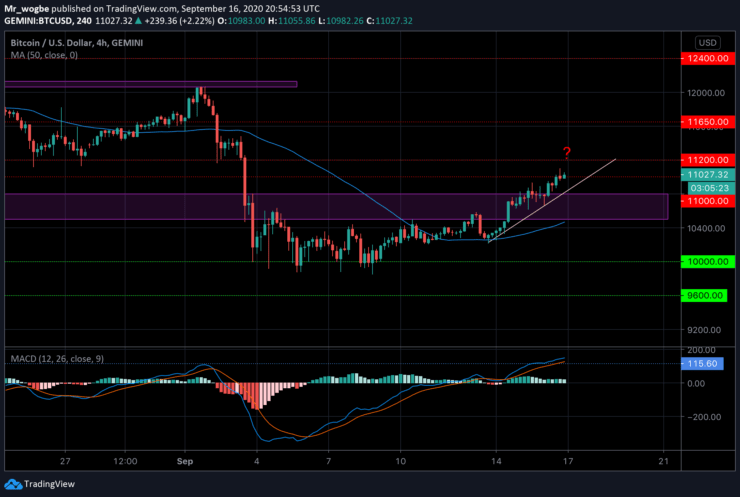

However, many traders fear that this goodish bounce may come to an end soon. Analysts have set their eyes on the $11,200 resistance as the potential area where Bitcoin could come under selling pressure.

Meanwhile, this doesn’t affect the long-term fundamentals of BTC, which many revered commentators believe is positive.

One analyst has pointed out that BTC is currently forming a pattern structurally identical to the crash in March. If history repeats itself, then we could see a significant descent from the $11,200 resistance level.

However, whatever the fate of Bitcoin might be in the near-term, most analysts believe that Bitcoin’s long-term upside bias will remain intact.

Key BTC Levels to Watch

BTC has finally broken above the $11,000 psychological line. However, it appears that the cryptocurrency lacks the momentum to climb higher in the near-term.

Considering the expectations of analysts for BTC in the near-term, we could see a slight reversal to the mid-$10,000 level. This sentiment is further bolstered by the fact that Bitcoin has just entered overbought conditions on our MACD indicator.

However, if Bitcoin manages to record a clean break above $11,200, we could see the benchmark cryptocurrency climb to the $11,650 supply level.

Total market capital: $350.6 billion

Bitcoin market capital: $204 billion

Bitcoin dominance: 58.2%

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.