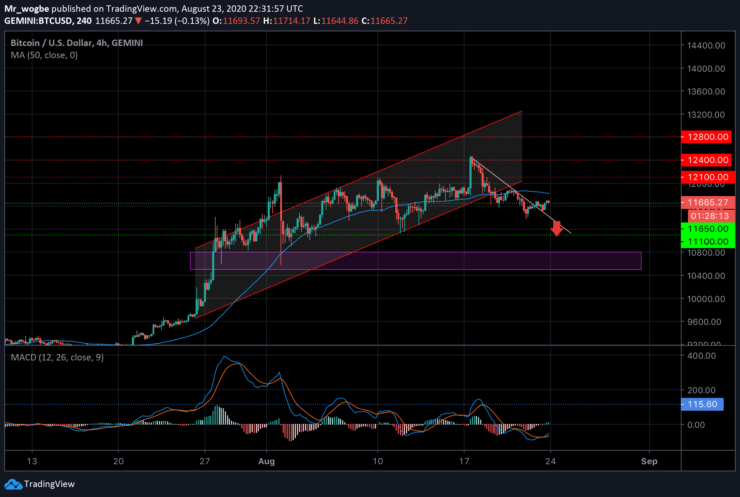

Bitcoin’s decline, after touching the top $12,000 level, increased in pace after it broke below the $11,800 support. It subsequently dipped below the $11,500 and tested the $11,350 support.

A weekly low was formed around $11,370, after which the price attempted to regain its original bullishness.

Meanwhile, there has now been a healthy break above a prevailing downward-facing trendline around the $11,650 resistance on the 4-hour BTC/USD chart. The next hurdle for the benchmark cryptocurrency to topple is the $11,700 and subsequently the $11,800.

Also, the 100 simple moving average appears to be around the $11,800 level as well, forming a confluence of resistance at that level.

That said, a clean break and close above the aforesaid resistance could send Bitcoin on a fresh surge towards the $12,000 region again. The next target after that is the $12,350 mark.

Key Levels to Watch

Failure for Bitcoin to reclaim its footing above the $11,800 soon could send the cryptocurrency on its way down to the $11,350 key support area again. Further decline could send the price down to the $11,100, which is also below the prevailing downwards-facing trendline. The next level of support to watch out for after that is the $10,800-500 area.

Total Market Cap: $364.2 billion

Bitcoin Market Cap: $215.7 billion

BTC Dominance Index: 59%

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.