Bitcoin started the week off around $11,700 and maintained that price tag for a while before heavy volatility was pumped in on Monday, causing the benchmark cryptocurrency to reach a high of $12,475. The cryptocurrency community went into a frenzy as the long-coveted $12,000 barrier had finally been broken. However, this excitement was short-lived.

About a day later, Bitcoin had completely dropped below the $12k mark again. Fast-forward to this moment and Bitcoin is trading around $11,570, lower than the start of the week.

However, one pacifying observation is the striking correlation Bitcoin has exhibited with gold throughout the week. It shows that the cryptocurrency is becoming even more stable and durable like other traditional safe-haven assets.

Key Levels to Watch

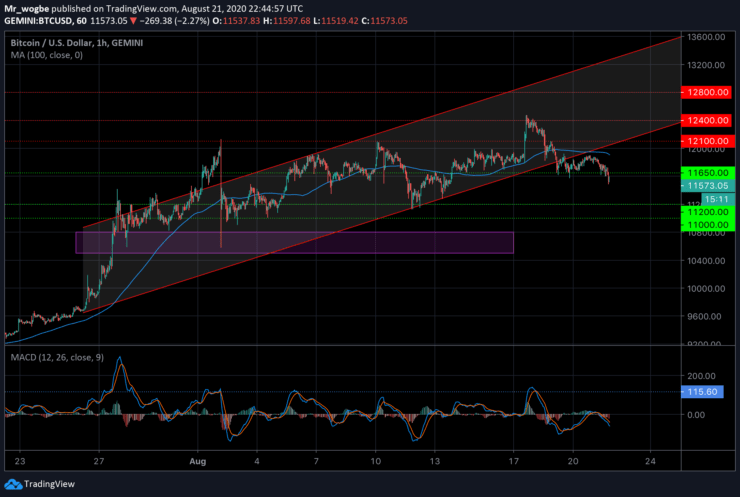

During the week, BTC topped the $12,000 resistance and reached a year high of $12,475 but was unable to sustain itself at that level for long. Bitcoin has started picking up bearish steam as it continues to stray further away from our prevailing channel and the coveted $12k mark.

The cryptocurrency bulls appear to be ‘holding the fort’ at $11,550. A break below this level could send us quickly to the $11,200 and $11,000 psychological line subsequently.

The original bullish steam seen at the start of this week has already started to wane and some traders expect to see the $11,000 in the near-term.

On the flip side, Bitcoin needs to rise above the first resistance at $11,912, which is our 11 simple moving average. Subsequently, the $12k should be attempted again and finally the $12,400.

Total market capital: $361 billion

Bitcoin market capital: $214 billion

Bitcoin dominance: 59.2%

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.