GBPJPY Price Analysis – September 9

The GBPJPY pair retained its selling bias into the American session through the mid-European and was last seen trading beneath the low mark of 137.00. Anxieties over Brexit trade negotiations have continued to undermine the pound, which has lost some extra ground.

Key Levels

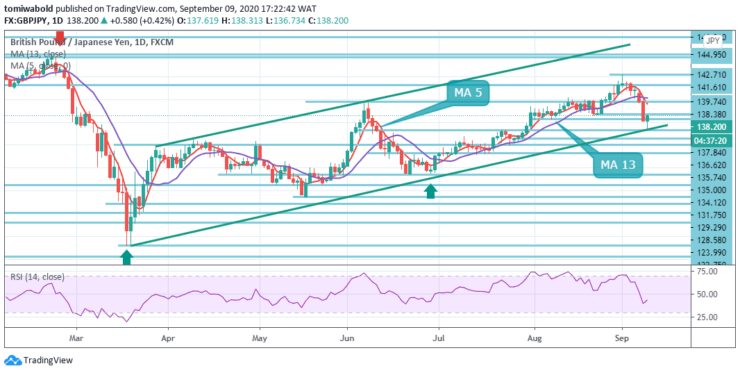

Resistance Levels: 147.95, 144.95, 142.71

Support Levels: 137.84, 135.74, 134.12

Since the start of the week, the GBPJPY pair has tumbled more than 300 pips. It recently reached the lowest level under the 137.00 mark. In the larger context, a growth from level 123.99 is seen as an upswing from level 122.75 (low) of the sideway consolidation trend.

As lengthy as resistance level 147.95 retains, there stays an impending downside breakout per the opinion. A strong breach of 147.95 level, after all, may increase the risk of a long-term bullish reversal. Validation of the emphasis may then be shifted to the resistance level 156.59.

At this moment, the intraday bias within GBPJPY stays on the downside. The current decline from level 142.71 should target a retracement of 38.2 percent from 123.99 to 142.71 at levels 135.74. After this, interactions might well determine whether entire growth from level 123.99 has been finished.

Upside, the lower resistance level beyond 138.38 level may initially alter intraday bias neutral. The region at the GBPJPY level of around 138.00 is the initial support. A consolidation beneath may posits further vulnerability going forward, aiming the region of 137.84.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.