The yellow metal recorded a daily high of $1962, but was immediately met with strong bearish pressure and was sent down as far as $1927. At press time, gold is trading at $1928.

The dollar-denominated commodity fell as the US dollar index (DXY) erased most of its accrued losses, recording a 93.30 daily high. The equity markets were not left out of the gains as the Dow Jones (DJIA) gained about 1% and the Nasdaq 100 (NDX) grew by 0.45%. Also, US yields are trading higher today, extending further support for the greenback and causing the non-yielding commodity to slide.

Furthermore, the upcoming speech by Jerome Powell at the Jackson Hole symposium continues to weigh on the directional clarity of the gold market in the meantime.

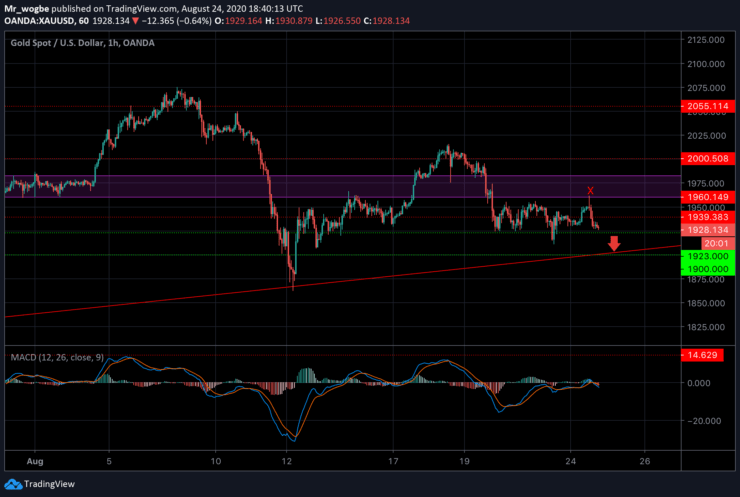

Gold (XAU) Value Forecast — August 24

XAU/USD Major Bias: Bearish

Supply Levels: $1939, $1960, and $1983

Demand Levels: $1923, $1900, and $1865

Gold failed to capitalize on a goodish bounce seen today in the middle of the European session. The XAU/USD rose to our $1960 resistance/pivot region but was swiftly hijacked by sellers who took it near the $1923 bearish trigger.

It would be nice to see how the price will react to the $1923 support—if it gets there in the near-term. Failure to bounce off that line could compel gold to continue on its bearish momentum down to the $1904 (our 41-day-old trendline) and subsequently to the $1900 psychological level. Further declines from that level could open gold up to August’s low ($1862) once again.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.