Bitcoin has had a considerably rough week compared to other cryptocurrencies, especially DeFi assets, which recorded massive gains.

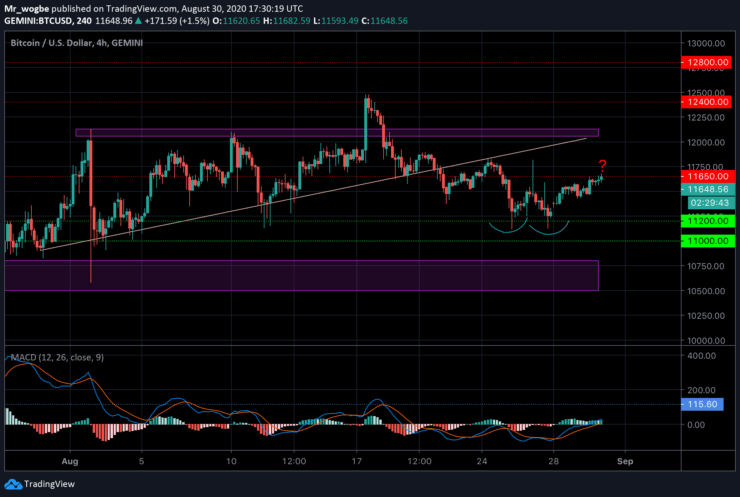

On the 4-hour chart, we can see that BTC has formed a “double bottom” around the $11,100 support area. This pattern is widely recognized to be a bullish indicator, except in a case where the bottom is broken significantly.

Meanwhile, for the past few days, the benchmark cryptocurrency has been trapped in a consolidation range between $11,650 and $11,400. If Bitcoin remains stuck-in-place, we can expect Altcoins or DeFi assets to continue on an upward trajectory.

An analyst has predicted that a reduced amount of trading volume coupled with stability in BTC could cause the cryptocurrency to rally strongly towards either direction. This rally is expected to occur early this week.

A bullish breakout could likely occur considering that Bitcoin always closes up the range right after an Altcoin rally. However, a bearish breakout is also likely given the lingering decline in trading volume.

Key BTC Levels to Watch

At press time, Bitcoin remains locked in a battle with the $11,600 supply region. A break above should send the cryptocurrency to the $11,800 strong resistance again. Subsequently, the $12k psychological line will come into contention followed by the $12,100 level, and finally, 2020’s high at $12,475.

On the flip side, the first support level to look out for is the $11,400 area. A break below that line will likely usher-in last week’s double bottom level $11,100, and subsequently the $10,800. $10,500 remains the near-term target if a bear-run is triggered.

Total Market Cap: $371.9 billion

Bitcoin Market Cap: $215 billion

BTC Dominance Index: 57.9%

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.