Despite the renewed market selloff triggered by the Chinese government crackdown, Bitcoin (BTC) and most other cryptocurrencies have posted significant recoveries. However, the market has fallen into a sideways pattern for the past few days now.

As is typical with FUD moves, the market absorbed the news-induced selloff as long-term investors (HODLers) accumulated more coins during the dip. That said, a healthy bullish recovery and rally might have to wait as the industry awaits the final vote on the US infrastructure bill, set to hold on Thursday.

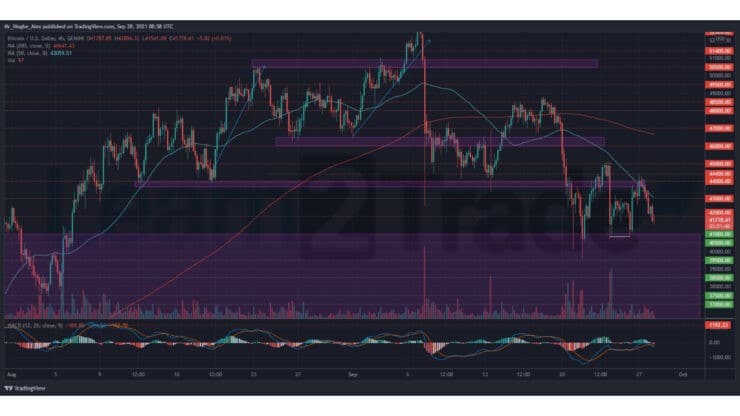

Nonetheless, HODLers have shown that they are not scared regardless of the effect this event could have on the market in the short term. Bitcoin’s restrictive movement between $45,000 and $41,000 shows there is a persistent cycle of bulls buying the dips and short-sellers selling the upside.

As bulls and bears battle it out, Glassnode data shows that roughly 13,000 new entities enter the market every day, significantly higher than that of the 2018 – 2020 bear market baseline. That said, the majority of market participants at the moment appear to be HODLers and accumulators.

Key Bitcoin Levels to Watch — September 28

Following a resurgence to the $44,000 high early yesterday, more sellers took the opportunity to short BTC, causing the primary cryptocurrency to fall below the $42,000 line today. As mentioned earlier, we expect the price to remain in a sideways bias through this week, considering the upcoming vote on the infrastructure bill on Thursday.

In the meantime, we expect a minor bounce back above the $43,000 line in the coming hours. However, a fall below the $41,500 area could trigger another plunge into the $40,000 pivot zone, and near the $39,000 level given the prevailing bearish market sentiment.

Meanwhile, our resistance levels are at $42,000, $43,000, and $44,000, and our key support levels are at $41,000, $40,500, and $40,000.

Total Market Capitalization: $1.86 trillion

Bitcoin Market Capitalization: $785.8 billion

Bitcoin Dominance: 42.2%

Market Rank: #1

You can purchase crypto coins here: Buy Tokens

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.