It is still unclear in what direction a breakout could occur soon, but it looks like the bulls are winning despite the enduring BTC weakness.

Crypto traders always say that when bitcoin breaks above a crucial resistance, it seldom trades below that level again. Given Bitcoin’s performance in the past few days, it appears that this is the case now.

Despite the several attempts to break below the 5-digit level, the sell-off has failed to secure a close below that level. Instead, it has left several wicks behind and these wicks are starting to shorten indicating that bears are getting tired.

By tomorrow, the seventh daily candle will be completed. If that candle maintains its position above the $10k mark, a strong bullish spike could ensue afterward.

Meanwhile, for the past decade, September has held the reputation for being a red month for the benchmark cryptocurrency. That said, it would be interesting to see how things play out for Bitcoin in the near-term.

Key BTC Levels to Watch

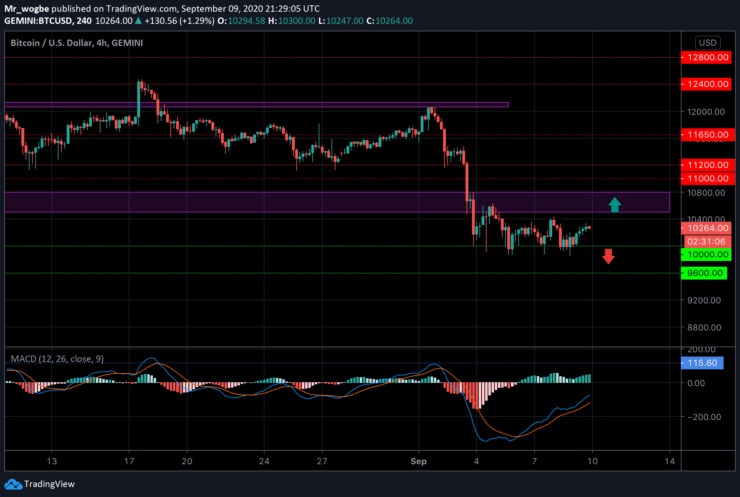

Bitcoin remains locked in a narrow channel between $10,345 and $9,880. Given the weakening condition of bears, we could see BTC climb higher soon. Bitcoin could break the bearish sentiment if it breaks back into the $10,500-800 pivot zone, which could propel it to further highs.

On the flip side, a break and close below the $10k mark is all bears need to take Bitcoin closer to the $9,600 CME gap.

Total market capital: $332.8 billion

Bitcoin market capital: $189 billion

Bitcoin dominance: 56.9%

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.