GBPJPY Price Analysis – August 30

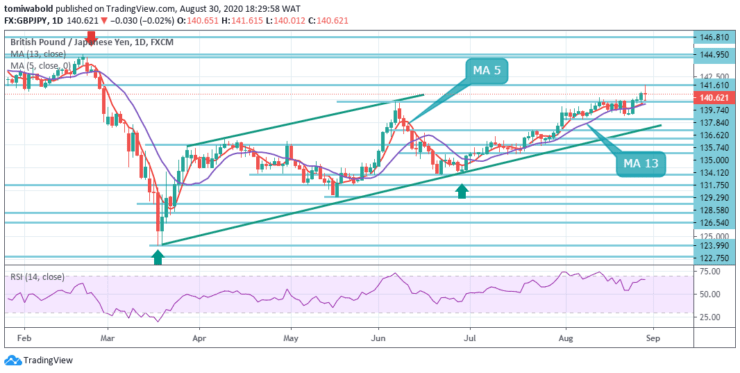

The GBPJPY cross continued its rapid intraday drawdown from six-month highs and fell further beneath the 141.00 marks, nearer back to the lower end of its prior daily trading range. The pair added to the gains from the prior week and continued shifting upwards as its attempt to resume upside trajectory is capped beneath level 141.00.

Key Levels

Resistance Levels: 147.95, 144.95, 141.61

Support Levels: 137.84, 135.74, 134.12

In the wider sense, an increase from level 123.99 is also seen as a rise from level 122.75 (low) of the sideway consolidation trend. As long as resistance level 147.95 holds, there remains a potential downside breakout in support.

Since late February, the GBPJPY cross-shot to the highest level but lost traction near the region of 141.60. A steady breach of 147.95 marks, nevertheless, may increase the risk of a long-term bullish reversal. Validation would then transform the attention to a resistance level of 156.59.

The GBPJPY rally revived last week and reached a high of 141.62 level. In the event of retreat, a further increase can be seen as long as 138.24 support levels remain. Sustained 100% forecast shift of 123.99 to 135.74 levels from 129.29 to 141.07 levels sets the stage for a forecast of 161.8% at 148.36 level.

Moreover, short-term oscillators support an enhanced image. In the positive area, the MA 5 red line spends some time, and it’s above the blue MA 13 signal line, while the RSI is striving to ascend over the 60 marks.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.