This drop saw BTC drop as far as $11,600 before bulls stepped in to prevent further declines.

Many analysts believe that this sharp decline has disrupted Bitcoin’s price action in the near-term. A bearish divergence has now emerged on Bitcoin’s ‘Renko’ chart, confirming the fresh BTC weakness. Worth mentioning is that the last time this pattern emerged, the cryptocurrency fell by $1,300.

If history repeats itself, which it usually does, Bitcoin could see a further extension of this correction. One analyst points out that if the crypto failed to bounce off its current level, we could see $10k again.

Key Levels To Watch

At press time, Bitcoin is trading at $11,770, roughly 1.6% down from its previous high.

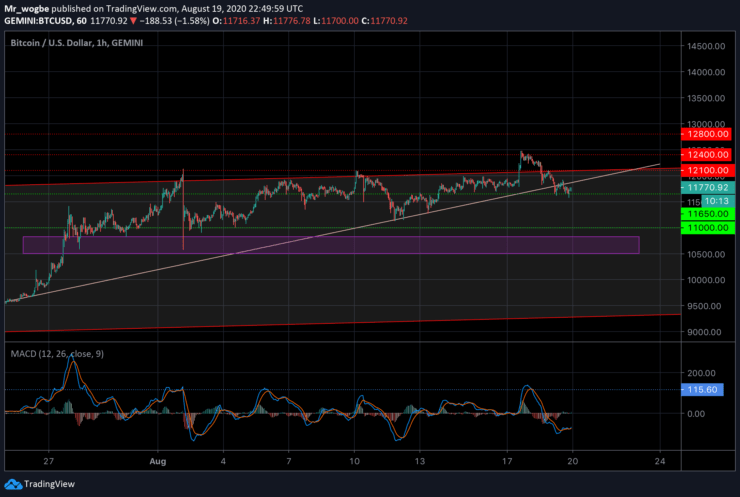

As projected in our last analysis, the benchmark cryptocurrency dropped to $11,600 before finding a strong bounce from that area. After this, the crypto appeared to enter a consolidation range just like the one it was in before we broke the $12k mark.

Bulls are now tasked with reclaiming dominance above $12k again or risk handing over control to bears.

On the hourly chart, we can see that BTC needs to get back on top of the prevailing trendline and continue on that trajectory. Our MACD indicator shows that we are now heading into oversold conditions, making a bullish comeback more feasible.

If the $11,600 support caves, Bitcoin could head towards the $11,200-000 region fairly quickly. A further decline from that level should be strongly supported by the $10,800-500 pivot zone (colored in purple).

On the flip side, a good recovery from this level would send Bitcoin back into the $12,000’s and higher.

Total market capital: $365.6 billion

Bitcoin market capital: $217 billion

Bitcoin dominance: 59.4%

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.