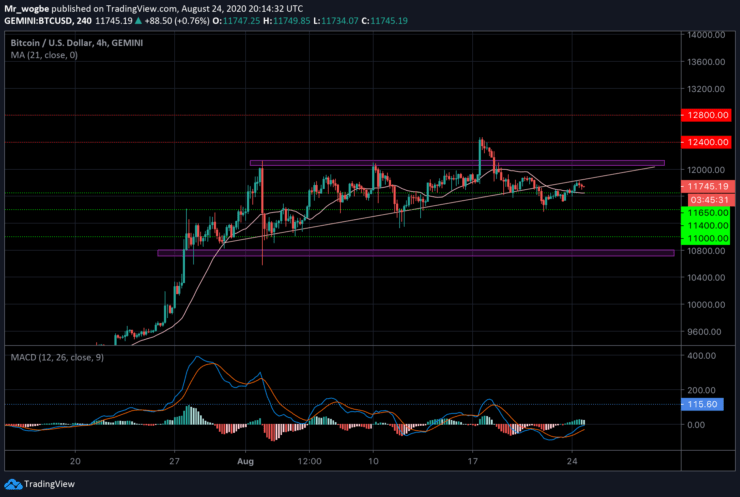

This previous key support (the ascending trendline line), which helped BTC multiple times on its recent bull run, is now the major hurdle preventing the cryptocurrency from regaining its bullish momentum.

The general cryptocurrency market cap appears to be forming lower highs, suggesting that there’s an impending drop on the way unless a bull run that could help bitcoin break above the crucial resistance is seen soon.

Meanwhile, traders across markets are on the sidelines ahead of the annual Federal Reserve Symposium set to hold online on the 27th and 28th of this month. The Fed Chair Jerome Powell is expected to speak about the condition of the US and global economy and what the Fed outlook for further stimulus packages and programs are.

The anticipation of this event is expected to take out most of the volatility from the market, which will likely leave Bitcoin in a consolidatory state in the near-term.

Key Levels to Watch

With the $11,800 hurdle proving significantly difficult, Bitcoin is losing bullish steam quickly. This could have adverse effects on the cryptocurrency in the near-term.

The $11,650 support is expected to hold for the time being considering the confluence status at that level with the 21 SMA and the key support.

However, if this line fails to hold, then we could see the $11,400 support and the $11,000 psychological level again. A subsequent decline from there will be met with strong support at $10,800.

On the flip side, a break and close above the strong $11,800 hurdle could send Bitcoin back into the ascending wedge and back above the $12,000 mark.

Total market capital: $367 billion

Bitcoin market capital: $216 billion

Bitcoin dominance: 58.8%

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.