GBPJPY Price Analysis – September 16

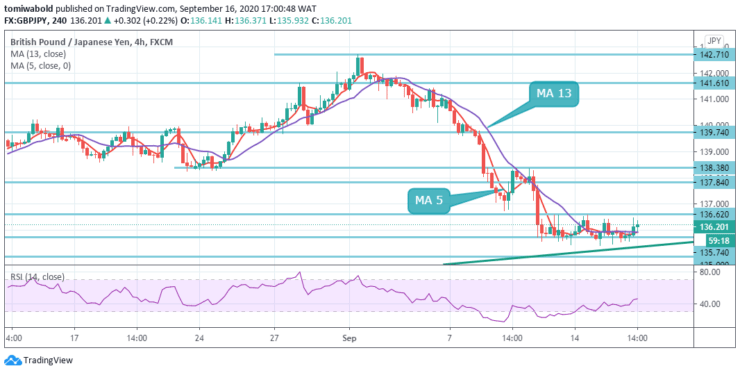

During the early American session, the GBPJPY cross notched higher and renewed daily highs, in the last hour around the 136.40 area. Despite growing concerns of a no-deal Brexit, the uptick was backed by a pickup in demand for the British pound.

Key Levels

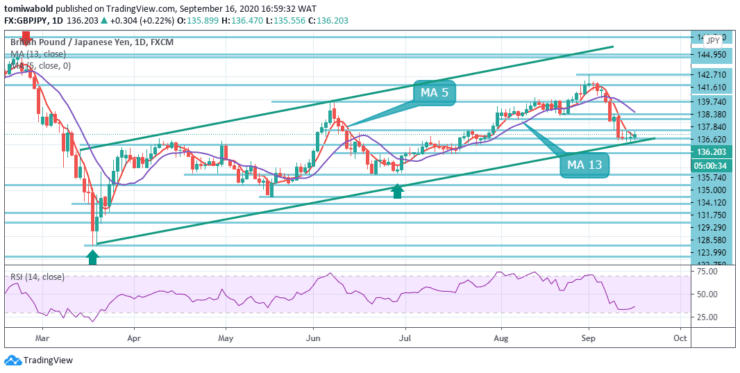

Resistance Levels: 147.95, 142.71, 138.38

Support Levels: 135.74, 131.75, 129.29

In the wider sense, the growth from the 123.99 level is seen as the growing phase of the 122.75 (low) level horizontal consolidation trend. As long as the level of resistance is 147.95, a potential downside breakout stays in order.

A firm breach of the 147.95 marks, therefore, may increase the risk of a long-term bullish reversal. The emphasis for validation may then be shifted to a 156.59 resistance level. Alternatively, to persuade buyers, an upside breach of the multi-day resistance line, prior support, near 136.62 level would need to surpass the moving average 13 levels of 138.38.

The GBPJPY intraday bias stays neutral initially. Further dropping may stay slightly in favor as long as the level of mild resistance retains at 138.38. The continuous breach of 38.2 percent retracement at 135.73 level from 123.99 to 142.71 may mean that the entire rebound from 123.99 has been achieved.

A further decline may then be seen at the next level of 131.75 to 61.8% retracement. However, a significant turnaround from the present phase, followed by a breach of a slight resistance level of 138.38, would instead transform bias back to the upside to retest the level of 142.71.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.