The global cryptocurrency market remained depressed into today’s session as the market shed another $11 billion.

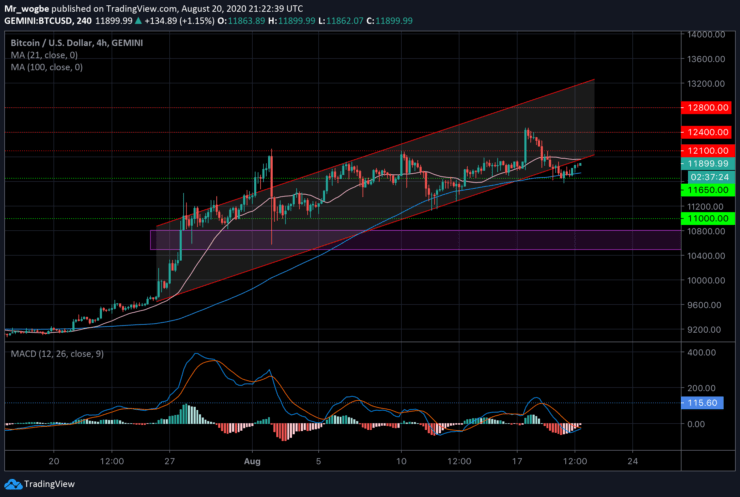

It appears that Bitcoin has now slipped below an ascending channel that has been prevailing for close to a month now on our 4-hour chart. The base of the channel, which was a former support level, has now turned into a resistance for BTC to defeat before reaching $12k again.

Key Levels to Watch

As mentioned above, BTC continues to struggle beneath the channel resistance around $11,890. Bulls have to push the benchmark cryptocurrency back into the channel before panic selling is triggered.

Immediate support can be found at the 100 simple moving average ($11,744), where Bitcoin should be able to find a good bounce if it drops further in the near-term.

A continuation in decline should activate the $11,650 support and subsequently the $11,400 level. Finally, the last safety net for bulls is the $11,000 psychological line. A break below that level could trigger a massive sell-off.

On the flip side, the first line of defense is the 21 simple moving average ($11,966) and subsequently the $12k mark. Next up is the $12,100 followed by the 12,350.

On our MACD indicator, we can see that Bitcoin is building up steam to attempt the $12k level once again.

Total market capital: $373 billion

Bitcoin market capital: $219 billion

Bitcoin dominance: 58.7%

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.