Meanwhile, data from Coinmarketcap indicate that the cryptocurrency market fell back under $325 billion earlier today and has recorded a new lower high for the first time since the Coronavirus pandemic hit in March. This is very indicative of a bearish bias.

Still, bulls are showing just how strong and determined they are with the recent rebound. That said, BTC remains in a struggle to find any significant momentum in the near-term, as bulls and bears continue to struggle for control. The coming trading days will determine who the near-term winner will be, bearing in mind that the path of least resistance for BTC is leaning towards the downside.

Key BTC Levels to Watch

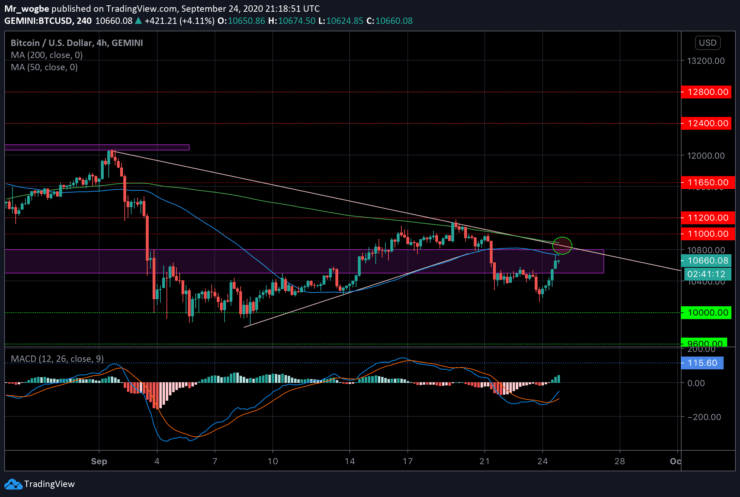

Bitcoin has now entered a slight rebound over the past few hours, as bulls keep $11,200 in mind. At press time, the benchmark cryptocurrency is trading at $10,630, not too far from the $10,650 supply level. It appears that the recent rebound has been stalled after the crypto touched the 50 SMA ($10,732).

Given the current momentum, we’re likely going to see a retest and possible break of that level, which will be met by yet a strong confluence of resistance (the descending trendline, the 200 SMA, and the $10,800 pivot point).

A healthy break above that resistance confluence could pave the way for a retest of the $11,200 supply level, while a failure to clear this hurdle could send BTC spiraling to $10,200.

Total market capital: $337 billion

Bitcoin market capital: $197 billion

Bitcoin dominance: 58.4%

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.